Business Plan Organization and Management: How to Write Guide .

Sep 17, 2023 | Business Consulting , Business Plan , Organization and Management , Organizational Development , Strategy

Writing the Business Plan Organization and Management Section

It provides critical information for those looking for evidence that your staff has the necessary experience, skills, and pedigree to realize the objectives detailed in the rest of your business plan.

What Is the Organization and Management Section in a Business Plan?

The organization and management section of your business plan should provide details about your business structure and team. This section typically comes after the executive summary. However, some people have it further in the document after the market analysis section.

This section generally is separated into two parts. The first concerns the organization as a whole. It gives readers an overview of the company structure, which is an excellent opportunity for the reader to lift the roof off your office and peer into its inner workings. For your legal design, you may set up as a limited liability company (LLC) or nonprofit/ charity or form a partnership. It’s crucial to include this section. However, suppose you’re starting a home business or have an already operating business where you’re the only person involved. In that case, you can skip this section or show the company registration details from either the company’s house or the awarding .gov.

The second part focuses specifically on your management team and introduces readers to each member — your chance to impress them with the many accomplishments pinned to your organization’s management team.

This section may seem less important than some of the other parts of your business plan, but the truth is that your people are your business. If they’re highly competent and accomplished, the implication is that so is your business.

Of course, if you’re a sole proprietor with no management structure or any employees, this section is unnecessary other than to talk about yourself and your achievements.

The section on organization and management should outline the hierarchy, individual roles, and corresponding responsibilities. It should also highlight each person’s strengths and qualifications for their positions.

Business Plan Organization Section

The organizational section of your business plan outlines the hierarchy of individuals involved in your business, typically in a chart format. This section identifies the President or CEO, CFO, Director of Marketing, and other roles for partnerships or multi-member LLCs. If you’re a single-person home business, this section is straightforward as you are the only person on the chart.

Although this section primarily focuses on owner members, you can include outsourced workers or virtual assistants if you plan to hire them. For example, you may have a freelance web admin, marketing assistant, or copywriter. You may even have a virtual assistant who coordinates with your other freelancers. While these individuals are not owners, they hold significant responsibilities in your business.

There are various business structures, such as sole proprietorships, partnerships, LLCs, and corporations.

Detail the Legal Structure within the Business Plan Organization and Management Section

Here is an indicative list of business structures. It would help if you talked to your accountant and legal advisors to determine which legal form is the best for your business proposition.

Sole Proprietorship

When embarking on a business venture, it’s essential to consider the various structures available. A sole proprietorship is a structure whereby the business is not regarded as separate from its owner’s finances. The owner retains complete control and responsibility for the company. However, they are unable to sell stocks or bring in new owners. The business becomes a sole proprietorship if not registered under any other structure.

Partnership

When forming a partnership, it can either be a limited partnership (LP) or a limited liability partnership (LLP). One partner assumes most liability in a limited partnership (LP). In contrast, the other partners have limited liability and control over the business. Alternatively, in a limited liability partnership (LLP), all partners have limited liability from debts and actions of other partners, and there is no general partner.

Limited Liability Company

A limited company (LTD) or limited liability company (LLC) is a mixture of business structures that mixes aspects of partnerships and corporations. It offers limited personal liability to the owner and passes profits through to their tax returns.

Corporation

There are various types of corporate structures. A C-corporation enables the issuance of stock shares, pays corporate taxes instead of personal returns, and provides the highest level of personal protection from business activities. On the other hand, nonprofit corporations are similar to C corporations. However, they do not aim to make profits and are exempt from state or federal income taxes.

More information on company legal structures is available on UK.Gov and USA.SBA websites.

Describe Your Company’s Organizational Structure

This first step illustrates the positions in your organization’s employee hierarchy and how they all relate to each other.

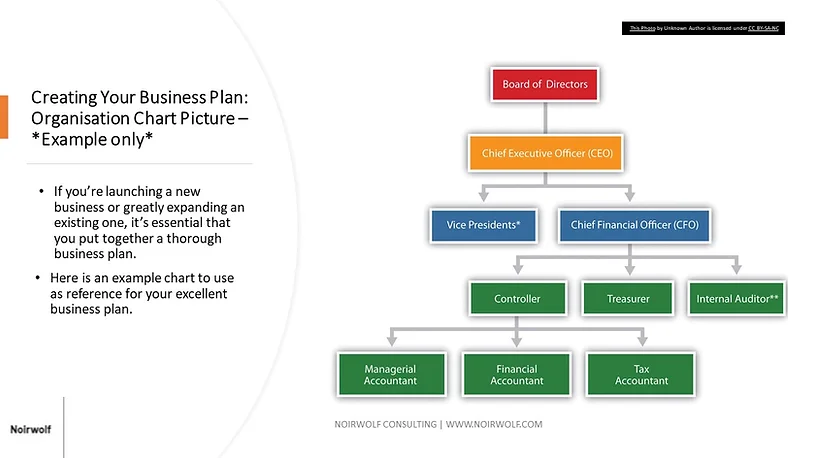

This is usually done graphically as a guide, using an organizational chart, or “org chart” for short. People use a Microsoft tool, i.e., PowerPoint or Excel, to help.

Organization Charts typically follow a top-down hierarchy, starting with your CEO/ Managing Director in the top box at the top of the page. Lines extend down from that person’s name to boxes containing the terms of the CEO’s direct reports.

We have included an example organizational chart below for guidelines only.

Identify your business organization structure and list your team members’ strengths and skills.

Those managers then have lines extending to those who report to them, and so on, down to your lowest staff positions.

This section will give your readers a quick understanding of your management and governance structure, the size of your organization, and your lines of control and communication.

