Free Financial Templates for a Business Plan

By Andy Marker | July 29, 2020

- Share on Facebook

- Share on LinkedIn

Link copied

In this article, we’ve rounded up expert-tested financial templates for your business plan, all of which are free to download in Excel, Google Sheets, and PDF formats.

Included on this page, you’ll find the essential financial statement templates, including income statement templates , cash flow statement templates , and balance sheet templates . Plus, we cover the key elements of the financial section of a business plan .

Financial Plan Templates

Download and prepare these financial plan templates to include in your business plan. Use historical data and future projections to produce an overview of the financial health of your organization to support your business plan and gain buy-in from stakeholders

Business Financial Plan Template

Use this financial plan template to organize and prepare the financial section of your business plan. This customizable template has room to provide a financial overview, any important assumptions, key financial indicators and ratios, a break-even analysis, and pro forma financial statements to share key financial data with potential investors.

Download Financial Plan Template

Word | PDF | Smartsheet

Financial Plan Projections Template for Startups

This financial plan projections template comes as a set of pro forma templates designed to help startups. The template set includes a 12-month profit and loss statement, a balance sheet, and a cash flow statement for you to detail the current and projected financial position of a business.

Download Startup Financial Projections Template

Excel | Smartsheet

Income Statement Templates for Business Plan

Also called profit and loss statements , these income statement templates will empower you to make critical business decisions by providing insight into your company, as well as illustrating the projected profitability associated with business activities. The numbers prepared in your income statement directly influence the cash flow and balance sheet forecasts.

Pro Forma Income Statement/Profit and Loss Sample

Use this pro forma income statement template to project income and expenses over a three-year time period. Pro forma income statements consider historical or market analysis data to calculate the estimated sales, cost of sales, profits, and more.

Download Pro Forma Income Statement Sample - Excel

Small Business Profit and Loss Statement

Small businesses can use this simple profit and loss statement template to project income and expenses for a specific time period. Enter expected income, cost of goods sold, and business expenses, and the built-in formulas will automatically calculate the net income.

Download Small Business Profit and Loss Template - Excel

3-Year Income Statement Template

Use this income statement template to calculate and assess the profit and loss generated by your business over three years. This template provides room to enter revenue and expenses associated with operating your business and allows you to track performance over time.

Download 3-Year Income Statement Template

For additional resources, including how to use profit and loss statements, visit “ Download Free Profit and Loss Templates .”

Cash Flow Statement Templates for Business Plan

Use these free cash flow statement templates to convey how efficiently your company manages the inflow and outflow of money. Use a cash flow statement to analyze the availability of liquid assets and your company’s ability to grow and sustain itself long term.

Simple Cash Flow Template

Use this basic cash flow template to compare your business cash flows against different time periods. Enter the beginning balance of cash on hand, and then detail itemized cash receipts, payments, costs of goods sold, and expenses. Once you enter those values, the built-in formulas will calculate total cash payments, net cash change, and the month ending cash position.

Download Simple Cash Flow Template

12-Month Cash Flow Forecast Template

Use this cash flow forecast template, also called a pro forma cash flow template, to track and compare expected and actual cash flow outcomes on a monthly and yearly basis. Enter the cash on hand at the beginning of each month, and then add the cash receipts (from customers, issuance of stock, and other operations). Finally, add the cash paid out (purchases made, wage expenses, and other cash outflow). Once you enter those values, the built-in formulas will calculate your cash position for each month with.

Download 12-Month Cash Flow Forecast

3-Year Cash Flow Statement Template Set

Use this cash flow statement template set to analyze the amount of cash your company has compared to its expenses and liabilities. This template set contains a tab to create a monthly cash flow statement, a yearly cash flow statement, and a three-year cash flow statement to track cash flow for the operating, investing, and financing activities of your business.

Download 3-Year Cash Flow Statement Template

For additional information on managing your cash flow, including how to create a cash flow forecast, visit “ Free Cash Flow Statement Templates .”

Balance Sheet Templates for a Business Plan

Use these free balance sheet templates to convey the financial position of your business during a specific time period to potential investors and stakeholders.

