The A-Z of Market Research - Your Ultimate Glossary

This A-Z glossary is a reference tool for professionals in the market research industry. It encompasses an array of commonly used terms and concepts that are integral to effective market research practices. Covering everything from fundamental methodologies to specialized techniques, this glossary provides definitions that clarify the jargon often found in the field. Whether you are an experienced researcher, new to the industry, or a client aiming to enhance your understanding of research reports, this resource helps you to quickly access key market research terminology. Dive in and leverage this knowledge to elevate your expertise and drive impactful insights.

A/B Testing

A method of comparing two versions of a webpage or app against each other to determine which one performs better. It involves randomly showing the two variants (A and B) to users and analyzing which one drives more conversions. Read more about AB testing on HBR.

Access panels

A database of individuals who have agreed to be available for surveys of varying types and topics. They are used to save time and money in recruiting respondents for market research.

Accompanied shopping

A specialized type of individual depth interview where respondents are interviewed while they shop in a retail store. It combines observation with detailed questioning.

Alternative hypothesis

The hypothesis in statistical testing where some difference or effect is expected. It's the opposite of the null hypothesis.

Ambiguous question

An ambiguous question in market research is a poorly constructed query that lacks clarity and precision, allowing for multiple interpretations by respondents. These questions can lead to confusion and inconsistent answers, as different individuals may understand and respond to the question in varying ways. This ambiguity often stems from vague language, lack of context, or the inclusion of multiple concepts within a single question. As a result, ambiguous questions can compromise the reliability and validity of research data, potentially leading to misguided conclusions and decisions. Researchers must strive to craft clear, specific questions to ensure accurate and meaningful responses that truly reflect the opinions and experiences of their target audience.

A type of stimulus material where key frames for a television advertisement are drawn or computer generated with an accompanying soundtrack. They are used to test advertisement concepts before full production.

Annotation method

An approach to analyze qualitative data using codes or comments on transcripts to categorize points made by respondents.

ANOVA (Analysis of Variance)

A statistical test for the differences among the means of two or more variables. It's commonly used to compare multiple groups in experimental designs. Read more about ANOVA at Oxford University .

Area sampling

A type of cluster sampling where clusters are created based on the geographic location of the population of interest.

Artificial Intelligence (AI)

The use of computer algorithms and systems to simulate human intelligence and perform tasks such as data analysis or decision making. In market research, AI is increasingly used for data processing and analysis. Find out more about what AI is here .

Audience's thinking sequence

The sequence of thoughts that people go through when they are being communicated with. Understanding this helps in crafting effective marketing messages.

An examination and verification of the movement and sale of a product. There are three main types: wholesale audits, retail audits, and home audits.

A chart that uses a series of bars positioned horizontally or vertically to represent the values of various items. It's a common way to visually represent data in market research reports.

In market research, particularly when dealing with cross tabulations, the base refers to the total number of respondents or observations that form the foundation for calculating percentages or other statistical measures. It represents the entire sample or a specific subset of the sample for which data is being analyzed. The base is crucial for understanding the context and significance of reported percentages, as it indicates the size of the group from which conclusions are drawn. For instance, if a survey reports that 60% of respondents prefer a certain product, the base tells us how many people that percentage represents, allowing for more accurate interpretation of the data's reliability and representativeness.

Bayes' theorem

A mathematical formula that provides a way to update the probability of an event based on new information. In market research, it's used to estimate the likelihood of a target audience having certain characteristics.

Read more about Bayes rule in perception, action and cognition with Cambridge University's Machine Learning Group

Behavioural science

An interdisciplinary field applying theories and techniques mainly from psychology to uncover what consumers value and provide solutions to pricing, choice architecture, perceptions, and behaviors.

A term describing the significant volume and variety of data available to organizations and the increased frequency in which they are generated. It's increasingly important in market research for uncovering insights.

The use of physiological or behavioral characteristics to identify and verify a person's identity. In market research, it's used to authenticate survey respondents and measure physical responses to stimuli.

An abbreviated title for the term web log, meaning a frequent, chronological publication of personal thoughts and ideas. In market research, blogs can be a source of consumer insights.

Brand Equity Modelling

The creation of a Brand Equity measure and any Key Driver analysis to determine what drives Brand Equity. It helps in understanding and quantifying a brand's strength.

Let’s explore how well a brand's product qualities match what consumers truly desire. Understanding this alignment is key to optimizing your brand's positioning. Here are a few points to consider:

- What does your audience value? Discover the qualities that resonate with them.

- How do you measure this alignment? Use insights to refine your approach.

- Empower your brand strategy! When you align with customer desires, you create a stronger connection.

By focusing on these aspects, you’ll not only enhance your brand's appeal but also engage your audience in a meaningful way.

Brand mapping

A projective technique involving presenting competing brand names to respondents and getting them to group them into categories based on certain dimensions. It helps understand brand perceptions and positioning.

Brand personalities

A projective technique where respondents imagine a brand as a person and describe their looks, clothes, lifestyles, etc. It helps understand brand perceptions and associations.

Brand Price Trade Off

A technique for establishing brand and price preferences by presenting respondents with branded products at various price points. It helps in understanding price sensitivity and brand loyalty.

Canonical Correlations

A statistical technique used to identify how much one set of independent variables drives another set of dependent variables. It's particularly useful when there are multiple dependent variables or categorical variables.

CAPI (Computer Assisted Personal Interviewing)

A method where laptop computers, tablets, or mobile devices are used instead of paper-based questionnaires for face-to-face interviewing. It allows for more complex questionnaires and immediate data entry.

Discover a powerful market research method designed specifically for the automotive industry! This approach helps gather valuable insights about consumer preferences and pinpoint potential issues with a vehicle before it hits the production line. Here’s how it works:.

- Participants engage with a pre-production or prototype vehicle.

- They share their thoughts and feedback, enabling manufacturers to make informed decisions.

This collaborative process empowers users and ensures that their voices shape the final product.

Cartoon completion

A projective technique which involves a cartoon that the respondent has to complete. It's used to uncover underlying attitudes or perceptions.

CATI (Computer Assisted Telephone Interviewing)

A telephone interviewing method where interviewers input respondents' answers directly into a computer-based questionnaire. It allows for complex routing and immediate data entry.

CATS (Completely Automated Telephone Surveys)

Telephone interviews that use interactive voice technology and require no human interviewer. Respondents answer closed-ended questions using their touch-tone telephone.

Causal research

Research that examines whether one variable causes or determines the value of another variable. It's used to understand cause-and-effect relationships in marketing phenomena.

CAWI (Computer Assisted Web Interviewing)

Also known as online interviewing, CAWI involves respondents filling in a self-completion questionnaire delivered via the internet. It allows for complex routing and multimedia stimuli.

Research which involves collecting data from every member of the population of interest. It's typically used when the population is small or when complete data is required.

CHAID (CHi Squared Automatic Interaction Detection)

A type of decision tree technique based on significance testing. It's used to create rules to classify future respondents into identified groups or detect interrelationships between different questions.

Web-based platforms that can be used for online focus groups where individuals are recruited to discuss a subject online, usually using text. They allow for real-time qualitative research with geographically dispersed participants.

Chatbot survey

A traditional survey presented to the respondent in the form of an online conversation. Instead of answering static questions, respondents engage in a conversational exchange or chat.

A statistical test which tests the 'goodness of fit' between the observed distribution and the expected distribution of a variable. It's commonly used to analyze the relationship between categorical variables.

Choice Based Conjoint

A specific type of conjoint analysis where respondents are asked to make choices between different sets of products/services to derive the overall appeal of each component part. It's used to understand consumer preferences and trade-offs.