Describe your Team in your Business Plan Organization and Management Section

In your business plan’s Organization and Management section, please provide a detailed description of your team. Y ou will discuss the company’s management team, starting with the owners.

This section highlights who is involved in the running of your business and who are the support professionals. It also includes the roles and responsibilities of managers.

Suppose the company structure is a multi-owner arrangement or some other multi-owner arrangement. In that case, you’ll want to include information for every member and their percentage of ownership and ongoing involvement in the company.

It’s important to discuss how ownership interests are split, their responsibilities, what they did before securing their current position, and how they came to be involved with the company.

Here, it would help if you talked about some of your critical team members. These people are directly responsible for large portions of your business operations.

Owner/Manager/Members

Within your business o rganization and management section, y ou should introduce the team and talk about their experience, qualifications, previous companies and achievements, role in the company, and any special skills they bring with them. Please provide the following details for each owner, manager, or member of the business within your business plan:

- Percentage of ownership (if applicable)

- Level of involvement (active or silent partner)

- Type of ownership (e.g., stock options, general partner)

- Position in the company (CEO, CFO, etc.)

- Responsibilities and Duties

- Educational background

- Relevant experience and skills

- Previous employment history

- Skills that will benefit the business

- Awards or recognition received

- Compensation structure

- How each individual’s skills and experience will complement and contribute to the business’s success

Perhaps they’re an entrepreneur, business coach, exclusive advisor, or industry specialist to help you grow.

This is an ideal opportunity for companies with an Executive Board of Directors, Governance Structure, or Advisory Board to introduce them to your readers.

Executive Board

Having a board of directors is essential for your management team. Without one, you may be missing out on crucial information. This section includes details similar to those found in the ownership and management team sub-section, such as the names, areas of expertise, positions (if applicable), and involvement with the company of each board member.

Strategic Advisors

Suppose you’re looking for funding for your business or to fill a gap in your knowledge, or you may not have the funds to hire an executive board. In that case, you must inform potential partners and investors that you have a team of professionals assisting you. This includes lawyers, accountants, and any freelancers or contractors you may be working with. When listing these individuals, include their name, title, educational background, certifications, services they provide to your business, and their relationship with you (i.e., hourly rates, projects, retainer, as-needed, regular). Additionally, highlight their skills and experience that make them an asset to your team you need

Does anything else make them stand out as quality professionals (awards, past working with credible brands)?

Spotlight on the Wider Team Structure

Now, you’ve showcased the management team in its entirety. You can provide brief bios for hiring team needs or secondary members and talk at length about how the team’s combined skills complement each other and how they amplify the team’s effectiveness.

It’s also important to point out any gaps in the knowledge your team is currently suffering. Your readers will likely be savvy enough to pick up on existing holes.

Therefore, you’ll want to get ahead of these criticisms and demonstrate that you’re already aware of the positions and complementary skill sets your management team still requires and how you plan to address the knowledge gaps with future hires.

Do you need help writing your business plan o rganization and management section ?

Every successful business plan should include the organization and management section, helping you communicate your legal structure and team.

Writing a business plan can seem overwhelming, especially when starting a small, one-person business. However, it can be a reasonably simple task. This section of the plan should be updated if there are any changes to the organization structure or team members, such as additional training, awards, or other resume changes that benefit the business.

Creating your comprehensive business plan takes planning, research, time, and a herculean effort. If, at any point, the work becomes too much to handle, we can step in to assist.

Do you want an expert “second opinion” before creating your business plan or financial forecasts? Let’s talk !

Get in Touch

Are you looking to grow your business but unsure where to start? Our small business consulting and leadership coaching services are here to help! We’ll work with you to scale your operations and achieve your goals. Plus, we offer a free 30-minute consultation to ensure we fit your needs correctly. Let’s get started!

Contact Noirwolf Consulting today using the website contact form or by emailing [email protected] or call us at +44 113 328 0868.

Recent posts .

HR Trends for 2025: Shaping the Future of Work

Dec 20, 2024

As we step into 2025, HR continues to evolve, shaping the future of work through innovation and strategy. This article explores the key HR Trends for 2025, from hybrid work models and people analytics to DEIB initiatives and sustainability’s growing role in ESG. Packed with insights, practical advice, and links to trusted resources like CIPD and McKinsey, this guide is your roadmap to navigating the next phase of workplace transformation. Dive in and prepare to lead the charge in HR excellence!

Program Governance: Essential Standards for Gaining Control

Nov 21, 2024

Discover how effective program governance, through strategic planning, risk management, and stakeholder engagement, can elevate your organization’s success.

PMO Setup: Guide to Project Planning Success

Nov 18, 2024

Ready to set your projects up for success? Our PMO setup guide dives into proven strategies for seamless project planning and management. Start optimizing your portfolio and programme management today!

Happy clients .

Trevor mcomber, us.

I recently worked with Zoe@Noirwolf, who provided me with an outstanding 5-year business plan. The expertise in financial planning, market research, SWOT analysis, and consulting was exceptional. Zoe provided me with a comprehensive and well-researched plan tailored to my business. The entire process was professional, timely, and communicative.

Bill Walton, Leeds

Zoe provided first-rate work and is an excellent business consultant. I was trying to figure out my cash flow forecast for my startup. Zoe gave me an interactive consultation session over MS teams, which was valuable and saved me a lot of time. She is super quick in excel and knowledgeable about what to include in your estimates. She was able to offer me ideas & choices that I hadn't considered. Highly recommended.

Jeendanie Lorthe, US

Warren kim, us, oscar sinclair, london, get in touch ..

Looking to grow your business but feeling unsure about where to start? Our small business consulting and leadership coaching services are here to help! We'll work with you to scale your operations and achieve your goals. Plus, we offer a free one-hour consultation to ensure we fit your needs correctly. Let's get started!

- Search Please fill out this field.