Small Business Pro Forma Balance Sheet

Small businesses can use this pro forma balance sheet template to project account balances for assets, liabilities, and equity for a designated period. Established businesses can use this template (and its built-in formulas) to calculate key financial ratios, including working capital.

Download Pro Forma Balance Sheet Template

Monthly and Quarterly Balance Sheet Template

Use this balance sheet template to evaluate your company’s financial health on a monthly, quarterly, and annual basis. You can also use this template to project your financial position for a specified time in the future. Once you complete the balance sheet, you can compare and analyze your assets, liabilities, and equity on a quarter-over-quarter or year-over-year basis.

Download Monthly/Quarterly Balance Sheet Template - Excel

Yearly Balance Sheet Template

Use this balance sheet template to compare your company’s short and long-term assets, liabilities, and equity year-over-year. This template also provides calculations for common financial ratios with built-in formulas, so you can use it to evaluate account balances annually.

Download Yearly Balance Sheet Template - Excel

For more downloadable resources for a wide range of organizations, visit “ Free Balance Sheet Templates .”

Sales Forecast Templates for Business Plan

Sales projections are a fundamental part of a business plan, and should support all other components of your plan, including your market analysis, product offerings, and marketing plan . Use these sales forecast templates to estimate future sales, and ensure the numbers align with the sales numbers provided in your income statement.

Basic Sales Forecast Sample Template

Use this basic forecast template to project the sales of a specific product. Gather historical and industry sales data to generate monthly and yearly estimates of the number of units sold and the price per unit. Then, the pre-built formulas will calculate percentages automatically. You’ll also find details about which months provide the highest sales percentage, and the percentage change in sales month-over-month.

Download Basic Sales Forecast Sample Template

12-Month Sales Forecast Template for Multiple Products

Use this sales forecast template to project the future sales of a business across multiple products or services over the course of a year. Enter your estimated monthly sales, and the built-in formulas will calculate annual totals. There is also space to record and track year-over-year sales, so you can pinpoint sales trends.

Download 12-Month Sales Forecasting Template for Multiple Products

3-Year Sales Forecast Template for Multiple Products

Use this sales forecast template to estimate the monthly and yearly sales for multiple products over a three-year period. Enter the monthly units sold, unit costs, and unit price. Once you enter those values, built-in formulas will automatically calculate revenue, margin per unit, and gross profit. This template also provides bar charts and line graphs to visually display sales and gross profit year over year.

Download 3-Year Sales Forecast Template - Excel

For a wider selection of resources to project your sales, visit “ Free Sales Forecasting Templates .”

Break-Even Analysis Template for Business Plan

A break-even analysis will help you ascertain the point at which a business, product, or service will become profitable. This analysis uses a calculation to pinpoint the number of service or unit sales you need to make to cover costs and make a profit.

Break-Even Analysis Template

Use this break-even analysis template to calculate the number of sales needed to become profitable. Enter the product's selling price at the top of the template, and then add the fixed and variable costs. Once you enter those values, the built-in formulas will calculate the total variable cost, the contribution margin, and break-even units and sales values.

Download Break-Even Analysis Template

For additional resources, visit, “ Free Financial Planning Templates .”

Business Budget Templates for Business Plan

These business budget templates will help you track costs (e.g., fixed and variable) and expenses (e.g., one-time and recurring) associated with starting and running a business. Having a detailed budget enables you to make sound strategic decisions, and should align with the expense values listed on your income statement.

Startup Budget Template

Use this startup budget template to track estimated and actual costs and expenses for various business categories, including administrative, marketing, labor, and other office costs. There is also room to provide funding estimates from investors, banks, and other sources to get a detailed view of the resources you need to start and operate your business.

Download Startup Budget Template

Small Business Budget Template

This business budget template is ideal for small businesses that want to record estimated revenue and expenditures on a monthly and yearly basis. This customizable template comes with a tab to list income, expenses, and a cash flow recording to track cash transactions and balances.

Download Small Business Budget Template

Professional Business Budget Template

Established organizations will appreciate this customizable business budget template, which contains a separate tab to track projected business expenses, actual business expenses, variances, and an expense analysis. Once you enter projected and actual expenses, the built-in formulas will automatically calculate expense variances and populate the included visual charts.