Closed question

A closed question in market research is a type of survey question that limits respondents to choosing from a predetermined set of answer options. Unlike open-ended questions, closed questions do not allow for free-form responses. They typically come in two main forms: dichotomous questions, which offer only two possible answers (e.g. yes/no, true/false), and multiple-choice questions, which provide several options to choose from. Closed questions are valued for their ability to generate easily quantifiable data, simplify the analysis process, and reduce the time and effort required from respondents. However, they may also limit the depth of insights by constraining respondents to predefined choices, potentially missing nuanced or unexpected responses that could be captured by open-ended questions.

Cluster analysis

A statistical technique used to group similar objects or individuals. In market research, it's often used for market segmentation, grouping consumers with similar characteristics or behaviors.

Cluster sampling

A probability sampling approach in which clusters of population units are selected at random and then all or some of the units in the chosen clusters are studied. It's often used when it's impractical or expensive to sample from a widely dispersed population.

The procedures involved in translating responses into a form that is ready for analysis. It typically involves assigning numerical codes to responses, especially for open-ended questions.

Coefficient alpha

See Cronbach alpha.

Coefficient of determination

A measure of the strength of linear relationship between a dependent variable and independent variables. It indicates how much of the variance in the dependent variable is predictable from the independent variable(s).

Concept boards

Introducing a dynamic tool for gathering valuable insights: stimulus materials! These boards showcase various product, advertising, and packaging designs, helping you collect feedback on exciting new products or campaigns. Here’s what you need to know:

- What are they? A set of boards that illustrate different designs.

- Why use them? To engage your audience and gather their thoughts on potential innovations.

- How they help: Empower you to make informed decisions based on real feedback.

We’re here to foster collaboration and curiosity—let’s explore new ideas together! What designs resonate with you? We’d love to hear your thoughts!

Confidence level

The probability that the true population value will be within a particular range (result +/– sampling error). It's typically set at 95% in market research studies.

Conjoint analysis

A statistical technique to understand what combination of a limited number of attributes is most influential in the consumer's decision-making process. It's often used in product development and pricing research.

Constant sum scales

A scaling approach which requires the respondent to divide a given number of points, usually 100, among a number of attributes based on their importance to the individual. It forces respondents to make trade-offs between attributes.

Construct validity

An analysis of the underlying theories and past research that supports the inclusion of various items in a scale. It's most commonly considered in two forms: convergent validity and discriminant validity.

Content analysis

The analysis of any form of communication, whether it's advertisements, newspaper articles, television programmes, or taped conversations. It's frequently used for the analysis of qualitative research data.

Content analysis software

Software used for qualitative research which counts the number of times that pre-specified words or phrases appear in text. It's used to analyze large volumes of textual data efficiently.

Content validity

A subjective yet systematic assessment of how well a rating scale measures a topic of interest. For example, a group of subject experts may be asked to comment on the extent to which all of the key dimensions of a topic have been included.

Continuous research

See Longitudinal research.

Contrived observation

A research approach which involves observing participants in a controlled setting. It allows researchers to manipulate variables and observe their effects on behavior.

Convenience sampling

Convenience sampling is a non-probability sampling method in market research where participants are selected based on their accessibility and willingness to participate, rather than through random selection. This approach involves choosing readily available individuals or groups that are easy for the researcher to reach, such as passersby in a shopping mall, students on a university campus, or online volunteers. While convenience sampling offers advantages in terms of speed, cost-effectiveness, and ease of implementation, it comes with significant limitations. The primary drawback is the potential for bias and lack of representativeness, as the sample may not accurately reflect the characteristics of the broader target population. This can lead to skewed results and limit the generalizability of the research findings, making it less suitable for studies requiring high levels of accuracy or those aiming to make broad inferences about a population.

Convergent validity

A measure of the extent to which the results from a rating scale correlate with those from other scales or measures of the same topic/construct. It's used to assess the validity of measurement scales.

Text files placed on a user's computer by web retailers in order to identify the user when they next visit the website. In market research, they can be used to track online behavior.

Correlation

Let’s dive into a statistical approach that helps us explore the relationship between two variables! Here’s what you need to know:

- Understanding relationships : This method uses an index to clearly describe both the strength and direction of the relationship between variables.

- Empower your insights : By examining these connections, you can gain valuable insights into how different factors interact.

Isn’t it exciting to uncover these relationships? Feel free to share your thoughts or questions!

Cost per complete (CPC)

A common term in quantitative research for the price paid per completed survey. This calculation usually includes the cost of the sample, fielding costs, and the cost of using the survey software.

Critical path method (CPM)

A managerial tool used for scheduling a research project. It's a network approach that involves dividing the research project into its various components and estimating the time required to complete each component activity.

Cronbach Alpha

Cronbach's Alpha , also known as coefficient alpha, is a widely used statistical measure in market research to assess the internal consistency reliability of a multi-item scale. It quantifies how closely related a set of items are as a group, typically in questionnaires or surveys where multiple questions aim to measure the same underlying construct. The coefficient ranges from 0 to 1, with higher values indicating greater internal consistency. Generally, an alpha of 0.7 or higher is considered acceptable in most research scenarios, though this can vary depending on the field and purpose of the study. Cronbach's Alpha is particularly valuable in developing and validating measurement scales for concepts like customer satisfaction, brand loyalty, or employee engagement. It helps researchers ensure that the items in their scale are measuring the same concept consistently, thus improving the overall reliability and validity of their research instruments.

Cross tabulation (crosstab)

A technique used to analyze and compare the relationship between two or more variables. It involves creating a table that shows the distribution of one variable across the different categories of another variable.

Cross sectional research

Research studies that are undertaken once, involving data collection at a single point in time, providing a 'snapshot' of the specific situation. It's the opposite of longitudinal research.

Customer database

A manual or computerized source of data relevant to marketing decision making about an organization's customers. It's a valuable resource for customer relationship management and targeted marketing efforts.

Customer Lifetime Value (CLV)

A prediction of the net profit attributed to the entire future relationship with a customer. It's used to determine how much to invest in acquiring or retaining a customer.

CX (Customer Experience)

Refers to how customers feel or perceive all aspects (touchpoints) when they buy goods or services or interact with a business. It's crucial for understanding and improving customer satisfaction and loyalty.

Data analysis errors

Non-sampling errors that occur when data is transferred from questionnaires to computers by incorrect keying of information. They can be minimized through data cleaning and validation processes.

Data cleaning

To ensure data quality before analysis, it's essential to conduct computerized checks on your data. This friendly process helps you:

- Identify inconsistencies

- Detect any unexplained missing responses

Taking this crucial step empowers you to work with reliable information and make informed decisions. Let's embrace good data practices together!

Data conversion

The reworking of secondary data into a format that allows estimates to be made to meet the researcher's needs. It's often necessary when using data from different sources or time periods.

Data fusion

The process of combining multiple data sources into a single, comprehensive representation of information. In market research, it's used to gain a more complete understanding of consumer behavior and market trends.

Refers to the type of data to be analyzed in a hierarchical survey. For example, in a healthcare study, analysis could be based at the doctor, patient, or therapy level.

Data mining

The process of discovering patterns and knowledge from large amounts of data using techniques such as statistical analysis and machine learning. It's used to extract useful insights and make data-driven decisions.

Data validation

The verification of the appropriateness of the explanations and interpretations drawn from qualitative data analysis. It's crucial for ensuring the credibility and trustworthiness of qualitative research findings.

Degrees of freedom (d.f.)

The number of observations (i.e., sample size) minus one. It's used in various statistical calculations and tests.

Depth interview

Descriptive statistics.

Statistics that help to summarize the characteristics of large sets of data using only a few numbers. The most commonly used are measures of central tendency and measures of dispersion.

Desk research

See Secondary research.

A continuous measurement tool used to gather feedback from participants when watching or listening to content media. Participants indicate their continuous level of agreement/like or disagreement/dislike with the content being presented.