- Building Your Business

- Becoming an Owner

- Business Plans

Writing the Organization and Management Section of Your Business Plan

What is the organization and management section in a business plan.

- What to Put in the Organization and Management Section

Organization

The management team, helpful tips to write this section, frequently asked questions (faqs).

vm / E+ / Getty Images

Every business plan needs an organization and management section. This document will help you convey your vision for how your business will be structured. Here's how to write a good one.

Key Takeaways

- This section of your business plan details your corporate structure.

- It should explain the hierarchy of management, including details about the owners, the board of directors, and any professional partners.

- The point of this section is to clarify who will be in charge of each aspect of your business, as well as how those individuals will help the business succeed.

The organization and management section of your business plan should summarize information about your business structure and team. It usually comes after the market analysis section in a business plan . It's especially important to include this section if you have a partnership or a multi-member limited liability company (LLC). However, if you're starting a home business or are writing a business plan for one that's already operating, and you're the only person involved, then you don't need to include this section.

What To Put in the Organization and Management Section

You can separate the two terms to better understand how to write this section of the business plan.

The "organization" in this section refers to how your business is structured and the people involved. "Management" refers to the responsibilities different managers have and what those individuals bring to the company.

In the opening of the section, you want to give a summary of your management team, including size, composition, and a bit about each member's experience.

For example, you might write something like "Our management team of five has more than 20 years of experience in the industry."

The organization section sets up the hierarchy of the people involved in your business. It's often set up in a chart form. If you have a partnership or multi-member LLC, this is where you indicate who is president or CEO, the CFO, director of marketing, and any other roles you have in your business. If you're a single-person home business, this becomes easy as you're the only one on the chart.

Technically, this part of the plan is about owner members, but if you plan to outsource work or hire a virtual assistant, you can include them here, as well. For example, you might have a freelance webmaster, marketing assistant, and copywriter. You might even have a virtual assistant whose job it is to work with your other freelancers. These people aren't owners but have significant duties in your business.

Some common types of business structures include sole proprietorships, partnerships, LLCs, and corporations.

Sole Proprietorship

This type of business isn't a separate entity. Instead, business assets and liabilities are entwined with your personal finances. You're the sole person in charge, and you won't be allowed to sell stock or bring in new owners. If you don't register as any other kind of business, you'll automatically be considered a sole proprietorship.

Partnership

Partnerships can be either limited (LP) or limited liability (LLP). LPs have one general partner who takes on the bulk of the liability for the company, while all other partner owners have limited liability (and limited control over the business). LLPs are like an LP without a general partner; all partners have limited liability from debts as well as the actions of other partners.

Limited Liability Company

A limited liability company (LLC) combines elements of partnership and corporate structures. Your personal liability is limited, and profits are passed through to your personal returns.

Corporation

There are many variations of corporate structure that an organization might choose. These include C corps, which allow companies to issue stock shares, pay corporate taxes (rather than passing profits through to personal returns), and offer the highest level of personal protection from business activities. There are also nonprofit corporations, which are similar to C corps, but they don't seek profits and don't pay state or federal income taxes.

This section highlights what you and the others involved in the running of your business bring to the table. This not only includes owners and managers but also your board of directors (if you have one) and support professionals. Start by indicating your business structure, and then list the team members.

Owner/Manager/Members

Provide the following information on each owner/manager/member:

- Percentage of ownership (LLC, corporation, etc.)

- Extent of involvement (active or silent partner)

- Type of ownership (stock options, general partner, etc.)

- Position in the business (CEO, CFO, etc.)

- Duties and responsibilities

- Educational background

- Experience or skills that are relevant to the business and the duties

- Past employment

- Skills will benefit the business

- Awards and recognition

- Compensation (how paid)

- How each person's skills and experience will complement you and each other

Board of Directors

A board of directors is another part of your management team. If you don't have a board of directors, you don't need this information. This section provides much of the same information as in the ownership and management team sub-section.

- Position (if there are positions)

- Involvement with the company

Even a one-person business could benefit from a small group of other business owners providing feedback, support, and accountability as an advisory board.

Support Professionals

Especially if you're seeking funding, let potential investors know you're on the ball with a lawyer, accountant, and other professionals that are involved in your business. This is the place to list any freelancers or contractors you're using. Like the other sections, you'll want to include:

- Background information such as education or certificates

- Services provided to your business

- Relationship information (retainer, as-needed, regular, etc.)

- Skills and experience making them ideal for the work you need

- Anything else that makes them stand out as quality professionals (awards, etc.)

Writing a business plan seems like an overwhelming activity, especially if you're starting a small, one-person business. But writing a business plan can be fairly simple.

Like other parts of the business plan, this is a section you'll want to update if you have team member changes, or if you and your team members receive any additional training, awards, or other resume changes that benefit the business.

Because it highlights the skills and experience you and your team offer, it can be a great resource to refer to when seeking publicity and marketing opportunities. You can refer to it when creating your media kit or pitching for publicity.

Why are organization and management important to a business plan?

The point of this section is to clarify who's in charge of what. This document can clarify these roles for yourself, as well as investors and employees.

What should you cover in the organization and management section of a business plan?

The organization and management section should explain the chain of command , roles, and responsibilities. It should also explain a bit about what makes each person particularly well-suited to take charge of their area of the business.

Want to read more content like this? Sign up for The Balance’s newsletter for daily insights, analysis, and financial tips, all delivered straight to your inbox every morning!

Small Business Administration. " Write Your Business Plan ."

City of Eagle, Idaho. " Step 2—Write Your Business Plan ."

Small Business Administration. " Choose a Business Structure ."

Related Articles

Business Plan Section 3: Organization and Management

This section explains how your business runs and who’s on your team. Learn how to present the information in this section of your business plan.