Download Professional Business Budget Template

For additional resources to plan and track your business costs and expenses, visit “ Free Business Budget Templates for Any Company .”

Other Financial Templates for Business Plan

In this section, you’ll find additional financial templates that you may want to include as part of your larger business plan.

Startup Funding Requirements Template

This simple startup funding requirements template is useful for startups and small businesses that require funding to get business off the ground. The numbers generated in this template should align with those in your financial projections, and should detail the allocation of acquired capital to various startup expenses.

Download Startup Funding Requirements Template - Excel

Personnel Plan Template

Use this customizable personnel plan template to map out the current and future staff needed to get — and keep — the business running. This information belongs in the personnel section of a business plan, and details the job title, amount of pay, and hiring timeline for each position. This template calculates the monthly and yearly expenses associated with each role using built-in formulas. Additionally, you can add an organizational chart to provide a visual overview of the company’s structure.

Download Personnel Plan Template - Excel

Elements of the Financial Section of a Business Plan

Whether your organization is a startup, a small business, or an enterprise, the financial plan is the cornerstone of any business plan. The financial section should demonstrate the feasibility and profitability of your idea and should support all other aspects of the business plan.

Below, you’ll find a quick overview of the components of a solid financial plan.

- Financial Overview: This section provides a brief summary of the financial section, and includes key takeaways of the financial statements. If you prefer, you can also add a brief description of each statement in the respective statement’s section.

- Key Assumptions: This component details the basis for your financial projections, including tax and interest rates, economic climate, and other critical, underlying factors.

- Break-Even Analysis: This calculation helps establish the selling price of a product or service, and determines when a product or service should become profitable.

- Pro Forma Income Statement: Also known as a profit and loss statement, this section details the sales, cost of sales, profitability, and other vital financial information to stakeholders.

- Pro Forma Cash Flow Statement: This area outlines the projected cash inflows and outflows the business expects to generate from operating, financing, and investing activities during a specific timeframe.

- Pro Forma Balance Sheet: This document conveys how your business plans to manage assets, including receivables and inventory.

- Key Financial Indicators and Ratios: In this section, highlight key financial indicators and ratios extracted from financial statements that bankers, analysts, and investors can use to evaluate the financial health and position of your business.

Need help putting together the rest of your business plan? Check out our free simple business plan templates to get started. You can learn how to write a successful simple business plan here .

Visit this free non-profit business plan template roundup or download a fill-in-the-blank business plan template to make things easy. If you are looking for a business plan template by file type, visit our pages dedicated specifically to Microsoft Excel , Microsoft Word , and Adobe PDF business plan templates. Read our articles offering startup business plan templates or free 30-60-90-day business plan templates to find more tailored options.

Discover a Better Way to Manage Business Plan Financials and Finance Operations

Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.

Discover why over 90% of Fortune 100 companies trust Smartsheet to get work done.

Templateral

Free Projected Balance Sheet Template (Excel)

As a business owner, it’s crucial to have a clear understanding of your financial standing and prospects. One way to achieve this is by creating a projected balance sheet . This document provides a snapshot of your company’s financial health and helps you make informed decisions regarding budgeting, investment, and growth strategies.

This article will explore what a projected balance sheet is, why it is important, how to create one, provide examples and samples, and offer tips for successful implementation.

What is a Projected Balance Sheet?

A projected balance sheet is a financial statement that shows the assets, liabilities, and equity of a business at a specific point in time. It provides an overview of the company’s financial position and helps stakeholders assess its ability to meet financial obligations, determine profitability, and make informed decisions about the future.

Unlike the regular balance sheet, which reflects historical data, a projected balance sheet estimates future financials based on anticipated revenue, expenses, and growth.

Why is a Projected Balance Sheet Important?

A projected balance sheet is important for several reasons:

- Financial Planning : It helps in setting realistic financial goals and planning for the future.

- Budgeting: It assists in developing an accurate budget by projecting future income and expenses.

- Investment Decisions: It aids in evaluating investment opportunities and determining the financial impact of different scenarios.