Dichotomous questions

Dichotomous questions are survey or interview questions that offer only two possible response options, typically "Yes" or "No". While these questions are easy for respondents to answer, they yield limited information due to their binary nature.

Discrete Choice Modeling

A statistical technique used to predict a choice from a set of two or more alternatives. It's often used in market research to understand consumer preferences and decision-making processes.

Discriminant analysis

A statistical technique that uses responses to a set of questions to predict existing group membership. The output can then be used to classify future respondents into the same groups.

Discriminant validity

A measure of the extent to which the results from a rating scale do not correlate with other scales from which one would expect it to differ. It's used to assess the validity of measurement scales.

Discussion guide

Used to structure and direct focus groups or depth interviews with participants. It serves as a guide for the facilitator or interviewer, providing questions, topics, and prompts to cover during the discussion.

Disproportionate stratified random sampling

A form of stratified random sampling where the units or potential respondents from each population set are selected according to the relative variability of the units within each subset.

Do-It-Yourself (DIY) research

DIY research refers to market research methods that can be conducted independently, without professional assistance. This approach is generally more cost effective and faster than traditional market research techniques.

Double opt-in (DOI)

Refers to a person who has agreed to join a research panel and has confirmed their agreement through a two-step verification process. It helps ensure explicit consent and accurate contact information.

Double-barrelled question

A badly constructed question where two topics are raised within one question. It should be avoided as it can lead to confusion and inaccurate responses.

Doughnut chart

A form of pie chart which allows different sets of data (e.g., for different years) to be shown in the same chart. It's useful for comparing proportional data across categories.

Emotion recognition

The use of AI algorithms to detect and interpret human emotions, often through analysis of facial expressions, voice, or text. It's used in market research to understand emotional responses to products or advertisements.

Ethnography

A research method used for investigating cultural practices, rituals, consumer behavior, routines, and social norms. It helps unearth previously unseen opportunities by looking at people's worlds in an authentic way.

Eye tracking

A method of measuring and analyzing where and how people look at visual information. In market research, it's used to understand how people interact with visual stimuli like advertisements or product packaging.

Face to face survey

Research which involves meeting respondents in person and interviewing them using a paper-based questionnaire, a laptop computer, tablet, or mobile device. It allows for more complex questions and use of visual aids.

Facial tracking

A method of measuring and analyzing facial expressions and movements. In market research, it's used to understand emotional responses to advertising, products, and other stimuli.

Factor Analysis

A statistical technique to examine the similarities between items in order to identify a more concise summary of themes. It's often used for data reduction or to identify underlying constructs.

Focus group

A qualitative research method used to gather data through group discussions. Participants are brought together in a moderated setting to discuss a specific topic, product, or service.

Frequency distributions

See Holecounts.

Funnel sequence

A method for ordering questions in a questionnaire that starts with broad, general topics and gradually narrows down to more specific, detailed questions. This approach helps ease respondents into the survey, building rapport and context before addressing more complex or sensitive issues, potentially improving the quality and depth of responses.

The funnel sequence is a common and effective technique in questionnaire design, particularly useful for in-depth interviews and complex surveys.

Gabor Granger

A pricing technique used to understand price elasticity for set products. Respondents are asked how likely they are to purchase a product at different price points, allowing researchers to establish optimal pricing.

Galvanic Skin Response (GSR)

A method of measuring changes in the electrical conductance of the skin, which can indicate changes in emotional arousal. In market research, it's used to understand emotional reactions to stimuli.

Gamification

The process of adding game-like elements to a research activity to engage participants and collect data in a more interactive way. It can lead to better quality data by making surveys more engaging and fun.

GANTT chart

A managerial tool used for scheduling a research project. It's a form of flowchart that provides a schematic representation incorporating the activity, time, and personnel requirements for a given research project.

Geo-fencing in market research

The use of GPS or RFID technology to define a geographic boundary, then trigger a response when a mobile device enters or leaves the area. It's used in location-based market research and mobile surveys.

Geodemographic profiling

A profiling method which uses postal addresses to categorize different neighborhoods in relation to buying power and behavior. It's useful for targeted marketing and location-based strategies.

Grounded theory

Grounded Theory is a systematic methodological approach to qualitative research, particularly valuable in market research when exploring new or poorly understood phenomena. Unlike traditional research methods that begin with a hypothesis, Grounded Theory starts with data collection and analysis, allowing theories to emerge from the data itself. Researchers using this method gather information through various qualitative techniques such as interviews, focus groups, or observations, and then analyze this data through a process of coding and constant comparison. As patterns and concepts emerge, researchers develop theories that are "grounded" in the actual experiences and perspectives of the participants. This approach is especially useful in uncovering consumer motivations, decision-making processes, or market trends that may not be apparent through conventional research methods. While more time-consuming and complex than some other research techniques, Grounded Theory can provide deep, nuanced insights that lead to innovative marketing strategies or product development ideas.

Group depth interviews

See Focus group.

Group moderator

The interviewer responsible for the management and encouragement of participants in a group discussion. They play a crucial role in facilitating productive discussions and ensuring all participants contribute.

Research undertaken in a central hall or venue commonly used to test respondents' initial reactions to a product, package, or concept. It's also known as a Central Location Test (CLT).

A graphical representation of data where values are depicted by color. In market research, they're often used to show where people click on websites or focus their attention in visual stimuli.

Holecounts refer to the number of respondents who selected each possible answer for each question in a survey. This concept is also known as frequency distributions or topline numbers, providing a basic summary of how responses are distributed across answer options.

An assumption or proposition that a researcher puts forward about some characteristic of the population being investigated. It's tested through research to determine if it's supported or refuted.

IDI (InDepth Interview)

A qualitative research method using a relatively open, discovery-oriented approach to obtain detailed information about a topic from a participant. It allows for deep exploration of individual perspectives and experiences.

IHUT (In Home Usage Test)

A market research method that allows consumers to test products in their own homes. Participants are given a product to use and are asked to provide feedback on its features, benefits, and overall satisfaction.

Impact indices

Measure the impact any independent variable has on changing a dependent variable. Often used when the independent variables are binary, it can evaluate the impact of different product qualities on preference.

Implicit Association Test (IAT)

A psychological measurement technique used to uncover unconscious biases. It measures a respondent's automatic associations between mental representations of objects in memory and evaluations, attitudes, or stereotypes.

Implicit assumption

A badly constructed question where the researcher and the respondent are using different frames of reference as a result of assumptions that both parties make about the question being asked.

Independent samples

Samples in which the measurement of the variable of interest in one sample has no effect on the measurement of the variable in the other sample. It's important for certain statistical tests.

Internal data

Secondary data sourced from within the organization that is requiring the research to be conducted. It can include sales data, customer records, and previous research findings.

Interquartile range

A measure of dispersion that calculates the difference between the 75th and 25th percentile in a set of data. It's useful for understanding the spread of the middle 50% of the data.

Interval data

Similar to ordinal data with the added dimension that the intervals between the values on a scale are equal. However, the ratios between different values on the scale are not valid.

Interviewer bias

Bias and errors in research findings can significantly impact results, stemming from the actions of the interviewer. Factors such as the selection of interview subjects, the methodology employed during the interview process, and the precision in recording responses can all influence the integrity of the data. It's crucial to understand these elements to ensure reliable outcomes in research.

Interviewer Quality Control Scheme (IQCS)

A quality control scheme for interviewers in the UK. The scheme is aimed at improving selection, training, and supervision of interviewers.

Judgement sampling

A non-probability sampling procedure where a researcher consciously selects a sample that he or she considers to be most appropriate for the research study. It relies on the researcher's expertise but may introduce bias.

Key Driver Analysis

The analysis of the relationship between a dependent variable and one or more independent variables. Its purpose is to determine whether a relationship exists and the strength of the relationship, used to help prioritize what to focus on.