This section of your business plan, Organization and Management, is where you’ll explain exactly how you’re set up to make your ideas happen, plus you’ll introduce the players on your team.

As always, remember your audience. If this is a plan for your internal use, you can be a little more general than if you’ll be presenting it to a potential lender or investor. No matter what its purpose, you’ll want to break the organization and management section into two segments: one describing the way you’ve set up the company to run (its organizational structure), and the other introducing the people involved (its management).

Business Organization

Having a solid plan for how your business will run is a key component of its smooth and successful operation. Of course, you need to surround yourself with good people, but you have to set things up to enable them to work well with each other and on their own.

It’s important to define the positions in the company, which job is responsible for what, and to whom everyone will report. Over time, the structure may grow and change and you can certainly keep tweaking it as you go along, but you need to have an initial plan.

If you’re applying for funding to start a business or expand one, you may not even have employees to fit all the roles in the organization. However, you can still list them in your plan for how the company will ideally operate once you have the ability to do so.

Obviously, for small businesses, the organization will be far more streamlined and less complicated than it is for larger ones, but your business plan still needs to demonstrate an understanding of how you’ll handle the workflow. At the very least, you’ll need to touch on sales and marketing, administration, and the production and distribution of your product or the execution of your service.

For larger companies, an organizational plan with well-thought-out procedures is even more important. This is the best way to make sure you’re not wasting time duplicating efforts or dealing with internal confusion about responsibilities. A smooth-running operation runs far more efficiently and cost-effectively than one flying by the seat of its pants, and this section of your business plan will be another indication that you know what you’re doing. A large company is also likely to need additional operational categories such as human resources and possibly research and development.

One way to explain your organizational structure in the business plan is graphically. A simple diagram or flowchart can easily demonstrate levels of management and the positions within them, clearly illustrating who reports to whom, and how different divisions of the company (such as sales and marketing) relate to each other.

Here is where you can also talk about the other levels of employees in your company. Your lower-level staff will carry out the day-to-day work, so it’s important to recognize the types of people you’ll need, how many, what their qualifications should be, where you’ll find them, and what they’ll cost.

If the business will use outside consultants, freelancers, or independent contractors, mention it here as well. And talk about positions you’d want to add in the future if you’re successful enough to expand.

Business Management

Now that we understand the structure of your business, we need to meet the people who’ll be running it. Who does what, and why are they onboard? This section is important even for a single practitioner or sole proprietorship, as it will introduce you and your qualifications to the readers of your plan.

Start at the top with the legal structure and ownership of the business. If you are incorporated, say so, and detail whether you are a C or S corporation. If you haven’t yet incorporated, make sure to discuss this with your attorney and tax advisor to figure out which way to go. Whether you’re in a partnership or are a sole owner, this is where to mention it.

List the names of the owners of the business, what percent of the company each of them owns, the form of ownership (common or preferred stock, general or limited partner), and what kind of involvement they’ll have with day-to-day operations; for example, if they’re an active or silent partner.

Here’s where you’ll list the names and profiles of your management team, along with what their responsibilities are. Especially if you’re looking for funding, make sure to highlight the proven track record of these key employees. Lenders and investors will be keenly interested in their previous successes, particularly in how they relate to this current venture.

Include each person’s name and position, along with a short description of what the individual’s main duties will be. Detail his or her education, and any unique skills or experience, especially if they’re relevant to the job at hand. Mention previous employment and any industry awards or recognition related to it, along with involvement with charities or other non-profit organizations.

Think of this section as a resume-in-a-nutshell, recapping the highlights and achievements of the people you’ve chosen to surround yourself with. Actual detailed resumes for you and your management team should go in the plan’s appendix, and you can cross-reference them here. You want your readers to feel like your top staff complements you and supplements your own particular skill set. You also want readers to understand why these people are so qualified to help make your business a success.

This section will spell out the compensation for management team members, such as salary, benefits, and any profit-sharing you might be offering. If any of the team will be under contract or bound by non-compete agreements, you would mention that here, as well.

If your company will have a Board of Directors, its members also need to be listed in the business plan. Introduce each person by name and the position they’ll hold on the board. Talk about how each might be involved with the business (in addition to board meetings.

Similar to what you did for your management team, give each member’s background information, including education, experience, special skills, etc., along with any contributions they may already have had to the success of the business. Include the full resumes for your board members in the appendix.

Alternately, if you don’t have a Board of Directors, include information about an Advisory Board you’ve put together, or a panel of experts you’ve convened to help you along the way. Having either of these, by the way, is something your company might want to consider whether or not you’re putting together the organization and management section or your business plan.

When it comes to your finances, you want clear guidance and easy-to-implement tools based on your unique needs. Visit Learn with AOF to get started strengthening your financial management and meeting your goals.

Experience a different kind of financial education. Learn with AOF has flexible, on-demand courses developed by small business owners for small business owners. Learn on your schedule, with no time commitment or limit. Save your progress any time to fit courses into your busy schedule.

NEXT ARTICLE > Business Plan Section 4: Products and Services

Apply for a loan, get started.

Loans from $5,000 - $100,000 with transparent terms and no prepayment penalty. Tell us a little about yourself, your business and receive your quote in minutes without impacting your credit score.

Thanks for applying!

Loans are originated and funded through our lending arm, Accion Opportunity Fund Community Development. By clicking “Continue to Application,” you consent to, Accion Opportunity Fund Community Development’s Terms of Use and Privacy Policy ; and to receive emails, calls and texts , potentially for marketing purposes, including autodialed or pre-recorded calls. You may opt out of receiving certain communications as provided in our Privacy Policy .

Get the fundamentals for your consulting and service business in 1 hour.