- Growth Strategies: It enables business owners to assess their financial capacity for expansion, such as securing loans or attracting investors.

- Identifying Financial Issues: It highlights potential cash flow problems, debt obligations, or liquidity concerns.

How to Create a Projected Balance Sheet

Creating a projected balance sheet involves several key steps:

- Gather Financial Data: Collect all relevant financial information, including historical balance sheets, income statements, and cash flow statements.

- Estimate Future Revenue: Use sales forecasts, market research, and historical data to project future revenue.

- Forecast Expenses: Estimate future expenses based on historical data, industry trends, and planned changes.

- Calculate Assets: Determine the value of your business assets, including cash, accounts receivable, inventory , and fixed assets.

- Assess Liabilities: Identify and quantify your business liabilities, such as accounts payable, loans, and outstanding debts.

- Calculate Equity: Calculate the equity of your business by subtracting liabilities from assets.

- Compile the Data: Organize the projected financial data into a balance sheet format.

- Review and Adjust: Review the projected balance sheet for accuracy and make adjustments as needed.

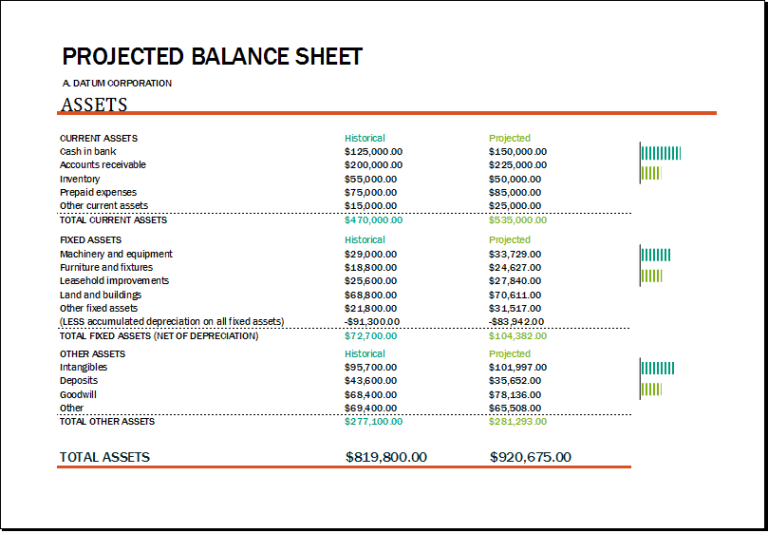

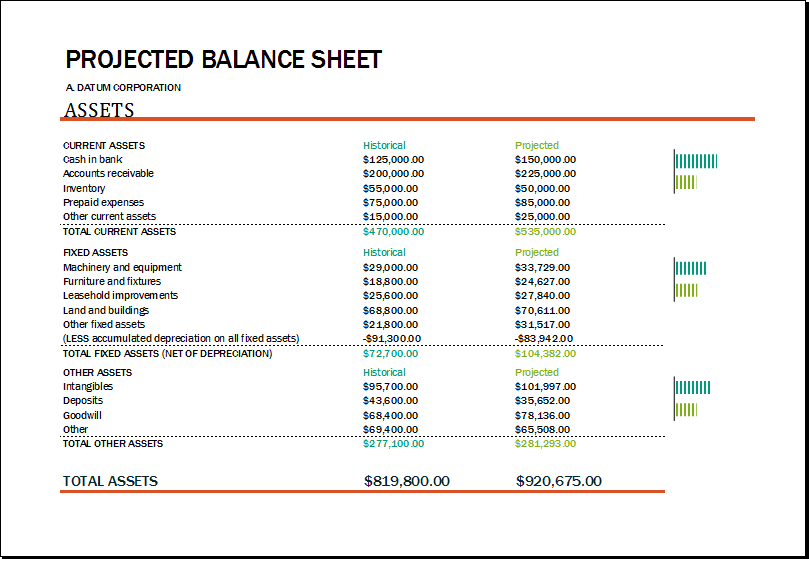

Example and Sample of a Projected Balance Sheet

Here is an example of a projected balance sheet:

XYZ Company

Projected Balance Sheet

Tips for Successful Implementation of a Projected Balance Sheet

Here are some tips to ensure successful implementation of a projected balance sheet:

- Regular Updates: Update the projected balance sheet regularly to reflect changes in your business and financial circumstances.