Kiosk-based survey

A survey often undertaken at an exhibition or trade show using touch screen computers to collect information from respondents. It can be cheaper to administer compared to traditional exit surveys with human interviewers.

Kruskal's relative importance analysis

A type of Key Driver Analysis used as an alternative to other techniques such as ordinary regression analysis. It's particularly useful when there is missing data or when variables are strongly related to each other.

Latent Class Analysis

A statistical method used to identify subgroups of related cases from multivariate categorical data. It's often used in market segmentation to identify groups with similar response patterns.

Leading question

A badly constructed question that tends to steer respondents toward a particular answer. Sometimes known as a loaded question, it should be avoided to prevent biased responses.

Least filled quota sampling

A variation of quota sampling where the research team attempts to fill the quotas in the most efficient way possible by selecting respondents from the sub-population that has the lowest representation in the sample.

Least squares approach

A regression procedure that is widely used for deriving the best-fit equation of a line for a given set of data involving a dependent and independent variable.

Lifetime value

The present value of the estimated future transactions and net income attributed to an individual customer relationship. It's crucial for customer relationship management and marketing strategy.

Likert scale

A rating scale which requires the respondent to state their level of agreement with a series of statements about a product, organization, or concept. It typically uses five points from "Strongly agree" to "Strongly disagree".

Linear regression

Used to find out the relative importance of different drivers in order to re-create a dependent variable. For example, the influence of brand imagery items on brand appeal.

Logistic regression

Used to find out the relative importance of different drivers in order to re-create a dependent variable when the dependent variable is binary. It's particularly useful in propensity modeling.

Longitudinal research

A study involving data collection at several periods in time, enabling trends over time to be examined. It may involve asking the same questions on multiple occasions to the same respondents or to respondents with similar characteristics.

Machine learning

A subset of AI that involves training computer models to learn from data and make predictions or decisions. In market research, it's increasingly used to automate much of the classification and analysis of both structured and unstructured data.

Mall intercept interviews

A type of market research technique where participants are approached in a shopping mall or other public area and asked to participate in a survey or interview. It allows for the collection of data from a diverse sample in a specific geographic location.

Market Basket Analysis

A data mining technique used to understand purchasing behavior by finding associations between different items that customers place in their "shopping baskets". It's often used in retail to inform product placement and promotions.

Market Research Online Communities (MROCs)

Groups of individuals recruited and engaged by a market research company to participate in ongoing research studies, surveys, and discussions about a specific topic or product. They provide ongoing insights and feedback.

Marketing research

The collection, analysis, and communication of information undertaken to assist decision making in marketing. It encompasses a wide range of methods and techniques to understand markets, consumers, and marketing effectiveness.

MaxDiff (Maximum Difference Scaling)

A technique used to understand relative importance or appeal amongst a list of features/statements. Respondents choose the most and least appealing/important items from sets, resulting in a ranking of all items.

MBC (Menu-Based Conjoint)

A specific type of conjoint analysis able to handle a variety of menu choice situations in which respondents make from one to multiple choices in the process of building their preferred selection.

The arithmetic average calculated by summing all of the values in a set of data and dividing by the number of cases. It's one of the most common measures of central tendency.

Measures of central tendency

Measures that indicate a typical value for a set of data by computing the mean, mode, or median. They provide a single value that attempts to describe a set of data.

Measures of dispersion

Measures that indicate how 'spread out' a set of data is. The most common are the range, the interquartile range, and the standard deviation.

The median is a measure of central tendency in statistics that represents the middle value in a sorted dataset. When all values are arranged in ascending or descending order, the median is the value that divides the dataset into two equal halves. It's one of the three primary measures of central tendency, alongside the mean and mode.

The method for calculating the median depends on whether the number of values in the dataset is odd or even.

Odd numbers Formula: Median position = (n + 1) / 2, where n is the number of values.

Even numbers Formula: Median = (Value at position n/2 + Value at position (n/2) + 1) / 2

Method Bias

When we say method we broadly refer to aspects of a test or task that can be a source of systematic measurement error. In a questionnaire, this includes the wording of instructions and items, or the response format (e.g. Likert, Visual Analogue Scale, etc). Many researchers, such as Podsakoff, MacKenzie, and Podsakoff’s (2012), also consider a study’s measurement context as a potential methodfactor.

Read our tips for reducing Method Bias

Mixed Mode Studies

Research studies that use a variety of collection methods in a single survey (e.g., using the same questionnaire online and face to face) in order to improve response rates and representativeness.

The mode is a statistical measure that represents the value that appears most frequently in a dataset. It's one of the three main measures of central tendency, alongside the mean and median. The mode is particularly useful for understanding the most common or typical value in a dataset, especially when dealing with categorical or discrete data.

Examples of Mode Calculation:

Example 1: Unimodal Data Dataset: 2, 3, 3, 4, 5, 5, 5, 6, 7 Mode: 5 (appears three times)

Example 2: Bimodal Data Dataset: Red, Blue, Green, Red, Yellow, Blue, Purple Modes: Red and Blue (each appears twice)

Example 3: No Mode Dataset: 1, 2, 3, 4, 5 No mode (all values appear once)

Monadic testing

A survey method where each respondent only evaluates one concept out of several being tested. It's commonly used in the early stages of product or concept development.

Multi stage sampling

A sampling approach where a number of successive sampling stages are undertaken before the final sample is obtained. It's often used when a complete list of the population is not available.

Multidimensional scaling

A statistical technique used to visualize the level of similarity of individual cases in a dataset. In market research, it's often used to create perceptual maps of brands or products.

Multiple discriminant analysis

A statistical technique used to classify individuals into one of two or more segments (or populations) on the basis of a set of measurements.

Multiple regression analysis

A statistical technique to examine the relationship between three or more variables and also to calculate the likely value of the dependent variable based on the values of two or more independent variables.

Multivariate data analysis

Statistical procedures that simultaneously analyze two or more variables on a sample of objects. Common techniques include multiple regression analysis, factor analysis, cluster analysis, and conjoint analysis.

Mystery shopping

A method of testing the quality of services provided to customers by using researchers posing as regular customers. It's used to assess whether employees are following company procedures or industry guidelines.

Short for "national representative sample," it refers to a research sample that is intended to be representative of the entire population of a country or region. It's crucial for studies aiming to generalize findings to a whole population.

Natural Language Processing (NLP)

A branch of AI that involves understanding and generating human language. In market research, it's used for tasks such as sentiment analysis, text classification, and chatbot interactions.

Net Promoter Score (NPS)

A measure of customer loyalty and advocacy, calculated by asking customers how likely they are to recommend a company's products or services to others. It's widely used as a simple metric of customer satisfaction and loyalty.

Netnography

A qualitative research method used to study online communities. It involves the systematic observation and analysis of the interactions, communications, and content generated by a group of people on the internet.

Neuroscience

Used in market research to provide an accurate and unbiased measure of consumer response. Techniques such as EEG and fMRI are used to measure brain activity and understand how people respond to marketing stimuli.

Nominal data

Numbers assigned to objects or phenomena as labels or identification numbers that name or classify but have no true numeric meaning. They're used for categorization only.

Non probability sampling

A set of sampling methods where a subjective procedure of selection is used, resulting in the probability of selection for each member of the population of interest being unknown. It's often used when probability sampling is not feasible.

Non response errors

An error in a study that arises when some of the potential respondents do not respond. This may occur due to respondents refusing or being unavailable to take part in the research.

Non sampling error

Errors that occur in a study that do not relate to sampling error. They tend to be classified into three broad types: sampling frame error, non-response error, and data error.

Normal distribution

A continuous distribution that is bell-shaped and symmetrical about the mean. It's important in statistics because many natural phenomena follow this distribution.

Null hypothesis

The hypothesis that is tested and is the statement of the status quo where no difference or effect is expected. It's typically what researchers try to disprove in statistical testing.

