Cookies on GOV.UK

We use some essential cookies to make this website work.

We’d like to set additional cookies to understand how you use GOV.UK, remember your settings and improve government services.

We also use cookies set by other sites to help us deliver content from their services.

You have accepted additional cookies. You can change your cookie settings at any time.

You have rejected additional cookies. You can change your cookie settings at any time.

Stamp Duty Land Tax: transactions that don't need a return

Find out which property transactions are exempt from Stamp Duty Land Tax (SDLT).

You don’t pay SDLT if you buy a property in:

- Scotland from 1 April 2015 - you pay Land and Buildings Transaction Tax

- Wales from 1 April 2018 - you pay Land Transaction Tax (LTT)

You don’t need to tell HM Revenue and Customs ( HMRC ) about some land and property transactions which are exempt from SDLT . They include:

- transactions where no money or other type of payment changes hands

- property left to you in a will

- property transferred because of divorce or dissolution of a civil partnership

You don’t need to tell HMRC about some leasehold transactions either.

You need to tell HMRC about all other land and property transactions on an SDLT return .

Exempt transactions

Property transactions where no money or other type of payment changes hands.

You can give property or land away or transfer ownership to another person. If there’s no ‘chargeable consideration’ you don’t have to pay SDLT or file a return. The chargeable consideration is a payment that can be cash or another type of payment, including:

- works or services

- release from a debt

- transfer of a debt, including the value of any outstanding mortgage

Property left in a will

Property left to you in a will is almost always exempt from SDLT . This includes property that has outstanding debt on it, for example a mortgage.

It also applies to a transaction that changes the terms of a will within 2 years of someone dying. The transaction is exempt from SDLT as long as:

- a different beneficiary gets the property

- the new beneficiary doesn’t pay a compensation payment, this includes taking over a mortgage

Divorce or dissolution of a civil partnership

A transaction is exempt from SDLT when a couple divorce, separate or end their civil partnership, and they either:

- agree to split their property and land between them

- split the property under the terms of a court order

Find out about SDLT on land and property transfers and linked transactions .

Freehold property purchases involving transactions less than £40,000

You don’t need to pay SDLT or tell HMRC about freehold land and property transactions with a total chargeable consideration of less than £40,000, unless the total chargeable consideration includes any linked transactions .

Leasehold transactions you don’t need to tell HMRC about

Leasehold purchases with a lease of 7 years or more.

You don’t have to tell HMRC or pay SDLT when:

- you buy a new or assigned lease of 7 years or more, as long as the premium is less than £40,000 and the annual rent is less than £1,000

- you assign or surrender a residential or non-residential lease (granted for 7 years or more) and the chargeable consideration is less than £40,000

Leasehold property purchases where the lease is for less than 7 years

You don’t have to pay SDLT or tell HMRC if you buy a new or assigned lease of less than 7 years, as long as the chargeable consideration is less than the residential or non-residential SDLT threshold.

Chargeable consideration includes:

- any premium and the net present value of any rent in the case of a new lease

- the consideration given for the assignment or surrender of an existing lease

To work out the net present value (based on the average rent over the life of the lease) you can use the Stamp Duty Land Tax calculator .

Alternative property finance

Sometimes the financial arrangements for buying a property or land involve a secondary transaction with the lender. This follows on from the main transaction (for example when you follow Sharia law).

These later transactions may be exempt from SDLT where you meet specific conditions .

Updates to this page

From 1 April 2018 SDLT will no longer apply in Wales. You'll pay Land Transaction Tax which is dealt with by the Welsh Revenue Authority.

First published.

Sign up for emails or print this page

Related content, is this page useful.

- Yes this page is useful

- No this page is not useful

Help us improve GOV.UK

Don’t include personal or financial information like your National Insurance number or credit card details.

To help us improve GOV.UK, we’d like to know more about your visit today. Please fill in this survey (opens in a new tab) .

Your perfect office is just a click away!

Let us do the work for you. Request a free shortlist from our expert advisors.

We'll send you a curated list the very same day.

Why use Tally Workspace to find your next office?

Are you overpaying for office space?

Compare your office to others on the market now to find out.

- Search All Offices >

- Part-Time Offices

- Day Offices

- Shared Offices

- Dedicated Desks

- List Your Office Space

- Why find an office on Tally Workspace?

- West London

- City of London

- Covent Garden

- Canary Wharf

- Liverpool Street

- South East London

- London Bridge

- Kings Cross

- Search all coworking >

- Meeting Rooms

- Private Office

- Event Space

- Conference Rooms

- Training Rooms

- Podcast Studios

- Huddle Rooms

- Collaboration Spaces

- Interview Rooms

- Why book coworking on Tally Workspace?

- Case Studies

Looking for a new office? Search our marketplace and find the best options in just a few minutes!