- Accuracy: Ensure the accuracy of your projections by relying on reliable data, market research, and expert advice.

- Realistic Assumptions: Use realistic assumptions when projecting future revenue and expenses to avoid overestimating or underestimating.

- Scenario Analysis: Perform scenario analysis by creating multiple versions of the projected balance sheet to assess the financial impact of different scenarios.

- Professional Help: Consider seeking assistance from a financial advisor or accountant to ensure the accuracy and reliability of your projected balance sheet.

Free Projected Balance Sheet Template!

A projected balance sheet is a valuable tool for any business owner. It provides a clear picture of your company’s financial health, helps with financial planning, budgeting, and investment decisions, and enables you to identify and address potential financial issues.

By following the steps outlined in this article and implementing the tips provided, you can create an accurate and reliable projected balance sheet that will assist you in making informed decisions and driving the success of your business.

Projected Balance Sheet Template Excel – Download

Leave a Comment Cancel reply

Save my name, email, and website in this browser for the next time I comment.

Projected Balance Sheet

Projected balance sheet template:

How do you create the projected balance sheet.

- Fixed assets

- Current assets

- Other types of assets

- Total assets

Benefits of using the template:

- Debit Memo Template for Excel

- Winter Attire Inventory

- Financial Projections Worksheet

- Employee Absence Tracker

- Weekly Sales Report Template

- Budget Vs Actual Statement

- Remote Work Attendance Tracker

- Mileage Expense Report Template

- Fitness Calendar Template

- Project Gantt Chart

- Daily Attendance Tracker for an Individual Employee

- Overtime Hours Tracker Template

- Vacation and Leave Tracker Template

- Departmental Expense Report Template

- Event Planning Gantt Chart

Leave a Reply

Your email address will not be published. Required fields are marked *

← Previous Article

Next Article →

You may also like

Corporate Analysis Balance Sheet Template

Microsoft Excel Balance Sheet Templates

Comparative Income Statement Template

Check Register Balance Sheet

Daily Cash Sheet Template

Cash Reconciliation Sheet Template

Cash Drawer Reconciliation Sheet

Opening Day Balance Sheet

Proforma Balance Sheet

- Employee Attendance Dashboard

- Monthly Study Reminder & Planner

- Move-in Checklist Template

- Camping Checklist Template

- Employee Orientation Checklist Template

- Salon Startup Checklist Template

- Project Completion Checklist

- Construction Site Checklist Template

- Rental Inventory Checklist Template

- Customer Support Representative Duty List

- Balance Sheets

- Business Analysis

- Calculators

- Event Orientation

- Family Stuff

- Inventory Templates

- List Templates

- Log Templates

- Schedule Templates

What Is a Projected Balance Sheet and How Do You Create One?

Last Updated August 28, 2024

Planning for future growth is an obvious critical component of running a business, but how to do this effectively is not quite as obvious.

This is where a projected balance sheet comes into play. This document is a great tool for forecasting future financial position, anticipating financial needs, managing cash flow , and making more informed, strategic decisions down the line.

This guide will help you understand what a projected balance sheet is, why it’s so essential, and how to create a projected balance sheet as you ultimately learn how to build a reliable and accurate financial forecast.

What Is a Projected Balance Sheet?

A projected balance sheet, also known as a pro forma balance sheet, estimates a company’s future financial position. Unlike a standard balance sheet that reflects past performance, it forecasts assets, liabilities, and equity based on expected financial activities.

This balance sheet projection includes current and long-term assets (like cash and property), liabilities (such as accounts payable and loans), and equity (owners’ interest after liabilities).

Projected balance sheets help businesses anticipate financial needs, manage cash flow, and plan for growth. They provide valuable insights for investors, lenders, and management. Pro forma balance sheets are an essential tool for strategic planning, budgeting, and financial management. They offer a snapshot of a company’s anticipated financial health.