About | Speaking | Newsletter | Contact

How to Write an Organization and Management Section for Your Business Plan

Article Outline

The organization and management section of your business plan isn’t just window dressing for your plan’s audience. This section is also the map for your entire organization no matter how big or small you want it to be. In short, this section becomes the foundation for running your business now and in the future.

No pressure.

But that doesn’t mean it has to be perfect, only written. Unfortunately, somewhere around only 30 – 40% of businesses have a written business plan. According to BusinessDIT.com, entrepreneurs who finish their business plan are 260% more likely to launch and twice as likely to succeed .

So make sure you write one, even if you’re just writing the plan to clarify your thinking (and I think every entrepreneur should write a plan for this reason).

The organization and planning section can be one of the more intimidating sections to write. It doesn’t have to be.

Here are the things to include in this section:

- How you will legally structure your business

- How to factor for partnerships

- When you will hire and for what roles (or clarifying existing roles)

- And finally, a look at self-management if you choose to remain a solopreneur

How to Structure Your Business

Structuring your business is one of the most critical decisions you make. Choose wrong, and besides lost filing fees and expenses tied to restructuring, your risk exposure and unfavorable tax benefits could have immense costs associated with them.

So… how should you structure your business? Should you be a sole proprietor, LLC, LP, LLP, S Corp, C Corp, etc?

Here’s what I tell every entrepreneur who approaches me with that question: ask your attorney AND your accountant.

I’m pretty smart, but I’m not qualified to give professional advice, nor should anything I say, write herein, either expressed or implied, be construed as such. Consult with a qualified professional whenever possible (consider this your legalese disclaimer).

The default structure many entrepreneurs opt for is sole proprietorship. It’s the easiest, cheapest, and simplest structure to enter. Besides possible licensing, zoning, and certification requirements required by your local government, you can launch a sole proprietorship today as First-and-Last-Name Enterprises.

This structure is common for consultants and professional service entrepreneurs. In fact, the SBA finds that sole proprietorship makes up 87% of small businesses in America . But despite how popular this structure is, there are significant downsides.

The pros of sole proprietorship:

- Low initial setup cost

- No annual reports to file

- No corporate tax

- No restrictions because of business structure

The cons of sole proprietorship:

- Unlimited liability — your personal finances and properties are connected to the business

- Can’t sell the business entity

- Difficult to raise funding

- Not able to assume business debt

I think the cons significantly outweigh any potential benefits. And if you plan to take on partners or share equity with early hires, or raise capital at any point, you most definitely cannot assume this structure.

Here’s a list of common legal business structures within the United States which you can discuss with your attorney and tax accountant:

- Partnership: A partnership of two or more individuals where the primary partner has unlimited liability for debts or limited liability depending on which partnership structure is selected

- Limited Liability Company (LLC): Varying from state to state, an LLC is a structure where the personal responsibilities of the owners is limited and tax returns are filed individually by the owners

- C Corporation (C Corp): Defined by the U.S. Tax Code, a C Corp is a structure that is taxed on its own — the owners and shareholders are taxed separately

- S Corporation (S Corp): Also defined by the tax code, the S Corp is more advantageous for smaller companies with fewer than 100 shareholders because it allows its taxable income and losses to be passed through to the shareholders

It’s a lot to consider.

Which is why I will offer one more warning before you jump in, do a little research, and choose a structure: you can’t foresee every outcome.

I do not advise you to head online and pick the first “fast and cheap” legal form you find to create your business’s structure. Consult with an attorney whose experience and foresight can help protect you from a multitude of future scenarios, some of which you’ve never thought of. A few hundred dollars invested now can save tens of thousands of dollars in compounded errors, which if you ask me is a great ROI.

How You Will Operate With Partners

Another important decision is whether you will have business partners. While you may not have partners now, you might want partners in the future to help with growth, scaling, additional skill sets and expertise, and to add cash into the business.

As with structuring your business, you will also want to consult with your lawyer here to help you craft a partnership agreement . The attorney will help you identify, discuss, and come to an agreement about how you want to manage the business with your partners.

If you choose to take on partners, the organization and management section of your business plan should define roles, equity, and responsibilities among the partners, answering questions like these:

- How is the equity split and who holds the majority share?

- What positions or titles will the founding partners have and who reports to whom?

- What will the founders’ salaries be?

- What financial contributions and commitments are the shareholders making?

- How will you decide what equipment or software to buy and where you’re going to invest resources and how much input will limited partners have in these decisions?

- Regarding investing partners, what is the agreed-upon return on their investment and how soon can they expect that return?

- If there’s a silent partner (contributing financially, with limited operational or consulting functions), what will and won’t they do?

- If they are a general partner (actively involved in operations), what areas of the business will fall under their purview?

And, yes, founders wear a lot of proverbial hats, so distinguish between their primary responsibilities and secondary and tertiary duties.

This may seem tedious, but it’s important to make expectations clear. In the early stages of every business, everybody’s excited about the opportunity; everybody is putting in time and effort, and expectations need to be identified and agreed upon, because later as the excitement wanes conflict can ensue. No matter how well you and your partners get along in the beginning, this honeymoon phase will end, and you’ll want to be on the same page regarding the best and worst of times.

Clear and present expectations eliminate unnecessary future friction.

How You Will Hire and Manage People as the Business Grows

We’ve looked at the organization side so far, the structure and founders, but how will you manage the company? Even if your first projected hire is months or years into the future, deciding in advance how you want to manage your staff as it assembles will help ease any growing pains.

Most likely, you’ve been in the workforce and have had both good and bad managers — companies you (hopefully) enjoyed working for, and maybe others that made you race for the exit. These experiences can help inform how you want your culture to feel and how your style of management might look.

In the 1950s, management professor Douglas McGregor proposed the Theory X and Theory Y styles of management. They provide a spectrum to help decide how you want to manage your workforce.

On one end of the spectrum, Theory X proposes all employees are inherently lazy and unmotivated and need various forms of coercion to make them productive. It depends on strong rules with punitive consequences for violating them and sometimes outright threats and intimidation to keep employees engaged.

Theory Y lies on the other end of the spectrum. This theory operates from the belief that employees are naturally motivated and eager to perform and simply need guidance and vision with minor oversight or management.

If you’re thinking of implementing either extreme, you should know that even McGregor believed the best approach lay somewhere in the middle region.

Like most founders, you most likely desire a high-performing team with minimal personnel issues. There are comprehensive books, online content, and consultants dealing with this fascinating area of management science.

For your purposes, as you craft the Organization and Management section of your business plan, I invite you to think intentionally about how you want to hire, work with, and sometimes fire people. Examine how you see these roles and their associated responsibilities and expectations emerging as your company grows.

Solopreneurs and Self-Management

When talking to fledgling entrepreneurs, they sometimes ask me if they should hire a team or remain a one-person shop. If you’re grappling with the same questions, the honest answer is… it’s up to you. There’s nothing wrong with either approach, and with 82% of small businesses operating with zero employees , remaining a solopreneur puts you in a popular crowd. Whichever avenue you choose to pursue, include it in your plan.

If you choose to be a solopreneur, there are special considerations you will want to plan for. In the beginning, especially if cash is tight, you’re doing A-to-Z and everything in between. At some point in the future, if everything goes well, cash won’t be tight, and you have a decision to make: will you bring on assistants, virtual assistants, or contracted people to help you run your business?

Consider, for the sake of planning, these scenarios:

- Bringing on a contracted professional to perform tasks you don’t enjoy

- Taking on a partner or consultant who possesses a skill set you don’t have

- Contracting or partnering with a junior professional to handle extra work when there’s a rush

- Working with an assistant/virtual assistant (VA) to free up your time for more lucrative tasks

- Or hiring only seasonal/part-time help if your business experiences predictable fluctuations

In the plan, decide at which point in your business you desire to free up your time. The point could be arriving at a milestone like when you retain a certain number of clients or revenue amount. Then evaluate and include the typical costs involved with bringing on a contractor. Estimate the savings and opportunities leveraging your time will create. Freeing up 3 to 5 hours a week could mean more time to work with a major client or more time for family.

Last, consider and record how you will budget your time. I’ve worn many hats in the early days of my businesses. I know what it’s like. What I have found helpful is to split duties throughout the week, allocating blocks of time to complete certain responsibilities or designating certain days for focused activities. And while you will mostly work in the business, schedule weekly or monthly blocks when you will work on the business to plan, strategize, review, and revise.

Also, plan for time to network and connect with mentors in your network, seeking to meet consistently for input and advice on your work and plans.

And just as you would do if planning to work with partners and eventual hires, I think it’s a good idea to capture some early expectations for yourself. The clarity and insights you glean from doing this work may be incredibly worthwhile.

Key Takeaways

The organization and management section can seem a bit intimidating, especially if you’re coming from a company where everything was predefined when you started the job. If you aren’t looking for funding at the start of your business, it can seem unnecessary to write a plan. But as you can see, planning is imperative to clarify your thoughts, further vet your ideas, and expose unnoticed vulnerabilities and deficiencies.

To recap, the Organization and Management section is where you capture how you will:

- Structure your business (with an attorney and accountant’s input, of course)

- Operate and perform with partners including the equity split, responsibilities, roles, expectations, and decision making

- Hire and manage people as you grow, deciding what your culture and management style will be, what roles will be created, and at what milestones you will make those hires

- Manage as a solopreneur if you choose, determining at what point you may augment your time and skill sets with assistants and contractors if at all

As Winston Churchill said, “Plans are of little importance, but planning is essential.” You can’t foresee every circumstance that will arise as you’re running your business, but with a solid plan, you’ll be able to take on challenges and opportunities more effectively.

Feras Alhlou

Feras has founded, grown, and sold businesses in Silicon Valley and abroad, scaling them from zero revenue to 7 and 8 figures. In 2019, he sold e-Nor, a digital marketing consulting company, to dentsu (a top-5 global media company). Feras has served as an advisor to 150+ other new startup businesses, and in his current venture, Start Up With Feras, he's on a mission to help entrepreneurs in the consulting and services space start and grow their businesses smarter and stronger.

- Visit author's facebook profile

- Visit author's twitter profile

- Visit author's linkedin profile

Related Content

Effective Project Retrospective: How to Evaluate and Improve Your Projects

How to Turn Difficult Clients Into Loyal Fans

The Ultimate Pricing Guide for Consulting Businesses for 2025

Creating Impactful Client Satisfaction Survey Questions for Growth

- Next »

Related Shorts

Putting Your Business On Hold

Tak Management 101

Why Founders Don’t Get Help

Seek help from others

How Mentors Effect Your Business

What Your Business Is Missing

No Business Experience

Careful With Taking Investments

What Strong Networks Can Do

The Hardest Decision You’ll Make

Every Business Needs This Person

Business Escalators

What Life Is About

Ditching My Job for Air Jordans

Robert Kiyosaki on Passive Income

Why Interview Prep Matters

The Difference Between Coaches & Advisors

Industries for a Reliable Revenue Stream

How to Wreck Your Career

Why Delivering Pizza is Bad For You

Small Is Better than Nothing

Is that a Side Hustle?

Winning the Lottery

Wanna Make Some Quick Cash?

How to Hire a Mediocre Employee

Don’t Hire the Most Qualified Person

How a Wealthy Doctor Burnt $200k (Real Story)

Is Business a Science or Just Luck

5 Criteria to Assess Help

How to Allocate Resources in a Small Business

Passive or Active Income?

The Risks of Starting a Consulting Business

Can a Services Business Have Intellectual Properties?

Service vs. Product Businesses: 3 Major Differences

2 Types of Revenue Models

4 Turning Points in Every Entrepreneur’s Life

Tech CEO Hearings: What Entrepreneurs Need to Know

Fool Me Twice Shame On… Process Optimization

Audit Your Suppliers

How to Get an Edge Over Competitors

Urgency with Clients

Pick a Lane

When to Hire as a Small Business Owner

How to Know Your Strengths & Weaknesses

The Remedy for Perfectionists

New Business Is Failing 😱 Should I Quit?

Should a Business Owner Know Every Aspect of Their Business?

How Much Time Does Starting a Business Require?

Should I Tell My Spouse Before Starting My Business?

Is It OK to Stay a Solopreneur?

Will AI Destroy Your Business?

Before Taking The Full Time Entrepreneurship Leap, Be Prepared

Edge for Consulting Startups: Learning and Certifications

7 types of stakeholders for your business plan.

Working with Family and Friends? Keep It Professional

How to Write a Business Plan: Organization Structure

How to write a business plan: organizational structure by dr. paul mba., what is the organizational structure for a business plan.

The organization structure section should discuss whether your business will be a sole proprietor, limited liability corporation, or corporation, who will run your business, each person’s responsibility, and how your business will expand if needed. There are numerous benefits to a detailed assessment of the company’s structure. First, examining the structure of the business will help for tax purposes. For example, limited liability and corporations are excellent for protecting shareholders concerning liabilities. However, tax-wise, these firms often are double-taxed. The second benefit of a detailed assessment of a company’s structure is understanding how each owner will contribute. In other words, if there is more than one owner, what are their responsibilities, and how will they be carried out?

Why is the Organizational Structure important?

There are numerous reasons why the organizational structure is essential for a business plan. The business owner will explain how the company will be structured in this section. For example, this section will include job titles and responsibilities, resumes from owners and management, showing expertise in the industry, and supporting accolades for expertise. By discussing job responsibilities and management experiences, readers will better understand why this type of business structure and management team will be successful in the proposed business.

A second important reason for the organizational structure is that the section introduces business owners. The owners and management team should not only be introduced in this section, but their experiences in the industry need to be highlighted and thoroughly explained. In doing this, a sound foundation for management competence will be established.

A final reason for its importance is the job responsibility segment. Ownership and management need a written document showing specific duties for each owner, if applicable, and specific job responsibilities for each position within the company. This document will help readers see how the business will function and better understand the breakdown of management responsibilities.

When to write the Organizational Structure?

The organizational structure should be written after the company description. In the company description, readers will be introduced to the problem that the company will solve and how they propose to solve it. This is usually the product or service offered. The next step is to show a business structure that allows the company to supply that product or service effectively and efficiently. Thus, the need for the organizational section follows immediately after the company description.

How to write the Organizational Structure?

When I write my organizational structure for a business plan, for the most part, I start the first paragraph by reminding the readers of the company name. I then introduce how the company will be held in ownership. For example, will the company be a limited liability corporation? Sole proprietorship? Next, I briefly introduce the management team and owners. Further, I also briefly introduce their experience in the industry.

Following this structure, the first paragraph is an excellent summation of the section. This allows the reader to understand the breadth of the ownership structure without gaining significant details.

Organizational Structure: Ownership

In the ownership section, I usually start by introducing the CEO/founder/majority owner. In this portion, I usually write the segment, almost like a brief biography. I will discuss the CEO's history in the industry and why they feel that they are best suited to start and run the operation.

Once this is complete, I follow the same structure with the other management team members and minority stakeholders. When this is done, the reader should walk away with an excellent understanding of the ownership team's qualifications and how their skills will complement each other.

Need Help Writing an Organizational Structure for a Business Plan?

Call or Text Dr. Paul, MBA.

321-948-9588

Email: [email protected]

Organizational Structure: Responsibilities

In the job responsibility section, I usually structure this portion as a bullet-pointed list. At the top, I put the title, such as CEO, project manager, or job title. Following this, I list the responsibilities and expectations for each position. Not only does this help show structure and foresight for the company, but it will also help management divvy up duties for the business.

Organizational Structure: Resume

The resume section is for senior managers and owners. By including resumes, supporting documentation is available for claims related to experience. For example, if the CEO claims to have 20 years of experience in the industry, then the resume will show where this experience came from, adding credibility to previous claims.

Organizational Structure: Compensation

Compensation is sometimes necessary to include in the organizational structure component. Investors expect management and employees to be compensated. However, excessive compensation is often an issue with startups and established businesses. By showing reasonable compensation for each position, a solid understanding of the pay for each position will be shown, and restraint for compensation by the management team and ownership may also be highlighted.

Organizational Structure: Achievements

This final section is almost like a cherry on top of the cake. By this point, the reader should be well-versed in the ownership and management team's experience and expertise. Adding achievements highlights their expertise in their chosen industry.

Organizational Structure Example

Organizational structure.

Legal Structure

ABC Restaurant will be a limited liability corporation.

Management Summary

John Smith, Sr., MBA., is the founder and CEO of ABC Restaurant. He has started and managed numerous successful small restaurants over the last ten years. Restaurants, including a breakfast cafe, food truck, and 24-hour diner, started and managed. He was responsible for all aspects of the organization for each business, from marketing to strategic planning.

Job Responsibilities

- Create and execute marketing strategies for business growth.

- Align business strategies with the vision statement.

- Negotiating contracts with vendors.

- Ensure legal compliance for the business.

- Continually examine the firm’s external environment for new market opportunities.

General Manager:

- Control inventory to ensure optimal levels are attained.

- Manage day-to-day operations of the restaurant.

- Servers and cooks during high volume times.

- Interview and hire new employees.

- Assist in the onboarding process for new employees.

- Set up all workstations in the kitchen

- Prepare ingredients to use in cooked and non-cooked foods.

- Check food while cooking for appropriate temperatures.

- Ensure great presentation by dressing dishes as trained.

- Keep a sanitized and clean environment in the kitchen area.

- Stock dining area tables with needed items.

- Greet customers when they enter.

- Present dinner menus and help customers with food/beverages selections.

- Take and serve orders quickly and accurately.

Author: Dr. Paul Borosky, MBA., Published Author

Updated: 11/4/2024

Creating Your Business Plan: Organization & Management | Tory Burch Foundation

Start my business, creating your business plan: organization & management, 48,422 views.

From the Small Business Administration

Link copied to clipboard

This section of your Business Plan should include the following: your company’s organizational structure, details about the ownership of your company, profiles of your management team, and the qualifications of your board of directors.

Individuals reading your business plan will want to see answers to important questions including who does what in your business, what their backgrounds are, why you are bringing them into the business as board members or employees, and what they are responsible for. A detailed description of each division or department and its function should be outlined.

This section should include who’s on the board (if you have an advisory board) and how you intend to keep them there. What kind of salary and benefits package do you have for your people? What incentives are you offering? How about promotions? Reassure your reader that the people you have on staff are more than just names on a letterhead.

WHAT TO INCLUDE IN THE ORGANIZATION & MANAGEMENT SECTION…

Organizational structure.

A simple but effective way to lay out the structure of your company is to create an organizational chart with a narrative description. This will prove that you’re leaving nothing to chance, you’ve thought out exactly who is doing what, and there is someone in charge of every function of your company. To a potential investor or employee, that information is very important.

OWNERSHIP INFORMATION

This section should also include the legal structure of your business along with the subsequent ownership information it relates to. Have you incorporated your business? If so, is it a C or S corporation? Or perhaps you have formed a partnership with someone. If so, is it a general or limited partnership? Or maybe you are a sole proprietor.

The following important ownership information should be incorporated into your business plan:

- Names of owners

- Percentage ownership

- Extent of involvement with the company

- Forms of ownership (i.e., common stock, preferred stock, general partner, limited partner)

- Outstanding equity equivalents (i.e., options, warrants, convertible debt)

- Common stock (i.e., authorized or issued)

- Management Profiles

- Experts agree that one of the strongest factors for success in any growth company is the ability and track record of its owner/management team, so let your reader know about the key people in your company and their backgrounds. Provide resumes that include the following information:

- Position (include brief position description along with primary duties)

- Primary responsibilities and authority

- Unique experience and skills

- Prior employment

- Special skills

- Past track record

- Industry recognition

- Community involvement

- Number of years with company

- Compensation basis and levels (make sure these are reasonable – not too high or too low)

- Be sure you quantify achievements (e.g. “Managed a sales force of ten people,” “Managed a department of fifteen people,” “Increased revenue by 15 percent in the first six months,” “Expanded the retail outlets at the rate of two each year,” “Improved the customer service as rated by our customers from a 60 percent to a 90 percent rating”)

Also highlight how the people surrounding you complement your own skills. If you’re just starting out, show how each person’s unique experience will contribute to the success of your venture.

BOARD OF DIRECTORS’ QUALIFICATIONS

The major benefit of an unpaid advisory board is that it can provide expertise that your company cannot otherwise afford. A list of well-known, successful business owners/managers can go a long way toward enhancing your company’s credibility and perception of management expertise.

If you have a board of directors, be sure to gather the following information when developing the outline for your business plan:

- Positions on the board

- Extent of involvement with company

- Historical and future contribution to the company’s success

Article topics

Help an entrepreneur by upvoting, timely topics, what to read now.

Product Development for Small Businesses

Make your great idea a reality when you take these first steps

Creating a Minimum Viable Product

Explore low-cost startup strategies to reach your customers ASAP.

58 min watch

Startup Strategies

Innovation and product consultant Dasanj Aberdeen (www.dasanjaberdeen.com) shares advice for launching a new product or business w...

Financial Tools for Your First Year in Business

Help preparing your small business finances in the first year

Legal and Tax Considerations for Your New Business

Setting up an LLC, creating contracts and more.

56 min watch

Finance Systems for Your First Year in Business

Outsourced CFO Tricia Taitt returns to our webinar series to help small business owners set up essential financial systems and hab...

BE PART OF OUR COMMUNITY

Receive the latest news on events, upcoming webinars, and small business resources, straight to your inbox

IMAGES

COMMENTS

Sep 17, 2023 · The organization and management section of your business plan should provide details about your business structure and team. This section typically comes after the executive summary. However, some people have it further in the document after the market analysis section.

Nov 30, 2022 · Organization . The organization section sets up the hierarchy of the people involved in your business. It's often set up in a chart form. If you have a partnership or multi-member LLC, this is where you indicate who is president or CEO, the CFO, director of marketing, and any other roles you have in your business.

Having either of these, by the way, is something your company might want to consider whether or not you’re putting together the organization and management section or your business plan. Learn More. When it comes to your finances, you want clear guidance and easy-to-implement tools based on your unique needs.

The organization and management section of your business plan isn’t just window dressing for your plan’s audience. This section is also the map for your entire organization no matter how big or small you want it to be. In short, this section becomes the foundation for running your business now and in the future. No pressure.

Nov 4, 2024 · By discussing job responsibilities and management experiences, readers will better understand why this type of business structure and management team will be successful in the proposed business. A second important reason for the organizational structure is that the section introduces business owners.

This section of your Business Plan should include the following: your company’s organizational structure, details about the ownership of your company, profiles of your management team, and the qualifications of your board of directors.