Tuesday 10th September 2024

Do You Have to Pay Stamp Duty on Commercial Leases?

Key takeaways

- Stamp duty Land Tax (SDLT) is a tax on both residential and commercial properties (including leases).

- With SDLT for commercial properties, tenants responsible for its payment, unlike residential leases, where buyers pay.

- Stamp duty land tax for commercial leases is calculated based on the net present value of future rents and any lease premium. Remember to include VAT if applicable. Different rates apply depending on the value tiers, so it’s important to know where your lease falls.

- Paying SDLT on time is crucial to avoid any penalties. Getting advice from specialist solicitors can be a smart move — they can help you navigate exemptions, reliefs, and even spot potential tax savings.

What is stamp duty on commercial leases?

What's the difference between stamp duty on residential and commercial properties.

How is stamp duty calculated on a commercial lease?

How much is stamp duty on commercial property in the uk.

- The first £150,000 of the NPV is exempt

- The next £100,000 is taxed at 2%

- Anything over £250,000 is taxed at 5%

When is stamp duty payable on commercial leases?

Who pays stamp duty on commercial leases, do you pay sdlt on a lease renewal, exemptions and reliefs for sdlt on commercial leases, stamp duty on commercial lease extensions.

How to avoid common pitfalls in stamp duty payments for commercial leases

How can i save stamp duty on commercial property.

Written by Jules Robertson

Related Articles

Office space

Offices With Free Meetings Rooms In London

We all know the feeling. You commit to a lovely new office in London for the team. You thought yo...

Read time: 3 mins

Everything You Need To Know About The Ministry

Introducing London's best-kept secret in SE1 - The Ministry! This fabulous venue offers a vibrant...

Traditional, Managed & Serviced Office Spaces Compared: Finding the Perfect Fit for Your Business

Choosing the right office space can feel like a big decision — because it is. Whether you’re gear...

Read time: 5 mins

Find an office today

Using our extensive mapping of startup and scaleup office space, find an office that fits your needs and your culture in just a few minutes.

- What our clients say

- Get in touch

- Two Twenty Limited Case Study

- Eclisse Case Study

- Bluetel Case Study

- Employee Ownership Case Studies

- Employee Ownership Trusts

- Employee Ownership FAQ's

- Download EOT Guide

- Commercial Property

- Management Buy-out

- Buying & Selling a Business

- Share Sale Guide

- Asset Purchase Agreement

- Cross Option Agreement

- Share Option Agreement

- Hive-Up Agreement

- Joint Venture Agreement

- Confidentiality Agreement

- Standard Terms & Conditions

- Website Development Agreement

- Software Development Agreement

- Articles of Association

- Share Issue Service

- Preference Share Issue Service

- Alphabet Shares

- Growth Shares

- LLP Agreement

- Partnership Agreement

- Shareholders Agreement

- Employee Ownership

- EMI Share Options

- SEIS Investments

- EIS Investments

- Investment Agreement

- Employee Share Schemes

- Share for Share Exchange

- Share Buyback

- Reduction of Share Capital

- Preference Shares Explained

- Loan Agreement

- Charge Registration Service

- Consultancy Agreement

- Settlement Agreement

- UK Employment

- UK Directors Service Agreement

- Fraud and Asset Recovery Claims

- Contract Disputes

- Forming a Company

- Forming an LLP

- About Companies

- What type of Company should you form?

- Why form a Company with Legal Clarity?

- Company Name Search - Pitfalls

- Company Formation FAQs

- After Formation

- Registered Office Service

- Company Secretarial Service

- Nominee Shareholder Service

- Sole Trader

- CIC Formation

- Charity Registration Service

- Company Restoration Service

- Striking Off

- Company Secretarial Training

- Trust Drafting Service

- Legal Opinions

- Services for Solicitors

- Services for Accountants

- Notary - Birmingham

- What is Employee Ownership?

- Ins and Outs

- Guide to EOTs

- Frequently asked questions

- Why Legal Clarity?

- Sole Traders

- Company Registers

- Our Services FAQs

- Company Name Search - pitfalls

- Introduction to Shareholders Agreements

- Do I need one?

- Sale of Shares

- Running the Company

- Veto Rights

- Company Finance

- Company Protection

- Introduction to Partnership Agreements

- Running the Partnership Business

- Partnership Finance

- Partnership Decisions

- Exiting Partnership

- Protection of Partners

- Dissolution/Winding Up

- What is a reduction of Share Capital?

- Why Reduce Share Capital?

- Preliminary Considerations

- Solvency Statement

- Procedural Outline

- Court Confirmation

- Reduction Timings?

- What is an LLP?

- What is an LLP Agreement?

- The LLP's Business

- LLP Decision Making

- LLP Finance, Profit, and Loss

- Protecting the LLP's Business

- Admission and Exit of Members

- What is a Share Buyback?

- Why Buyback Shares?