Why Creating a Balance Sheet Forecast Is Important

A balance sheet forecast helps businesses anticipate future financial conditions and prepare for potential challenges and opportunities. By projecting assets, liabilities, and equity, companies can better manage cash flow, plan for investments, and appropriately allocate resources.

A balance sheet forecast provides valuable insights for stakeholders, such as investors and lenders. It demonstrates the company’s financial stability and growth potential. The document assists in securing funding by showcasing the expected financial health of the business.

Moreover, forecasting supports strategic decision-making, which means management can set realistic goals and make informed choices. It identifies potential financial shortfalls and surpluses and guides corrective actions and strategic initiatives. Overall, a balance sheet forecast is a proactive tool for financial planning and sustainable business growth.

Considerations to Ensure Maximum Accuracy for Your Projected Balance Sheet

For a projected balance sheet to offer valuable insights, it must be accurate. Here are some key factors to keep in mind:

Historical Data Analysis

Start with a thorough analysis of historical financial data. This includes examining past balance sheets, income statements, and cash flow statements . These historical trends and patterns in assets, liabilities, and equity provide the needed information for making accurate projections. Use this data to establish a baseline for future estimates.

Integration With Financial Statements

A robust balance sheet forecast should not be created in isolation. Ensure your projections align with forecasts for the income statement and cash flow statement. The income statement influences net income, which affects earnings. Meanwhile, the cash flow statement shows changes in cash and cash equivalents.

Scenario Planning and Sensitivity Analysis

Conduct scenario planning to stimulate various strategic moves and market conditions. This helps assess potential impacts on your financial health. Additionally, perform sensitivity analysis to understand how changes in key assumptions affect your projections. This allows for adjustments based on different economic or business scenarios.

Incorporate Strategic Initiatives

Factor in any known future events such as acquisitions, divestitures, or capital expenditures. These strategic plans can significantly impact the structure of your balance sheet. Ensure these initiatives accurately reflect your projects to provide a realistic financial outlook.

Regular Review and Adjustment

Balance sheet forecasting is an iterative process. Regularly compare actual outcomes to your forecast to refine assumptions and methodologies. This review process ensures that your projects remain realistic and accurate over time.

Consistency and Reasonableness

Critically evaluate your projected balance sheet for consistency and reasonableness. This is an important key to maintaining credibility and accuracy.

What to Include on Your Projected Balance Sheet

When creating a projected balance sheet, include all relevant categories that reflect the company’s anticipated financial position. These categories are typically divided into assets, liabilities, and equity.

Below, we detail what each of these categories should include, along with examples.

Assets are resources owned by the company that are expected to provide future economic benefits. They are divided into current and long-term assets.

- Cash and Cash Equivalents: Liquid assets like cash in hand or bank accounts.

- Accounts Receivable: Money owed to the company by customers for goods or services delivered.

- Inventory: Goods available for sale or raw materials used in production.

- Prepaid Expenses: Payments made in advance for services to be received in the future, such as insurance premiums.

- Property, Plant, and Equipment (PP&E): Tangible assets like buildings, machinery, and equipment.

- Intangible Assets: Non-physical assets such as patents, trademarks, and goodwill.

- Long-Term Investments: Investments that the company intends to hold for more than one year, such as stocks and bonds.

Related: Fixes Assets vs. Current Assets

Liabilities

Liabilities are obligations that the company must pay in the future. They are divided into current and long-term liabilities.

- Accounts Payable: Money owed to suppliers for goods or services received.

- Short-Term Debt: Loans or borrowings that need to be repaid within a year.

- Accrued Expenses: Expenses that have been incurred but not yet paid, such as wages and utilities.

- Deferred Revenue: Money received for goods or services that have not yet been delivered.

- Long-Term Debt: Loans or bonds payable over a period longer than one year.

- Deferred Tax Liabilities: Taxes owed in the future due to temporary differences between accounting and tax treatment of assets and liabilities.

- Lease Obligations: Long-term lease agreements for property or equipment.

Equity represents the owners’ residual interest in the company after liabilities have been deducted from assets. It includes:

- Common Stock: The par value of common shares issued.

- Additional Paid-In Capital: The amount received from shareholders in excess of the par value of the stock.