Observation

A data gathering approach where information is collected on the behavior of people, objects, and organizations without any questions being asked of the participants. It can provide insights into natural behavior.

Omnibus surveys

A data collection approach that is undertaken at regular intervals for a changing group of clients who share the costs involved in the survey's set-up, sampling, and interviewing. It's a cost-effective way to ask a few questions to a large sample.

Open ended question

Questions which allow respondents to reply in their own words. There are no pre-set choices of answers and the respondent can decide whether to provide a brief one-word answer or something very detailed and long.

Ordinal data

Numbers that have the labeling characteristics of nominal data, but also have the ability to communicate the rank order of the data. The numbers do not indicate absolute quantities, nor do they imply that the intervals between the numbers are equal.

Paired interviews

An in-depth interview involving two respondents such as married couples, business partners, teenage friends, or a mother and child. It can provide insights into shared decision-making processes.

Panel research

A research approach where comparative data is collected from the same respondents on more than one occasion. Panels can provide information on changes in behavior, awareness, and attitudes over time.

Participant observation

A research approach where the researcher interacts with the subject or subjects being observed. The best-known type of participant observation is mystery shopping.

Participant Validation

A validation technique that involves taking the findings from qualitative research back to the participants/respondents that were involved in the study and seeking their feedback. It helps ensure the validity of qualitative findings.

Passive data

Data that is collected without actively seeking out the information from a respondent/participant. This type of data is generated naturally through actions such as website visits, online purchases, geolocation, and social media activity.

Pearson's product moment correlation

A correlation approach that is used with interval and ratio data. It measures the strength and direction of the linear relationship between two variables.

Perceptual mapping

An analysis technique which involves the positioning of objects in perceptual space. Frequently used in determining the positioning of brands relative to their competitors.

Photo sorts

A projective technique which uses a set of photographs depicting different types of people. Respondents are then asked to connect the individuals in the photographs with the brands they think they would use.

A type of bar chart which uses pictures of the items being described rather than bars. It can make data more visually appealing and easier to understand quickly.

Pilot testing

The pre-testing of a questionnaire prior to undertaking a full survey. Such testing involves administering the questionnaire to a limited number of potential respondents in order to identify and correct flaws in the questionnaire design.

Placement tests

The testing of reactions to products in the home and where they are to be used. Respondents are given a new product to test in their own home or office, and their experiences and attitudes are then collected.

Population of interest

The total group of people that the researcher wishes to examine, study, or obtain information from. It typically reflects the target market or potential target market for the product or service being researched.

Predictive analytics

The use of data, statistical algorithms, and machine learning techniques to identify the likelihood of future outcomes based on historical data. It's increasingly used in market research to forecast trends and behaviors.

Price Sensitivity Management (Van Westendorp)

A technique used to understand price preferences. Respondents are asked at what price they would consider a product to be too expensive, too cheap, etc. The optimal price point is determined where an equal proportion of respondents have said "too cheap" and "too expensive".

Primary data

Data collected by a program of observation, qualitative or quantitative research either separately or in combination to meet the specific objectives of a marketing research project. It's collected specifically for the research at hand.

Principal Component Analysis (PCA)

A descriptive method of multivariate analysis used to analyze numeric questions. It converts a set of observations of possibly correlated variables into a set of values of linearly uncorrelated variables called Principal Components.

Probability sampling

A set of sampling methods where an objective procedure of selection is used, resulting in every member of the population of interest having a known probability of being selected. It allows for statistical inference from the sample to the population.

Programme evaluation and review technique (PERT)

A managerial tool used for scheduling a research project. It involves a probability-based scheduling approach that recognizes and measures the uncertainty of project completion times.

Projective questioning

A qualitative research technique that asks respondents to consider what other people would think about a situation, rather than directly asking about their own opinions. Also known as third-party techniques, these methods are used to uncover deeper attitudes or beliefs that respondents might be unwilling or unable to express directly about themselves.

This technique is part of a broader category of projective techniques used in market research to gain insights into consumers' subconscious thoughts and feelings

Proportionate stratified random sampling

A form of stratified random sampling where the units or potential respondents from each population subset are selected in proportion to the total number of each subset's units in the population. It ensures representation of all subgroups in the sample.

Psychographic segmentation

A method of dividing a market into segments based on consumers' personality traits, values, attitudes, interests, and lifestyles. It goes beyond demographic segmentation to understand the psychological aspects of consumer behavior.

Purchase intent scales

A scaling approach which is used to measure a respondent's intention to purchase a product or potential product. It's often used in concept testing and new product development research.

Qualitative research

Qualitative research is an unstructured research approach with a small number of carefully selected individuals used to produce non-quantifiable insights into behavior, motivations, and attitudes. Methods include focus groups and in-depth interviews.

Quantitative research

Quantitative research is a structured research approach involving a sample of the population to produce quantifiable insights into behavior, motivations, and attitudes. It typically involves larger sample sizes and statistical analysis.

Questionnaire design process

A stepped approach to the design of questionnaires. It involves determining the information needed, question content, question wording, response format, and question sequence.

Quota sampling

Quota sampling is a non-probability sampling technique used in market research to create a sample that reflects specific proportions of characteristics in the target population. In this method, researchers divide the population into subgroups or "cells" based on relevant demographic or psychographic variables such as age, gender, income, or education level. For each subgroup, a quota is set that corresponds to its proportion in the overall population. Researchers then collect data from individuals within each subgroup until the predetermined quotas are met. While quota sampling aims to achieve a representative sample and can be more cost-effective than probability sampling methods, it is subject to potential bias in the selection process. This is because the final choice of respondents within each quota is often left to the researcher's discretion, which may inadvertently introduce selection bias and limit the generalizability of results.

A measure of dispersion that calculates the difference between the largest and smallest values in a set of data. It's a simple measure of variability but is sensitive to outliers.

Actual 'real' numbers that have a meaningful absolute zero. All arithmetic operations are possible with such data, including meaningful ratios.

A statistical approach to examine the relationship between two variables. It identifies the nature of the relationship using an equation and can be used for prediction.

Reliability of scales

Refers to the extent to which a rating scale produces consistent or stable results. Stability is most commonly measured using test-retest reliability and consistency is measured using split-half reliability.

Research brief

A written document which sets out an organization's requirements from a marketing research project. This provides the specification against which the researchers will design the research project.

River sampling

A method that invites respondents to take a survey via online banners, ads, promotions, offers, and invitations placed on various websites and social media. Respondents are screened and routed to appropriate surveys based on their characteristics.

Role playing

A projective technique which involves a respondent being asked to act out the character of a brand. It can reveal perceptions and associations with the brand that might not be expressed directly.

When designing a questionnaire, routing refers to the survey logic that allows you to change or limit the content based on previous answers given by respondents. Also known as branching or skip logic.

A subset of the population of interest. In market research, we typically study a sample and use statistical inference to draw conclusions about the wider population.

Sampling error

The difference between the sample value and the true value of a phenomenon for the population being surveyed. It can be expressed mathematically, usually as the survey result plus or minus a certain percentage.

Scaling questions

Questions that ask respondents to assign numerical measures to subjective concepts such as attitudes, opinions, and feelings. Common types include Likert scales and semantic differential scales.

Screening criteria

Criteria used to ensure that the participants in a study are relevant, qualified, and representative of the target population. Screening questions are usually asked at the start of the study and may include demographics as well as questions such as brand usage and product ownership.

Screening questionnaire

A questionnaire used for identifying suitable respondents for a particular research activity, such as a group discussion or in-depth interview.

Secondary data

Information that has been previously gathered for some purpose other than the current research project. It may be data available within the organization (internal data) or information available from published and electronic sources originating outside the organization (external data).

Segmentation

The process of dividing markets into groups of people or occasions that are similar to each other, but different from other groups. It's used to target marketing efforts more effectively.