- Funding a Buyback

- The Buyback Contract

- Share Buyback Procedure

- Post Buyback

- Funding a Buyback out of Capital

- Directors' Statement & Auditors Report

- What is a Business Transfer Agreement?

- Why Transfer your Business?

- Paying for the Business Transfer

- Approval and Consents

- What is a Transfer Agreement?

- Why choose an EOT over a buy-out or trade sale?

- Legal 500 - 'An excellent team'

- 10 Deals in 4 Days

- Recent surge in employee ownership

- Aerocom in Succession Planning using a VIAMBO

- Flexmort Acquired by Noar Limited

- Selling a Business as part of a Retirement Plan

- Possible Capital Gains Changes

Do You Pay SDLT (“Stamp Duty”) on Commercial Property?

SDLT (referred to in this article as Stamp duty or Stamp Duty Land Tax) can be complex and many businesses are unaware that there is stamp duty land tax on commercial property which inevitably results in penalties.

If you’re negotiating a commercial lease it’s essential that you understand what Stamp Duty is and whether it will affect you. This blog will answer all your questions like ‘Is there Stamp Duty on commercial property?’ and ‘How much is Stamp Duty?’.

What is Stamp Duty on commercial property?

Stamp Duty Land Tax (SDLT) is a tax applied to the acquisition of land or the grant of a lease in England and Northern Ireland. In Scotland they charge Land and Buildings Transaction Tax and Wales charges Land Transaction Tax, rather than SDLT.

What is Stamp Duty Land Tax charged on?

SDLT is payable in England and Northern Ireland and is charged on land transactions according to the price they were paid for, any premiums paid, the rent that is payable or in some cases the market value. Land transactions are any acquisition of chargeable interests, such as:

- Freeholds and leases;

- Rights; and

- Powers over land.

It is complicated but there are some exempt interests for example, mortgages and licences to use land.

Do you pay SDLT (“Stamp Duty”) on commercial property?

Yes, SDLT is payable on both residential and commercial properties.

Commercial Stamp Duty Land Tax rates

The appropriate rates for SDLT can be found by clicking on this link

HMRC also have a calculator that you can use to work out your SDLT liability but please note that this is indicative only and you should always seek professional advice to correctly confirm the amount of SDLT payable.

Please also note the following:

- If VAT is payable on the premium or rent then this is taken into consideration when calculating SDLT liability; and

- If you are taking an assignment of a lease, SDLT will only be payable on the price you pay for the assignment.

Do residential and commercial properties have the same rates of Stamp Duty Land Tax?

SDLT isn’t the same for commercial and residential properties. Commercial property has different rates than residential property.

Do you pay Stamp Duty Land Tax on commercial leases?

Landlords have no responsibility for stamp duty on commercial leases. Therefore the tenant of the commercial lease is responsible for calculating and paying SDLT.

SDLT may be payable on the following:

- Grant of a commercial lease;

- Assignment of a commercial lease;

- Variation of a commercial lease; and

- The surrender of a commercial lease.

It very much depends upon the circumstances of each matter and SDLT isn’t always payable for all commercial property transactions.

How Is SDLT (“Stamp Duty”) Charged On The Rent For Commercial Leases?

Calculating commercial property Stamp Duty Land Tax can be complex. As a result, we recommend contacting a tax lawyer or accountant with extensive experience in SDLT for further guidance and support.

SDLT rates for commercial leases can be found here but the following should also be noted:

- The ‘rent due’ is calculated on the first 5 years of rent payments. For leases lasting more than 5 years the ‘rent due’ is based on the highest amount paid over a 12 month period during the first 5 years.

- Once the ‘rent due’ figure is determined the Net Present Value (NPV) of the lease is calculated and the amount of SDLT owed is based on this figure.

- SDLT can also be applied to certain other payments made under the terms of a lease and can also be applied to ‘chargeable considerations’. This can include the tenant's obligations to carry out services or work on the property.

When Does Stamp Duty Land Tax Need To Be Paid?

SDLT must be paid within 14 days of the ‘effective date’ of the transaction, which can be any of the following:

- The completion of the transaction;

- The moving in date; or

- When the main part of the transaction has taken place.

What happens if I don’t pay Stamp Duty Land Tax in time?

If SDLT is due and has not been paid within the 14 days required, HMRC will issue a automatic fine of £100 if you are no more than 3 months late filing the return. The fine increases to £200 if you are more than 3 months late filing the return.

In addition to fines, you’ll also be charged interest which accrues at a daily rate and can be quite costly.

Are There Exemptions on paying Stamp Duty Land Tax for a Commercial Lease?

Yes there are a number of exemptions available but each case and each exemption is different and conditions have to be met. This is a complex area of law and we recommend you seek professional advice in relation to SDLT.

Looking to negotiate the terms of a commercial property lease? Get in touch with Legal Clarity today to see how we can support you!

Legal Clarity

Stamp Duty on a Commercial Lease (A Guide!)

- Last updated: 18 March 2024

IN THIS ARTICLE

Stamp Duty Land Tax (SDLT) must be paid on land transactions in England, including commercial leases over a certain threshold. SDLT may be payable on the grant, assignment, variation or surrender of a commercial lease.

The rules surrounding SDLT are complex and it is the tenant’s responsibility to calculate and pay any stamp duty on a commercial lease that is due to HMRC.

For commercial leases, SDLT can be charged on the premium (initial payment for the lease) and the rent, with different rules applying to each.

Understanding SDLT is crucial for businesses and landlords engaging in commercial property transactions because it affects the total cost of acquiring, leasing, or transferring property. The amount of SDLT payable depends on several factors, including the purchase price, property type, leasehold terms, and whether any SDLT reliefs or exemptions apply.

Several considerations can impact SDLT liability, including lease premiums, rent NPV, and specific lease terms like rent reviews.

Various SDLT reliefs could apply to reduce liability, such as for certain types of leases or transactions involving charities.

Properly managing SDLT obligations can prevent unexpected costs and penalties, making it a critical consideration for businesses and landlords in the UK commercial property market .

It’s essential to consult with professionals when negotiating lease terms and managing SDLT obligations to ensure compliance and minimise tax liability.

Section A: The Evolution of Stamp Duty

Stamp Duty in the UK has a long and varied history. It was initially introduced in 1694 as a temporary measure to fund war efforts against France.

It originally applied to vellum, parchment, and paper for legal documents or ‘instruments,’ with a physical stamp or seal signifying payment.

The success of the Stamp Acts in raising revenue led to their adoption in other European countries and attempts to introduce them in the American colonies, significantly contributing to the tensions leading to the American War of Independence.

Over the years, the scope of Stamp Duty expanded beyond legal documents to include newspapers, pamphlets, lottery tickets, playing cards, and various goods like hats, gloves, and perfumes. Initially charged as a fixed amount, Stamp Duty became an ad valorem tax (based on the value of the transaction) in 1808 for conveyances of sale, including land and shares.

The administration of stamp taxes has evolved. After several mergers of tax bodies, the Inland Revenue managed them, leading to the current oversight by HM Revenue & Customs (HMRC).

Significant changes in recent history include the replacement of Stamp Duty with Stamp Duty Land Tax (SDLT) for property transfers in 2003, which aimed to modernise the tax to apply to land transactions on a sliding scale.

SDLT requires a tax return to HMRC for all land transfers, with penalties for non-compliance, and is charged on leasehold transactions and freehold purchases. The tax structure and rates have seen adjustments over the years to reflect economic conditions and housing market changes, including various threshold adjustments and the introduction of relief measures for first-time buyers and certain disadvantaged areas.

Despite calls for its abolition and promises of reform, Stamp Duty continues to be a significant source of revenue for the UK government, reflecting the tax’s enduring role in the UK’s fiscal landscape.

Section B: How Stamp Duty is Calculated for Commercial Leases

Stamp Duty Land Tax calculation for commercial leases in the UK involves multiple components and depends on both the lease premium and the net present value (NPV) of the rent payable over the lease term. The process and applicable rates can vary depending on whether the property is considered residential or non-residential.

For new commercial leases, the SDLT calculation considers the premium and the rent’s net present value (NPV), which considers expected rental payments over the lease term at present-day prices. SDLT is not payable on premiums under £150,000 for annual rents less than £1,000, but once thresholds are exceeded, SDLT rates apply on a sliding scale based on the value of the transaction.

Additionally, the lease’s duration significantly impacts SDLT liability because the total rent payable over the life of the lease is considered, potentially attracting SDLT even for long leases with modest rent.

1. Calculation Components

a. Premium: SDLT on the lease premium is calculated similarly to that on the sale of a property. The rates may vary based on the total premium amount.

b. Rent: SDLT on rent is calculated based on the NPV of the rent over the lease term. The NPV is the current worth of all lease payments over the term, discounted back to present value.

2. For Non-Residential Leases

The SDLT on the premium follows a tiered structure. For example, you won’t have to pay SDLT on the premium for annual rents of £1,000 or more if the premium is under the £150,000 threshold.

SDLT on the rent portion is charged if the NPV exceeds certain thresholds. For instance, no SDLT is due on the NPV portion up to £150,000. Beyond this, SDLT rates apply on a sliding scale.

3. SDLT Calculator

For precise calculation, it’s recommended to use the SDLT lease transactions calculator provided by HMRC, as it accommodates various thresholds and rates for different portions of the consideration.

Section C: Current Stamp Duty Rates for Commercial Leases

For commercial leases in the UK, calculating Stamp Duty Land Tax (SDLT) involves considering both the premium paid for the lease and the net present value (NPV) of the rent over the lease term.

SDLT Rates for Non-Residential Leases are as follows:

Premium ◦ No SDLT is due on the premium if the annual rent is less than £1,000 and the premium is under the £150,000 threshold. ◦ The SDLT is calculated based on a percentage of the premium amount for premiums over these thresholds.

Rent (NPV) ◦ For the NPV of rent, no SDLT is payable if the NPV is less than £150,000. ◦ For NPVs between £150,001 and £5,000,000, the rate is 1%. ◦ If the rate is above £5,000,000, it increases to 2%.

SDLT Rates for Freehold Sales and Transfers • For transactions up to £150,000, no SDLT is payable. • For the portion from £150,001 to £250,000, a 2% rate applies. • For amounts above £250,000, a 5% rate is applicable.

An example provided for a freehold commercial property purchase priced at £275,000 shows a tiered calculation resulting in a total SDLT of £3,250, demonstrating how the tax applies progressively based on the transaction value.

It’s important to note that for new non-residential or mixed leasehold transactions, SDLT is calculated separately on the purchase price of the lease (lease premium) and the value of the annual rent (NPV). These amounts are then added together to determine the total SDLT due.

Section D: Stamp Duty Exemptions and Reliefs

Exemptions from Stamp Duty Land Tax (SDLT) on commercial leases include transfers with no payment exchange, properties inherited in wills, transfers due to divorce or dissolution of a civil partnership, freehold properties purchased for less than £40,000, and leases over seven years with premiums under £40,000 and annual rent less than £1,000. Reliefs may apply to first-time buyers, multiple dwellings, and properties bought for charitable purposes.

Always file an SDLT return to claim relief, even if no tax is due .

Section E: Submission and Deadlines

1. how to file & pay stamp duty.

To file and pay Stamp Duty Land Tax (SDLT) for a commercial lease in the UK, you typically need to use the HMRC’s online SDLT return system.

Gather the necessary documents, including transaction details, lease agreement, and proof of payment for the lease premium and rent.

Ensure accuracy in your submission to avoid penalties.

2. Filing & Payment Deadline

SDLT returns must be submitted to HMRC within 14 days of the effective transaction date, which could be the completion date, the date of the first rent payment, or when substantial performance of the transaction occurs. Late submission can result in penalties and interest charges .

For detailed and updated information on calculating SDLT for commercial leases, including any recent changes, visit the official GOV—UK pages on Stamp Duty Land Tax on Leasehold sales and the overview of SDLT .

3. Does Stamp Duty Land Tax only need to be paid at the start of the lease?

You may need to make further SDLT payments during the term of your lease.

Rent review

When the initial SDLT is calculated it is based on the first five years’ rent. If your lease includes a rent review within the first five years and a new rent is agreed you will need to file an additional SDLT payment to cover the revised rent. In some circumstances rent reviews that occur after the first five years may also incur SDLT if it has been deemed an abnormal increase. This situation can occur when rent has been kept artificially low for the initial period in an attempt to reduce SDLT.

Holding over

If a lease expires but the tenant remains in occupation of the premises this is known as ‘holding over’. Any lease that continues after its expiry is treated as if the original lease has extended for a year. If SDLT was paid at the commencement of the lease, or if the lease has been taken over the SDLT threshold with this additional year an SDLT Return and additional payment must be made to HMRC.

Lease renewals

Renewal leases are subject to the same SDLT rules as normal leases.

Breaking a lease

Tenants who are considering breaking their lease should be aware they will not be entitled to receive a SDLT refund from HMRC for the remainder of their lease term.

Section F: Common Mistakes to Avoid

Common mistakes businesses make with Stamp Duty on commercial leases include:

• Miscalculating the net present value (NPV) of the rent. • Not claiming eligible reliefs. • Missing deadlines for filing and payment can lead to penalties.

To avoid these errors, always use the HMRC’s SDLT calculator for accurate calculations, thoroughly review eligibility for reliefs or exemptions, and ensure that all SDLT returns are submitted and payments are made within 14 days of the transaction’s completion.

Stamp Duty on Commercial Leases FAQs

What are the Stamp Duty rates for commercial leases?

Rates vary based on the lease’s premium and the rent’s net present value (NPV). Use the HMRC’s SDLT calculator for specifics.

What are the deadlines?

SDLT returns and payments must be submitted within 14 days of transaction completion.

How do I file?

Filing is done through HMRC’s online portal. Have lease details and payment information ready.

Are there exemptions?

Certain transactions, like transfers with no payment, inheritances, and leases under specific thresholds, may be exempt.

Gill Laing is a qualified Legal Researcher & Analyst with niche specialisms in Law , Tax , Human Resources , Immigration & Employment Law .

Gill is a Multiple Business Owner and the Managing Director of Prof Services - a Marketing Agency for the Professional Services Sector.

- Gill Laing https://www.lawble.co.uk/author/editor/ Understanding Licensing Law: An Overview

- Gill Laing https://www.lawble.co.uk/author/editor/ Commercial Property Law: A Guide

- Gill Laing https://www.lawble.co.uk/author/editor/ Essential Guide to Business Start Up

- Gill Laing https://www.lawble.co.uk/author/editor/ Company Law Solicitors in the UK

Subscribe to our newsletter

Filled with practical insights, news and trends, you can stay informed and be inspired to take your business forward with energy and confidence.

Lawble is a Rokman Media brand © 2024. All rights reserved.

Lawble is a registered trademark of Rokman Group Limited and may not be used by third parties without permission.

Website by Prof Services

Type above and press Enter to search. Press Esc to cancel.

- Inheritance Tax Advice

- Tax Tribunal Representation

- Business and Corporation Tax

- Stamp Duty Land Tax

- SDLT Avoidance Schemes

- Stamp Duty Land Tax FAQs

- SDLT Planning

- Stamp Duty Refund

- Multiple Dwellings Relief

- Section 75A: SDLT Anti-avoidance

- SDLT Penalties and Appeals

- Stamp Duty on Commercial Properties

- SDLT on Divorce and Separation

- Stamp Duty for Non-UK Residents

- SDLT on Second homes

- Mixed Use Claims in SDLT

- Disguised Remuneration Loan Schemes

- Failed Tax Avoidance Schemes

- Mis-Sold Tax Avoidance Schemes

- Settlement Of Tax Avoidance Schemes

- Unexplained Wealth Orders

- GAAR Guidance

- Enabler Penalties

- GAAR Penalties

- GAAR Tax Arrangements

- Money Laundering

- Income Tax Fraud

- Code Of Practice 9

- Furlough Fraud

- Payroll fraud

- Proceeds of Crime Act

- Cryptocurrency Tax Investigations

- Bribery and Corruption Investigations

- Personal Tax Investigations Disputes

- Specialist Tax Investigations

- Tax Investigation Procedure

- HMRC Disputes

- Tax Related Commercial Litigation

- Corporate Criminal Tax Offences

- Cheating the Public Revenue

- Appeal a Tax Penalty

- Offshore Disclosure Facility / Voluntary Disclosures

- Direct Access

- Notable Cases

- Legal Articles

- Webinars & Events

- Publications

- Tax Avoidance Schemes

- Stamp Duty Land Tax Advisor

- SDLT Planning & Appeals

- SDLT on Divorce

- SDLT on Second Homes

- GAAR Penalties and Enabler Penalties

- GAAR Enabler Penalties

- Financial Crime

- Tax Investigations

- Civil & Criminal Tax Investigations

- Private Clients

- Webinar & Events

Stamp Duty on Commercial Property Explained

Practice areas, what is stamp duty land tax (sdlt).

Stamp Duty Land Tax is a tax on the acquisition of land in England and Northern Ireland. Scotland charges Land and Buildings Transaction Tax and Wales charges Land Transaction Tax, instead of SDLT. This page will outline and discuss the main points relating to stamp duty on commercial property.

What Is SDLT Charged On?

SDLT is charged on land transactions in England and Northern Ireland according to the price paid or in some cases the market value. A land transaction is any acquisition of a chargeable interest. This includes not only freeholds and leases, but also interests, rights and powers over land other than exempt interests such as mortgages and licenses to use land.

Do You Need to Pay Stamp Duty on Commercial Property?

Yes, stamp duty is payable on the acquisition of commercial property and residential property. Stamp duty on commercial properties is payable at the rates in Table B (see below). Stamp duty on commercial properties is charged at the rates in Table B where the land consists of or includes land that is not residential.

Is Stamp Duty the same for Residential and Commercial Property?

No, the headline rates of stamp duty for commercial property are lower than for residential property. However, the effect of the nil-rate bands in the various tables of rates for a residential property, including the stamp duty “holiday” until 30 June/30 September 2021 and reliefs such as those for multiple dwellings relief should be considered when comparing the total amount of SDLT payable.

You can read more about the latest updates relating to the stamp duty holiday on the HMRC site here

What Are The Rates for Stamp Duty on Commercial Property?

Where the land consists of or includes land that is not residential property, the percentages in Table B apply:

Table B: Non-Residential or Mixed

If the transaction forms part of a number of linked transactions the relevant consideration for the purpose of the table above is the total of the chargeable consideration for all the linked transactions.

Do You Pay Stamp Duty on Commercial Leases?

Yes, Stamp Duty Land Tax is charged in respect of leases on any premium paid for the grant of a lease and also on any rent. Lease premiums on leases of commercial property are taxed in accordance with the rates of SDLT in Table B (see further above) and SDLT on the rent is calculated according to the special formula described below.

How is Stamp Duty Charged on the Rent for Commercial Leases?

Stamp Duty Land Tax is charged on any chargeable consideration consisting of rent as a percentage of the net present value of the rent payable over the term of the lease.

In other words, the total rent payable over the term of the lease is in principle charged to tax (after discounting each annual rent by 3.5% per annum to arrive at its present value). This contrasts with Stamp Duty on rent that was charged on only one year’s average rent at varying percentages according to the term of the lease. On average, the SDLT charge on rent when it was originally introduced represented an increase of four times the Stamp Duty charge on a ten-year lease.

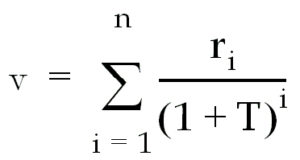

The net present value (V) of the rent payable over the term of the lease is calculated by applying the formula:

ri is the rent payable in respect of year ‘i’ i is the particular year for which the calculation is to be performed (a calculation is required for each year) n is the term of the lease T is the temporal discount rate (currently 3.5%)

Having calculated the net present value of the rent (referred to as the ‘relevant rental value’) the tax is charged as a percentage of so much of that value as falls within each rate band in Table B (please see above).

Are there any Stamp Duty Exemptions and Reliefs for Commercial Property?

Yes, there are stamp duty exemptions and reliefs for sales and leasebacks, dwellings acquired from relocated employees, compulsory purchases, incorporation of limited liability partnerships, and seeding reliefs for PAIFs and COACS to name a few.

Further Advice

If you have any questions or need advice about SDLT on commercial property contact Patrick Cannon now.

Frequently Asked Questions

This depends on a number of factors including how many questions HMRC are seeking answers to, the detail and complexity of the factual and legal issues involved, the speed or otherwise with which the taxpayer and the HMRC investigator deal with the correspondence and whether there are matters that have to be referred for legal advisers on either side for further advice.

It is now not unusual for tax investigations to last more than 12 months and sometimes 5 or more years especially where tax avoidance schemes are involved. What seems clear is that tax investigations seem to be taking longer as HMRC become more aggressive in their approach and tend to assume the worst, especially when it comes to assessing penalties they say are due for any underpayment of tax later found to have been due.

This can be for a number of possible reasons that include suspected omission of income, over claimed deductions, your business is of a type that is being targeted by HMRC for compliance checks, or a risk assessment has thrown up possible cash (undeclared) receipts or undeclared drawings, high expense claims or late filing of tax returns and payment of tax. HMRC’s guidance is published here .

If you are suspected of committing fraud, HMRC will make a thorough investigation into your affairs, including your financial conduct around the time you are thought to have committed tax fraud. This will come about due to suspected irregularities in your tax affairs and will need to be investigated before a decision is made as to whether fraud has actually taken place.

During the tax fraud investigation process you might be issued with a Code of Practice 9 (or COP 9 for short). This gives you the opportunity to disclose deliberate and non-deliberate financial misconduct that may have led to the irregularity in question. Read on here to find out more about this option and what it entails.

If you have received an enquiry or investigation from HMRC, contact Patrick Cannon today to get advice and representation against HMRC.

You can reclaim SDLT on a commercial lease when the amount of the rent for the first five years was uncertain or variable and on recalculating the actual rent at the five-year point, the SDLT charge is lower than originally paid.

Related Articles

What are the criteria for uninhabitable property.

What is an uninhabitable property? In stamp duty, there is an important difference between a dilapidated house in need of renovation and a truly uninhabitable dwelling,…

How to Handle R&D Tax Claim Conflicts

“Generous tax reliefs are available for expenditure relating to research and development (“R&D”). An additional deduction from profits is available over and above the amount of…

What is the ‘grey belt’, and what are the potential tax liabilities?

The Labour Government’s ‘grey belt’ redesignation of some parts of the existing green belt land in England raises some interesting tax planning questions around the taxation…

For Monthly Articles Like This, Sign Up To Our Newsletter

Get in touch.

For professional and insurance reasons Patrick is unable to offer any advice until he has been formally instructed.

+44 020 4539 6731

Click here to arrange a Zoom

First Name:

Your Email:

Your Telephone:

Your Enquiry:

Sign up to our mailing list, webinar invites and more? Yes please. Have you read our T&Cs ? I understand that Patrick does not offer free advice for professional and insurance reasons.

When is Stamp Duty payable on commercial leases?

15th april 2019.

Anyone purchasing a property will have heard of Stamp Duty Land Tax or SDLT for short. While most people will be aware that it’s payable on home purchases above a certain value, they may not be aware that it can also be payable on commercial leases .

What is SDLT?

Most simply put, SDLT is a tax applied to land transactions that are payable to HMRC. This tax includes leases, not just property purchases.

How much is SDLT?

As with domestic properties, the amount of SDLT depends upon the value of the commercial lease. The rates are:

- Up to £150,000 there is no SDLT liability

- Between £150,001 and £5,000,000 is liable at a rate of 1%

- Above £5,000,001 there is an SDLT rate of 2%

For example, a lease worth £10,000,000 will pay nothing on the first £150,000, then 1% on the amount between £150,001 and £5,000,000, then 2% on the remaining £5,000,000.

How is the value calculated?

The rules are somewhat complex, and calculating the correct amount can be difficult. However, it’s important to get it right as too low a payment will result in interest being added to the outstanding amount, while it can be difficult to secure a refund from HMRC if there is an overpayment.

SDLT takes into account a number of factors to reach what is known as the Net Present Value (NPV), including:

- The lease premium (a lump sum paid at the start of the lease)

- The rent, including VAT if applicable

- The length of the lease

- Chargeable considerations, for example, the tenant’s obligation to carry out repairs or services on the rented property

The value of the first five years’ rent is used to calculate the NPV. Should the lease extend beyond five years, then the highest yearly amount paid during the initial five years is used to calculate the NPV for those successive years.

When should SDLT be paid?

To ensure that no interest or charges are applied to the amount, SDLT needs to be paid within thirty days of the lease taking effect. Even deciding when the lease takes effect can be complicated as it can vary. It may be the day that the contract is signed, the day that the tenant takes possession of the property or the day that the first rent payment is made.

Certain events can also trigger additional SDLT payments, such as renewing and extending the lease, a change of terms, a rent revision, or the tenant staying in the property once the original lease has run out.

Who is responsible for SDLT?

The tenant is solely responsible for all aspects of SDLT, from calculating it to ensuring that it is paid on time. The landlord bears no responsibility.

It can be a surprise to learn that commercial leases can be liable for SDLT, in the same way, that property purchases are. Calculating SDLT correctly is important and, as demonstrated here, doing so is not a straightforward process. That’s why it’s vital to engage an experienced and knowledgeable solicitor, such as one of our expert team at Robinsons Solicitors.

For Businesses

For individuals.

IMAGES

COMMENTS

Jan 18, 2023 · Do I have to pay stamp duty on a commercial lease? If you are a tenant of a commercial property, it is your responsibility to calculate and pay SDLT on the lease on time. Landlords bear no responsibility for SDLT on the lease. For commercial tenants, SDLT may be payable on any of the following elements of your commercial lease: • Grant ...

Aug 19, 2013 · The new owner pays a lump sum for the assignment of the lease and pays SDLT on this amount. ... From 17 March 2016 you do not have to pay SDLT on the premium for annual rents of £1,000 or more if ...

Jan 3, 2014 · Leasehold property purchases where the lease is for less than 7 years. You don’t have to pay SDLT or tell HMRC if you buy a new or assigned lease of less than 7 years, as long as the chargeable ...

Stamp duty Land Tax (SDLT) is a tax on both residential and commercial properties (including leases). With SDLT for commercial properties, tenants responsible for its payment, unlike residential leases, where buyers pay. Stamp duty land tax for commercial leases is calculated based on the net present value of future rents and any lease premium.

Do you pay Stamp Duty Land Tax on commercial leases? Landlords have no responsibility for stamp duty on commercial leases. Therefore the tenant of the commercial lease is responsible for calculating and paying SDLT. SDLT may be payable on the following: Grant of a commercial lease; Assignment of a commercial lease; Variation of a commercial ...

Mar 18, 2024 · Stamp Duty Land Tax (SDLT) must be paid on land transactions in England, including commercial leases over a certain threshold. SDLT may be payable on the grant, assignment, variation or surrender of a commercial lease. The rules surrounding SDLT are complex and it is the tenant’s responsibility to calculate and pay any stamp duty on

Do You Pay Stamp Duty on Commercial Leases? Yes, Stamp Duty Land Tax is charged in respect of leases on any premium paid for the grant of a lease and also on any rent. Lease premiums on leases of commercial property are taxed in accordance with the rates of SDLT in Table B (see further above) and SDLT on the rent is calculated according to the ...

Apr 15, 2019 · It can be a surprise to learn that commercial leases can be liable for SDLT, in the same way, that property purchases are. ... a lease worth £10,000,000 will pay ...

The rules regarding payment of SDLT can be complex so we’ve pulled together the key things you need to know when taking out a commercial lease and when SDLT is payable. Q: Is there a difference depending on where the property is located? A: The Stamp Duty Land Tax (SDLT) regime only applies to properties in England and Northern Ireland.

Do I Have to Pay Stamp Duty on a Commercial Property Lease? Many commercial tenants are unaware of the fact that Stamp Duty Land Tax (SDLT) can be payable on the grant, assignment, variation or surrender of a commercial lease, where the total value of the transaction is above certain thresholds. The rules regarding payment […]