- Retained Earnings: Accumulated net income that has been retained in the company rather than distributed as dividends.

- Treasury Stock: The value of shares that the company has repurchased and holds in its treasury.

How to Make a Projected Balance Sheet

There are several key steps to creating an accurate and comprehensive projected balance sheet. This process helps businesses anticipate future financial positions and plan accordingly.

Here’s a step-by-step guide to making a projected balance sheet.

1. Gather Historical Data

Start by collecting historical financial statements, including past balance sheets, income statements , and cash flow statements . Analyze these documents to understand trends and patterns in assets, liabilities, and equity. This historical context forms the baseline for your future projections .

2. Forecast Revenue and Expenses

Next, project future sales and expenses based on market research, industry trends, and internal data. Consider factors like seasonality, economic conditions, and competitive landscape. Accurate revenue and expense forecasts impact many balance sheet items, including accounts receivable, inventory, and accounts payable .

3. Estimate Future Asset Values

Forecast the values of current and long-term assets. For current assets, such as cash, accounts receivable, and inventory, use projected sales and production levels. Adjust long-term assets, like property and equipment, for depreciation and anticipated investments.

4. Predict Liabilities

Estimate future obligations by considering expected business activities and financial commitments. Project accounts payable, short-term debt, and accrued expenses based on historical trends and anticipated changes. For long-term liabilities, factor in repayment schedules for existing loans and potential new debt .

5. Calculate Shareholders’ Equity

Determine changes in shareholders’ equity by forecasting retained earnings, additional capital contributions, and dividends. This involves projecting net income from the income statement and deciding on dividend payouts based on historical patterns or strategic goals.

6. Review and Adjust

Finally, critically evaluate your projected balance sheet for accuracy and consistency. Regularly compare it to actual outcomes and adjust assumptions as needed. Conduct sensitivity analysis to understand how changes in key variables affect your projections. This iterative process helps refine your forecast and maintain its reliability.

In-Summary: What Is a Projected Balance Sheet?

An important aspect of business accounting is not just reviewing past and current performance but planning ahead.

A projected balance sheet, or pro forma balance sheet, forecasts a company’s future financial position, detailing expected assets, liabilities, and equity. It differs from historical balance sheets by focusing on anticipated future performance based on assumptions and financial projections.

Essential for strategic planning, it helps businesses manage cash flow, secure funding, and make informed decisions by providing insights into their future financial health. This tool integrates with the other essential financial statements to ensure a comprehensive view of the company’s projected financial status .

Projected Balance Sheet FAQs

What is the difference between a projected and an estimated balance sheet.

A projected balance sheet is a detailed financial statement that forecasts a company’s future financial position based on specific assumptions and planned activities. In contrast, an estimated balance sheet approximates future financial conditions using simpler, less detailed calculations. The projected balance sheet is generally more precise and is used for strategic planning, while the estimated balance sheet provides a rough approximation for immediate needs .

What is financial modeling?

Financial modeling involves creating a detailed representation of a company’s financial performance, often using spreadsheets. It includes forecasting future revenues, expenses, assets, liabilities, and equity. These models help businesses assess the impact of various scenarios and decisions on their financial health. Financial modeling is essential for budgeting, investment analysis, and strategic planning .

What factors should you consider when making financial projections?

When making financial projections, consider factors such as historical financial data, market trends, economic conditions, and business strategies. Account for potential changes in revenue, expenses, and capital expenditures. Incorporate assumptions about growth rates, cost structures, and external factors like regulatory changes. Regularly review and adjust these projections based on actual performance.

What are balance sheet forecast methods?

Balance sheet forecast methods include historical trend analysis, the percentage of sales method, and driver-based modeling. Historical trend analysis uses past data to predict future values. The percentage of sales method projects balance sheet items as a percentage of forecasted sales. Driver-based modeling links balance sheet items to specific business drivers, such as production volumes or market conditions.

Michael McCareins is the Content Marketing Associate at altLINE, where he is dedicated to creating and managing optimal content for readers. Following a brief career in media relations, Michael has discovered a passion for content marketing through developing unique, informative content to help audiences better understand ideas and topics such as invoice factoring and A/R financing.