Semantic differential scales

A scaling approach which requires the respondent to rate a brand or concept using a set of bipolar adjectives or phrases (e.g., helpful and unhelpful; friendly and unfriendly). Each pair of adjectives is separated by a seven-category scale with neither numerical nor verbal labels.

The study of symbols and signs and how they communicate meaning. In market research, it involves analyzing the visual and linguistic elements of product packaging, advertising, and branding to understand cultural and emotional associations.

Sensory testing

A method of evaluating the characteristics of a product or food by measuring how it is perceived by the senses of smell, taste, sight, touch, and sound. It's used to assess product attributes and quality.

Sentence completion

A projective technique which involves providing respondents with an incomplete sentence or group of sentences and asking them to complete them. It can reveal underlying attitudes or perceptions.

Sentiment analysis

A form of text analytics that uses natural language processing and machine learning to determine the emotion expressed in a text. It's commonly used to analyze survey responses, user/customer feedback, and product reviews.

Sequential monadic testing

A survey method whereby each respondent provides feedback on two or more concepts in the same survey. The concepts should be presented in a random order to avoid order bias.

Share of Shelf (SOS)

A metric used to measure the proportion of space a product or brand occupies on a retail shelf compared to its competitors. It helps understand the visibility and accessibility of a product in the retail environment.

Share of Voice (SOV)

A measure of the proportion of advertising a brand or product receives compared to others in the same category. It helps understand how often a brand is advertised relative to its competitors.

Share of Wallet (SOW)

A metric used to measure a company's market share in terms of customer spending. It represents the proportion of a customer's total spending on a given product or service category that is going to a particular company.

Shelf impact testing equipment

Used to determine the visual impact of new packaging when placed on shelves next to competitors' products. It helps assess how well a product stands out in a retail environment.

Simple random sampling

A probability sampling method where every possible member of the population has an equal chance of being selected for the survey. Respondents are chosen using random numbers.

Simulated test markets

A research approach used to predict the potential results of a product launch and to experiment with changes to different elements of a product's marketing mix. It relies on simulated or laboratory-type testing and mathematical modeling.

Snowball sampling

Snowball sampling is a non-probability sampling procedure where additional respondents are identified and selected on the basis of referrals from initial respondents. It tends to be used where the population of interest is small or difficult to identify.

Social media analytics

The use of data from social media platforms to understand consumer behavior and sentiment, as well as to track the performance of campaigns or products. It provides insights into online conversations and trends.

Spearman's rank-order correlation

Spearman's rank-order correlation, often referred to as Spearman's rho , is a non-parametric statistical measure used to assess the strength and direction of the relationship between two ordinal variables. This technique is particularly valuable in market research when dealing with ranked data or when the relationship between variables may not be linear. It works by converting the raw scores of each variable into ranks and then calculating the correlation between these ranks. The resulting correlation coefficient ranges from -1 to +1, where -1 indicates a perfect negative correlation, +1 a perfect positive correlation, and 0 no correlation. Spearman's correlation is robust to outliers and doesn't require the assumption of normally distributed data, making it a versatile tool for analyzing various types of ordinal data in market research, such as customer satisfaction ratings, preference rankings, or Likert scale responses.

Split half reliability

Measures the internal consistency of a summated rating scale and refers to the consistency with which each item represents the overall construct of interest. The method involves randomly dividing the various scale items into two halves.

Standard deviation

A measure of dispersion that calculates the average distance that the values in a data set are away from the mean. It provides a measure of how spread out the data is.

Stapel scales

A scaling approach which is a variation of the semantic differential scaling approach. It uses a single descriptor and 10 response categories with no verbal labels.

Stimulus materials

Materials used in group discussions and individual depth interviews to communicate the marketer or advertiser's latest creative thinking for a product, packaging, or advertising to the respondents.

Stratified random sampling

A probability sampling procedure in which the chosen sample is forced to contain potential respondents from each of the key segments of the population. It ensures representation of all important subgroups.

Structural Equation Modelling

A statistical technique for testing and estimating causal relationships, using a combination of statistical data and qualitative causal assumptions. It allows for the construction of variables which are not measured directly.

Structured observation

A research approach where observers use a record sheet or form to count phenomena or to record their observations. It provides a systematic way of collecting observational data.

System 1 & System 2 thinking

A concept in psychology that describes two different ways the brain forms thoughts. System 1 is fast, instinctive, and emotional; System 2 is slower, more deliberative, and more logical. This concept is applied in market research to understand consumer decision-making processes.

Systematic sampling

A probability sampling approach similar to a simple random sample but which uses a skip interval (i.e., every nth person) rather than random numbers to select the respondents.

A hypothesis test about a single mean if the sample is too small to use the Z test. It's commonly used to determine if there is a significant difference between the means of two groups.

Tabular method of analysis

A method for analyzing qualitative research data using a large sheet of paper divided into boxes. It allows for systematic organization and comparison of qualitative data.

Test-retest reliability

Measures the stability of rating scale items over time. Respondents are asked to complete scales at two different times under as near identical conditions as possible.

Text Mining

The process of deriving high-quality information from text. It involves the discovery of patterns and trends in large volumes of unstructured text data.

Trend Analysis

A technique used to analyze the direction and rate of change in data over time. It's used to predict future values based on historical data.

Triangulation

Using a combination of different sources of data where the weaknesses in some sources are counterbalanced with the strengths of others. It increases the validity and reliability of research findings.

TURF (Total Unduplicated Reach and Frequency)

An analysis used for providing estimates of media or market potential and devising optimal communication and placement strategies. It's particularly useful for deciding on product ranges or media mixes.

Type I error

A Type I error, also known as a "false positive," is a fundamental concept in statistical hypothesis testing that has significant implications for market research. It occurs when a researcher incorrectly rejects a true null hypothesis, essentially concluding that there is a significant effect or relationship when, in reality, there isn't one. The probability of committing a Type I error is denoted by alpha (α), which is typically set at 0.05 or 0.01 in market research studies. This means that researchers accept a 5% or 1% chance of falsely detecting an effect. Type I errors can lead to misguided business decisions, such as implementing ineffective marketing strategies or product changes based on falsely perceived consumer preferences. To mitigate this risk, researchers must carefully consider their significance levels and sample sizes, and potentially employ multiple testing corrections when conducting numerous statistical tests simultaneously.

Type II error

A Type II error, also known as a "false negative," is a crucial concept in statistical hypothesis testing within market research. It occurs when a researcher fails to reject a false null hypothesis, essentially concluding that there is no significant effect or relationship when, in reality, one does exist. The probability of committing a Type II error is denoted by beta (β), and its complement (1-β) represents the power of the statistical test. Type II errors can have serious implications in market research, potentially leading to missed opportunities or overlooked insights. For instance, a company might fail to detect a genuine consumer preference or market trend, resulting in lost competitive advantage. To reduce the risk of Type II errors, researchers often increase sample sizes, choose more sensitive statistical tests, or adjust the significance level, balancing this against the risk of Type I errors. Understanding and managing both types of errors is essential for conducting robust and reliable market research.

See Population of interest.

Unstructured questions

See Open-ended questions.

Usability Testing

A technique used to evaluate a product by testing it with representative users. It's often used for websites, apps, and software to identify any usability problems and collect qualitative and quantitative data . Read more about usability testing on Prolific .

User generated content (UGC)

Online material such as comments, profiles, photographs that is produced by end users. It can be a valuable source of insights in market research.

UX (User Experience)

Refers to the overall experience of a person using a product or service, including the design, functionality, and ease of use. UX research is used to understand how people interact with a product, website, or service, and to identify areas for improvement.

Whether the subject requiring to be measured was actually measured. It's a crucial concept in ensuring that research findings are meaningful and accurate.

Verification

The process of checking and verifying the accuracy and reliability of data collected during research. This includes reviewing data for errors, inconsistencies, and missing information.

Viewing rooms

Specialist facilities/locations for group discussions. They are set out in the form of a boardroom or living-room setting with video cameras or a large one-way mirror built into one wall.

Virtual reality

Technology that can be used in market research to create immersive experiences for consumers, allowing researchers to gather data on how consumers interact with products and brands in a simulated environment.

VoC (Voice of Customer)

A research method used to collect customer feedback. It captures how customers feel about a business, product, or service, providing insights that can help create a stronger customer experience.

Refers to the second generation of the World Wide Web, characterized by the shift from static websites to dynamic, interactive, and user-generated content. It has significant implications for online market research.

Refers to the next generation of the World Wide Web, characterized by the integration of artificial intelligence, machine learning, and the decentralized web. It aims to create a more intelligent, rich, and interconnected web.

Web scraping

A technique used in market research to gather large amounts of data from the internet, such as information on prices, product reviews, or social media sentiment. This data can then be used to gain insights into market trends and consumer behavior.

The process of adjusting the value of survey responses to account for over- or under-representation of different categories of respondent. It's used to make the sample more representative of the population.

Word association tests

A projective technique that involves asking respondents what brands or products they associate with specific words. It's useful for understanding brand imagery and building rapport in group discussions.

A visual depiction of words used by respondents in qualitative research, open-ended survey questions, or content appearing on social media or reviews. The font size of the words is determined by the frequency of use.

A hypothesis test about a single mean where the sample size is larger than 30. It's used when the population standard deviation is known and the sample size is large.

You might also like

Building a better world with better data.

Follow us on

All Rights Reserved Prolific 2024

A Guide to Market Research Terminology For Beginners

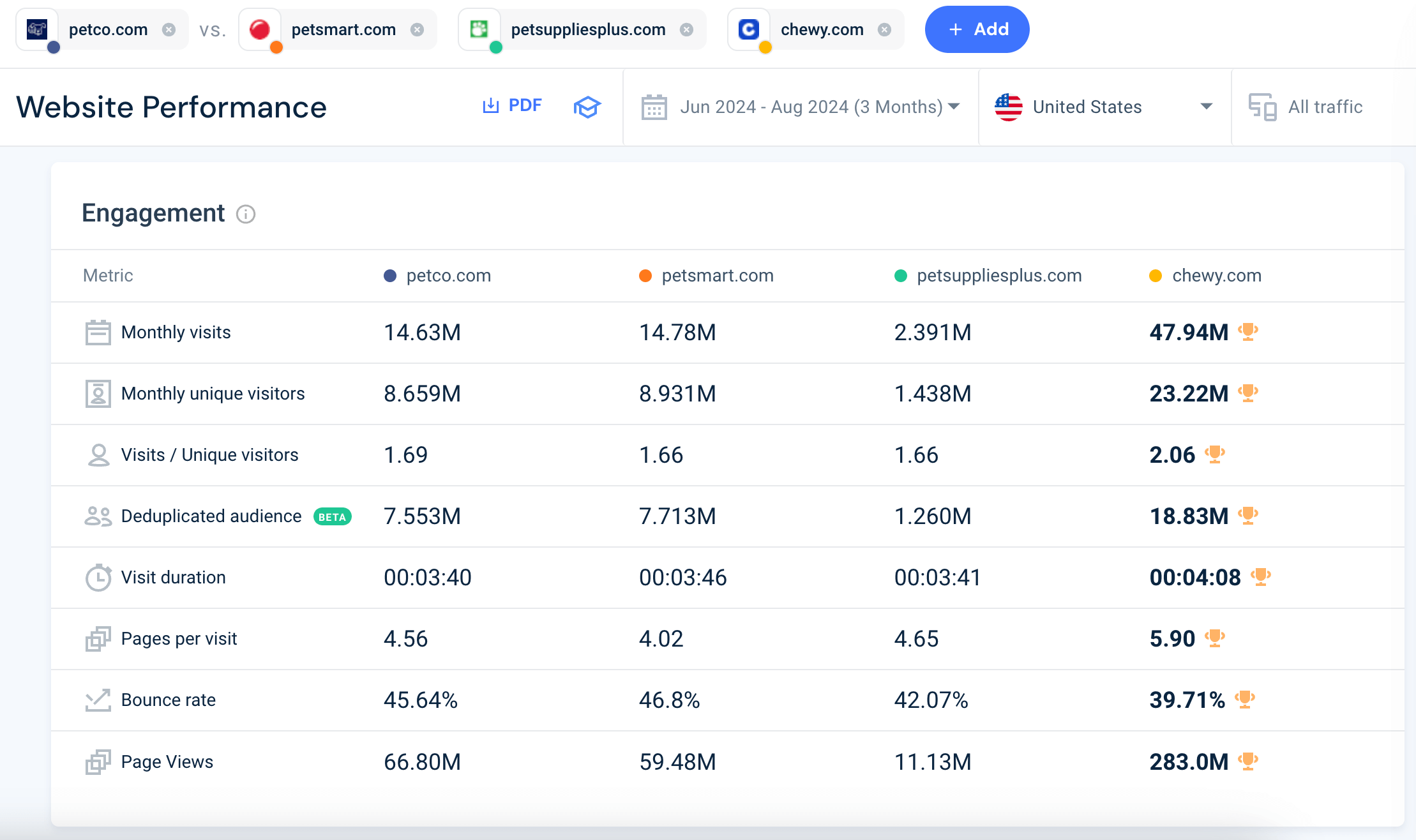

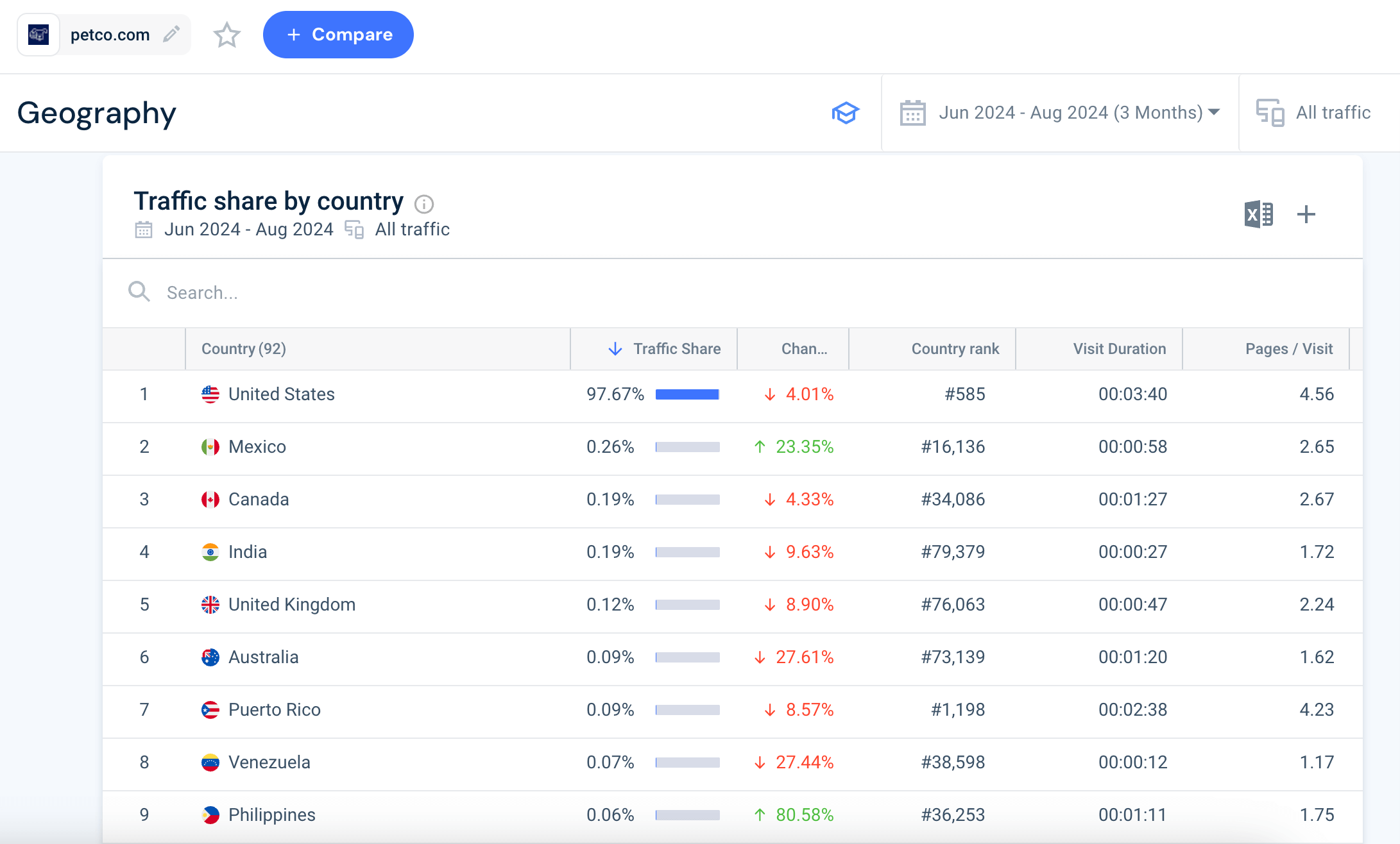

Free Website Traffic Checker

Discover your competitors' strengths and leverage them to achieve your own success

If you’re aiming to become a pro in market research, it all starts with getting familiar with key market research terminology.

Knowing the main market research terms helps you gather, analyze, and make sense of data that tells you how markets operate, what consumers are thinking, and what your competitors are up to.

According to a report by Hanover Research , market research is a game-changer for businesses, with 80% of companies using it to get insights into brand performance, customers, industry trends and the competition.

This market research glossary is here to break down the jargon, making complex market data easier to understand and use in your decision-making. We’ll dive into some of the main market research terms and their deeper meanings to boost your market research know-how.

Affinity groups

Affinity groups are made up of people who share common interests or demographics, and they’re key to shaping smart marketing strategies. These groups are the foundation that helps researchers figure out which approaches will click with different segments of a bigger target audience.

By understanding affinity groups, marketers can fine-tune their campaigns to better meet the specific needs and desires of each group.

Brand awareness

Brand awareness is all about how well people know and remember your brand’s name. If your brand has high awareness, it usually means your advertising is working and you’ve got a strong presence in the market. This makes it easier to launch new products and attract loyal customers.

You can track brand awareness via surveys and analytics tools to see how often your brand is recognized and talked about by consumers.

Behavioral data

Behavioral data gives you a peek into what consumers are actually doing—like their buying history or online activity. It is incredibly useful when trying to analyze trends and guide business decisions.

By predicting what your customers might do next, you can ramp up your marketing efforts, boost engagement, and drive conversions. Whether it’s tweaking your brand image to fit your audience or personalizing the user experience, behavioral data helps you stay one step ahead.

Benchmarking

Benchmarking is all about comparing your company’s performance with industry standards or your competitors to see where you stand. It covers things like financial results, customer satisfaction, and operational efficiency, among others.

Benchmarking isn’t a one-and-done deal, however, it’s an ongoing process that helps you keep your competitive advantage .

Brand equity

Brand equity is the extra value a brand adds to a product because of how customers perceive it and their loyalty to it. Strong brand equity often boosts sales and market share, thanks to factors like customer loyalty, brand awareness, associations, and perceived quality.

When a brand has high equity, it gives the company a competitive edge—people are usually willing to pay more for a branded product over a generic one.

Brand loyalty

Brand loyalty shows how often customers stick with the same brand over competing products. It’s a sign of how much trust and satisfaction the brand has built with its audience. Brand loyalty usually comes from delivering consistent quality and keeping strong relationships with customers.

Brand strength

Brand strength measures how well a brand can keep its customers and attract new ones, helping it stay solid in the market.

A strong brand can charge higher prices and handle competition more easily. Building brand strength takes time and comes from things like smart branding, quality products, great customer service, effective advertising, and clear communication.

Brand tracking

Brand tracking is an ongoing process that helps you keep tabs on how people see and feel about your brand.

The goal is to catch any shifts in perception and performance so you can make adjustments and keep things on track. Key metrics include brand recall, recognition, and sentiment analysis. These insights come from surveys, focus groups, and more recently, social media monitoring.

Churn rate is the percentage of customers who stop using a product or service over a certain period. A high churn rate usually means there are issues with customer satisfaction and retention.

To lower churn, you need to figure out why customers are leaving and fix those problems — whether it’s improving the product, offering better customer support or providing incentives to keep them loyal.

Cluster analysis

Cluster analysis is a way to group people based on shared characteristics. It’s a handy tool for market segmentation and targeted marketing. By sorting a market into distinct clusters, businesses can tailor their products, services, and messaging to fit each group’s specific needs.

Consumer insights

Consumer insights are deeper insights drawn from data about customers: their preferences, behaviors and motivations. These insights help shape product development and marketing strategies.

By tapping into consumer insights, companies can stay on top of changing customer needs, create more effective marketing messages and enhance the overall customer experience.

Consumer journey

The consumer journey is the entire experience a customer has with a brand—from the first time they hear about it to when they make a purchase and beyond. Journey mapping helps companies pinpoint key moments along the way where they can improve the customer experience.

By using these maps, businesses can figure out how to make the process smoother and more satisfying for their customers.

Consumer panel

Consumer panels are groups of people who are recruited to take part in multiple research studies over time. By gathering data from them repeatedly, researchers can track changes in their opinions and behaviors. The long-term data from these panels helps spot trends and patterns as they develop over time.

Consumer segmentation

Consumer segmentation is all about dividing customers into groups based on shared traits. This helps businesses create marketing messages that better connect with each group. Segments are often based on things like demographics, behaviors, psychographics or where people live.

Segment your customers

With the most up-to-date data in the world.

Control group

A control group is a group used in studies to compare against the experimental groups to see how an intervention or change affects them. It’s crucial to make sure the conclusions about the tested variable are valid.

Control groups are key in experimental research because they help researchers focus on the specific effects of what they’re testing.

Correlational research

Correlational research examines the relationship between two or more variables. It helps predict what might happen based on current data and spot any trends. While correlation doesn’t always mean causation, it’s a useful way to identify possible connections that can be explored further through more testing.

Customer retention

Customer retention is all about the efforts a company makes to keep its customers happy and coming back for more. It’s crucial because a loyal group of returning customers is way more profitable than constantly chasing new ones.

Retention strategies can include things like loyalty programs, personalized communication, proactive support, and staying engaged with customers through different channels.

Data collection

Data collection is how you gather info to answer research questions. Getting good data is crucial for solid, actionable results. You can collect data through surveys, interviews, observational studies, or even digital analytics. The key is making sure the data is accurate and reliable so your research findings hold up.

Data visualization

Data visualization is the process of turning data into visuals like charts and graphs. You can use tools like bar charts, line graphs, and heat maps to make data easier to understand. Visualizing data helps researchers share their findings clearly and effectively with stakeholders.

Demographic segmentation

Demographic segmentation splits a market into groups based on things like age, gender, income, education, and occupation. This helps businesses tailor their marketing to a specific group.

Understanding the demographics of potential customers lets companies create campaigns that are more relevant and likely to resonate.

Descriptive research

Descriptive research aims to give a detailed picture of a population or phenomenon. It helps you get a solid understanding of a subject, which can be a great starting point for deeper research. This type of research can use both quantitative methods or qualitative ones, like case studies and content analysis, to gather insights.

Desk research