Turn your outstanding invoices into cash

Rated Top Factoring Company of 2024 Investopedia, TheBalanceSMB, Fundera and more

Lending Options

- Invoice Factoring Services

- Accounts Receivable Financing

- Freight Factoring

- Browse by Location

- How Does Factoring Work?

- Invoice Factoring Rates

- Financial Terms Glossary

- Invoice Factoring Calculator

- Invoice Template

- Disclosures

- Privacy Policy

- Oil & Gas

- Manufacturing

- Commercial Cleaning

- Professional Services

- More Industries

- Customer Login

- Customer Referral Program

Plan Projections

ideas to numbers .. simple financial projections

Home > Financial Projections > Balance Sheet Forecast in a Business Plan

Balance Sheet Forecast in a Business Plan

The balance sheet forecast is one of the three main statements for business plan financials, and is sometimes referred to as the statement of financial position.

The balance sheet is in effect a representation of the two sides of the accounting equation . On one side of the balance sheet are the assets (property, plant, equipment, accounts receivables, cash etc.), and on the other side are the methods by which those assets are funded, which can either be liabilities (debt finance, accounts payable etc.) or equity (shareholder capital, and profits retained within the business).

There are many balance sheet formats, the layout below acts as a quick reference, and sets out the most commonly encountered accounting terms when dealing with a business plan balance sheet forecast.

As an example, the annual report for apple shows a typical balance sheet layout.

Use of the Projected Balance Sheet Forecast

The business plan financial section for most businesses tends to concentrate on the income statement and fails to get to grips with the accounting balance sheet. Our financial projections template always includes the balance sheet template.

- Management should use the projected balance sheet forecast to help identify whether the need for working capital (inventory plus accounts receivable less accounts payable) is growing, and how that need is being funded (cash, overdraft, loans etc).

- They are used by trade suppliers to decide on whether credit is given as they identify the net assets and cash position of the business.

- Bank managers utilise the balance sheet forecast, as they base their lending ratios on certain aspects of it, for example the current ratio = current assets / current liabilities is used to determine liquidity and the risk of non repayment of a loan.

- Balance sheet forecasts are used by investors to decide whether to invest or not and at what price. For example they will look at the debt / equity ratio to determine the level of risk involved

Any number of people could be using your balance sheet forecast to make decisions about your business. It is important that you have an understanding of what information the balance sheet forecast is providing and what that information is telling you.

About the Author

Chartered accountant Michael Brown is the founder and CEO of Plan Projections. He has worked as an accountant and consultant for more than 25 years and has built financial models for all types of industries. He has been the CFO or controller of both small and medium sized companies and has run small businesses of his own. He has been a manager and an auditor with Deloitte, a big 4 accountancy firm, and holds a degree from Loughborough University.

You May Also Like

IMAGES

COMMENTS

Jul 29, 2020 · The template set includes a 12-month profit and loss statement, a balance sheet, and a cash flow statement for you to detail the current and projected financial position of a business. Download Startup Financial Projections Template

Aug 15, 2024 · A projected balance sheet is a financial statement that shows the assets, liabilities, and equity of a business at a specific point in time. It provides an overview of the company’s financial position and helps stakeholders assess its ability to meet financial obligations, determine profitability, and make informed decisions about the future.

Mar 27, 2023 · This free 4 page Excel business plan financial projections template produces annual income statements, balance sheets and cash flow projections for a five year period for any business. The financial projections template is available for free download below.

The projected balance sheet template can be downloaded to complete the projection process quickly and easily. These templates are helpful for people wanting to expand their business and those thinking of starting a new business and wanting to know the potential financial benefits they will get after starting that business.

Aug 28, 2024 · Projected balance sheets help businesses anticipate financial needs, manage cash flow, and plan for growth. They provide valuable insights for investors, lenders, and management. Pro forma balance sheets are an essential tool for strategic planning, budgeting, and financial management.

Sep 27, 2019 · Use of the Projected Balance Sheet Forecast. The business plan financial section for most businesses tends to concentrate on the income statement and fails to get to grips with the accounting balance sheet. Our financial projections template always includes the balance sheet template. Balance sheet forecasting is important for many reasons: