100 Project Topics For Accounting Students [Updated]

The world of accounting is vast and diverse, offering exciting opportunities to explore various aspects of financial management and analysis. As an accounting student, embarking on a project can be a daunting yet enriching experience. But worry not! This blog serves as your guide to navigating the multitude of project topics for accounting students, categorized under key areas within accounting.

How Do You Choose a Research Topic in Accounting?

Table of Contents

Choosing a research topic in accounting involves balancing your interests, research feasibility, and relevance to the field. Here are some steps to guide you:

- Identify your interests: Reflect on the areas of accounting that excite you. Do you enjoy financial analysis, delving into regulations, or understanding cost management practices? Exploring your intrinsic motivation ensures you maintain enthusiasm for your project.

- Review current trends and literature: Browse academic journals, professional publications, and online resources related to accounting. See which areas are receiving significant attention or lack sufficient research. This helps identify potential gaps you can contribute to.

- Consult with professors or advisors: Discuss your interests and research ideas with professors or academic advisors. They can provide valuable insights, suggest relevant areas of research, and guide you towards feasible topics.

- Ensure feasibility and resources: Choose a topic with accessible data and research materials. Consider the time constraints of your project and ensure the topic can be adequately explored within that time frame.

- Refine your topic into a research question: Your chosen topic should culminate in a focused research question that can be answered through your research methodology. This helps maintain a clear direction for your research.

- Relevance: Ensure your topic aligns with your chosen field of study within accounting.

- Researchability: Choose a topic with sufficient data and resources readily available.

- Interest: Pick a topic that genuinely interests you to sustain your motivation throughout the research process.

By following these steps and considering these factors, you can choose a research topic in accounting that is both engaging and relevant to your academic pursuits and potential career path.

100 Project Topics For Accounting Students

Financial accounting and auditing.

- Impact of Cryptocurrency Adoption on Financial Reporting Standards.

- The Role of Blockchain Technology in Enhancing Audit Efficiency.

- Comparative Analysis of Accounting Standards: IFRS vs. US GAAP.

- Ethical Considerations in Revenue Recognition Practices.

- The Effectiveness of Internal Controls in Preventing Fraud: A Case Study.

- The Impact of Big Data Analytics on Financial Statement Analysis.

- Using Financial Ratios to Evaluate Company Performance Across Different Industries.

- The Role of Financial Statements in Mergers and Acquisitions.

- Exploring the Challenges and Opportunities of Implementing Cloud-based Accounting Systems.

- Analyzing the Effectiveness of Corporate Social Responsibility (CSR) Reporting.

Management Accounting and Cost Management

- Activity-Based Costing (ABC) vs. Traditional Costing Methods: A Comparative Study.

- Implementing Cost Reduction Strategies in a Specific Industry (e.g., Manufacturing, Healthcare).

- The Role of Management Accounting in Strategic Decision Making: A Case Study.

- Budgeting and Budgetary Control Techniques for Effective Financial Planning.

- Performance Measurement Systems for Different Departments: A Comparative Analysis.

- The Impact of Advanced Manufacturing Technologies on Cost Management Systems.

- Cost-Volume-Profit (CVP) Analysis for Pricing Decisions and Inventory Management.

- Exploring the Use of Lean Manufacturing Principles in Reducing Production Costs.

- The Role of Management Accounting in Sustainability Reporting Practices.

- Analyzing the Impact of Employee Engagement on Productivity and Cost Management.

Taxation and Public Accounting

- The Impact of Recent Tax Law Changes on Small Businesses.

- Exploring Tax Planning Strategies for Different Entity Types (e.g., C-Corporations, Partnerships).

- The Role of Government Agencies in Regulating Tax Compliance (e.g., IRS).

- Ethical Considerations in Tax Planning: A Case Study Analysis.

- The Future of Public Accounting in the Age of Artificial Intelligence (AI).

- Exploring Career Opportunities in Forensic Accounting and Fraud Investigation.

- The Impact of Tax Policy on Foreign Direct Investment (FDI) Decisions.

- Analyzing the Challenges and Opportunities of International Tax Compliance.

- The Role of Non-Profit Organizations in Public Accounting and Tax Planning.

- Comparing Tax Systems Across Different Countries: A Case Study Approach.

International Accounting and Finance

- The Challenges of Implementing International Financial Reporting Standards (IFRS) in Developing Economies.

- The Impact of Currency Fluctuations on Financial Statements of Multinational Companies.

- Comparative Analysis of Accounting Practices in the European Union (EU) vs. the United States (US).

- Exploring the Role of International Accounting Firms in Mergers and Acquisitions.

- The Ethical Implications of Transfer Pricing Practices in Multinational Corporations.

- Analyzing the Impact of Global Trade Agreements on International Accounting Standards.

- The Role of Cultural Differences in Financial Reporting Practices Across Countries.

- Exploring the Challenges of Foreign Corrupt Practices Act (FCPA) Compliance for Multinational Companies.

- The Future of International Accounting in the Era of Globalization and Technology.

- Analyzing the Impact of International Financial Reporting Standards (IFRS) on a Specific Industry.

Emerging Trends and Special Topics

- The Rise of Fintech and its Impact on Traditional Accounting Practices.

- Exploring the Ethical Implications of Using Big Data in Accounting and Auditing.

- Implementing Artificial Intelligence (AI) and Machine Learning (ML) in Accounting Tasks.

- The Future of the Accounting Profession in the Digital Age.

- The Increasing Focus on Environmental, Social, and Governance (ESG) Factors in Financial Reporting.

- The Impact of Blockchain Technology on Supply Chain Management and Accounting.

- Exploring the Use of Robotic Process Automation (RPA) in Streamlining Accounting Processes.

- The Impact of the Sharing Economy on Traditional Accounting and Tax Systems.

- Analyzing the Ethical Considerations of Cybersecurity Breaches in Accounting Firms.

- Exploring the Role of Accounting Professionals in Sustainable Development Goals (SDGs).

Additional Topics

- The Impact of Accounting Standards on Small and Medium-sized Enterprises (SMEs).

- The Role of Behavioral Accounting in Understanding Financial Decisions.

- The Importance of Communication Skills for Accounting Professionals.

- Ethical Considerations in Whistle-blowing Practices Within Accounting Firms.

- Exploring the Use of Data Visualization Tools in Financial Reporting.

- The Impact of Corporate Social Responsibility (CSR) on Investor Decisions.

- Analyzing the Cost-Effectiveness of Implementing Internal Audit Functions.

- Exploring the Ethical Implications of Market Manipulation Practices.

- Analyzing the Relationship Between Corporate Governance and Financial Performance.

- The Impact of Environmental Regulations on Accounting and Reporting Practices.

- The Role of Accounting Standards in Addressing Climate Change Issues.

- Exploring the Use of Blockchain Technology in Financial Reporting Automation.

- Analyzing the Ethical Considerations of Using Social Media by Accounting Professionals.

- The Impact of Artificial Intelligence (AI) on the Future of Tax Planning Strategies.

- Exploring the Challenges and Opportunities of Implementing Activity-Based Budgeting (ABB).

- Analyzing the Effectiveness of Different Management Accounting Information Systems (MAIS)

- The Role of Internal Controls in Ensuring Data Security and Privacy in Accounting Systems.

- Exploring the Use of Gamification Techniques in Accounting Education.

- Analyzing the Impact of the Gig Economy on Traditional Accounting and Tax Practices.

Specialized Topics

- The Role of Forensic Accounting in Detecting and Investigating Fraudulent Activities.

- Exploring the Ethical Considerations of Valuation Techniques in Mergers and Acquisitions.

- Analyzing the Impact of International Trade Agreements on Transfer Pricing Practices.

- The Role of Cost Accounting in Project Management and Decision Making.

- Exploring the Use of Financial Modeling in Corporate Budgeting and Forecasting.

- Analyzing the Ethical Considerations of International Tax Havens and their Impact on Global Tax Compliance.

- The Role of Government Accounting in Ensuring Transparency and Accountability in Public Spending.

- Exploring the Use of Blockchain Technology in Cryptocurrency Accounting and Auditing.

- Analyzing the Impact of Environmental, Social, and Governance (ESG) Factors on Investment Decisions in the Financial Sector.

- The Role of Accounting Information Systems (AIS) in Streamlining Financial Reporting Processes.

Contemporary Issues

- The Impact of COVID-19 Pandemic on Financial Reporting and Auditing Practices.

- Exploring the Ethical Considerations of Remote Work Arrangements for Accounting Professionals.

- Analyzing the Impact of Artificial Intelligence (AI) on the Job Market for Accountants.

- The Role of Accounting Professionals in Addressing Income Inequality and Social Justice Issues.

- Exploring the Use of Blockchain Technology in Disaster Recovery and Business Continuity Planning for Accounting Firms.

- Analyzing the Ethical Considerations of Accounting Practices in the Metaverse and Web3 Ecosystem.

- The Impact of Climate Change on Financial Reporting and Risk Management Strategies.

- Exploring the Use of Sustainable Accounting Practices to Address Environmental Concerns.

- Analyzing the Ethical Considerations of Artificial Intelligence (AI) Bias in Algorithmic Accounting Decisions.

- The Role of Accounting Professionals in Promoting Sustainable Development and Corporate Social Responsibility.

Personal Interest Topics

- The Role of Accounting in the Non-Profit Sector (e.g., Charities, Foundations).

- Exploring the Uses of Accounting Practices in the Sports Industry.

- Analyzing the Financial Management Strategies of a Specific Company.

- The History of Accounting and its Evolution Through Different Eras.

- Comparing the Accounting Practices of Different Historical Empires or Civilizations.

- The ethical considerations of using social media by accounting professionals.

- Exploring the impact of artificial intelligence (AI) on the future of tax planning strategies.

- Analyzing the challenges and opportunities of implementing activity-based budgeting (ABB).

- The role of internal controls in ensuring data security and privacy in accounting systems.

- Exploring the use of gamification techniques in accounting education.

- Analyzing the impact of the gig economy on traditional accounting and tax practices.

Tips to Make Successful Projects for Accounting Students

Before you start.

- Choose a topic you’re passionate about: This will keep you motivated throughout the research and writing process. Consider your personal interests and career aspirations when selecting a topic.

- Do your research: Understand the scope of your chosen topic. Explore existing academic literature, professional journals, and relevant news articles to gain a comprehensive understanding of the subject matter.

- Define clear objectives and research questions: What are you trying to achieve with your project? What specific questions do you want to answer? Having a clear focus will guide your research and ensure your project addresses a specific concern or adds to existing knowledge.

- Develop a project timeline: Set realistic deadlines for each stage of your project, including research, writing, and revisions. This will help you stay on track and avoid last-minute scrambles.

- Identify your resources: Ensure you have access to the necessary data and materials to complete your project successfully. This might involve requesting access to academic databases, collecting data through surveys or interviews, or finding reliable government and industry reports.

During your project

- Develop a strong research methodology: How will you gather your data? Will you use surveys, interviews, case studies, or other methods? Ensure your approach is appropriate for your chosen topic and research questions.

- Organize your research and findings: Take detailed notes, categorize your data, and use reference management tools to keep track of your sources. This will save you time and ensure proper citation when writing your project.

- Proofread and edit your work diligently: Ensure your project is free of grammatical errors, typos, and formatting inconsistencies. Consider asking a classmate or professor to review your work for additional feedback.

Additional tips

- Present your findings effectively: Consider using visual aids such as charts, graphs, or tables to enhance the clarity and impact of your presentation. Practice your presentation beforehand to ensure you convey your message confidently.

- Maintain a clear and concise writing style: Write in a professional tone that is easy to understand. Avoid unnecessary jargon and focus on delivering your message effectively.

- Seek feedback and guidance: Don’t be afraid to ask your professor, teaching assistants, or peers for feedback on your project. This can help you identify areas for improvement and strengthen your overall work.

- Utilize available resources: Many universities offer writing centers and research assistance programs. Don’t hesitate to seek help from these resources to ensure your project meets the required standards.

Unveiling a treasure trove of project topics for accounting students, this blog empowers accounting students to delve into the captivating realms of financial accounting, cost management, taxation, and beyond.

Whether your passion lies in financial analysis, navigating complex regulations, or mastering the intricacies of cost management, this diverse list serves as a springboard for your academic exploration. Remember, a successful project hinges on careful consideration.

Choose a topic that ignites your curiosity and aligns with your personal interests and career aspirations. Conduct thorough research, define clear goals and research questions, and create a realistic project timeline. Finally, ensure you have access to the necessary resources to embark on this enriching academic journey .

By following these steps and exploring the plethora of provided topics, you can transform your academic experience into a fulfilling and insightful exploration of the accounting world.

This blog was all about providing valuable insights on the topic! At Statanalytica, we go beyond just information—we offer live tutoring and consultation in data science, data analytics, accounts, and statistics. Get instant help from the best experts and excel in all your academic challenges. Click here to explore our Best Assignment Help and Homework Help services !

Related Posts

Step by Step Guide on The Best Way to Finance Car

The Best Way on How to Get Fund For Business to Grow it Efficiently

Top 100 Accounting Project Topics [Updated 2024]

Accounting is really important for students studying commerce in class 12. It’s about keeping track of, sorting, and summarizing financial transactions to give useful information for making decisions. Accounting projects help students understand these concepts in a practical way. This blog will guide you through various interesting and manageable accounting project topics suitable for students.

Why Are Accounting Projects Important?

Accounting projects are not just a requirement for your curriculum but also a way to:

- Apply theoretical knowledge: Projects help in applying what you have learned in theory classes to real-world situations.

- Develop analytical skills: Analyzing financial data improves your problem-solving and analytical skills.

- Understand financial systems: Working on projects helps you understand how financial systems work in businesses and organizations.

- Enhance research skills: Projects often require research, which enhances your ability to gather and interpret data.

How To Choose the Right Project Topic?

When selecting an accounting project topic, consider the following points:

- Interest: Choose a topic that interests you.

- Resources: Ensure that you have access to the necessary resources to complete the project.

- Scope: The topic should be neither too broad nor too narrow.

- Relevance: Pick a topic that is relevant to your syllabus and future career aspirations.

Top 100 Accounting Project Topics: Category Wise

Financial statement analysis.

- Comparative analysis of financial statements of two companies.

- Trend analysis of financial statements over five years.

- Analysis of profitability ratios of a manufacturing company.

- Evaluating liquidity ratios of a retail company.

- Solvency ratio analysis of a construction firm.

- Horizontal and vertical analysis of a service company’s financial statements.

- Ratio analysis of a food and beverage company.

- Financial health assessment of a pharmaceutical company.

- Analysis of a company’s cash flow statements.

- Evaluating the financial performance of a technology firm.

Budgeting and Forecasting

- Preparing a budget for a small business.

- Comparing forecasted and actual budgets of a household.

- Budgeting for a school event.

- Financial forecasting for a startup.

- Annual budget preparation for a non-profit organization.

- Analyzing the budgeting process of a corporation.

- Evaluating the effectiveness of zero-based budgeting.

- Preparing a capital expenditure budget for a manufacturing unit.

- Sales forecasting for a retail store.

- Budget variance analysis for a restaurant.

Cost Accounting

- Calculating the cost of manufacturing a product.

- Analysis of fixed and variable costs in a service industry.

- Cost-benefit analysis of a new project.

- Study of overhead cost allocation methods.

- Analysis of break-even points for a business.

- Cost control strategies in a manufacturing unit.

- Marginal costing analysis for decision making.

- Activity-based costing in a service organization.

- Cost-volume-profit analysis for a retail company.

- Standard costing and variance analysis in a production firm.

Cash Flow Management

- Preparing a cash flow statement for a small business.

- Analyzing cash inflows and outflows of a company.

- Cash flow management strategies for a startup.

- Improving cash flow for a seasonal business.

- Impact of credit policies on cash flow.

- Cash flow forecasting for a retail business.

- Strategies for managing cash deficits.

- Importance of cash flow in a non-profit organization.

- Analyzing the cash conversion cycle of a business.

- Impact of receivables and payables on cash flow.

Accounting Software Comparison

- Comparing features of QuickBooks and Tally.

- User-friendliness analysis of Xero and FreshBooks.

- Cost analysis of different accounting software.

- Evaluating customer support of various accounting software.

- Impact of cloud accounting on small businesses.

- Integration capabilities of accounting software.

- Security features of different accounting software.

- Comparing invoicing features of popular accounting software.

- Scalability of accounting software for growing businesses.

- Mobile app capabilities of different accounting software.

Taxation and Its Impact on Business

- Study of income tax laws and their impact on businesses.

- Analyzing the effects of GST on a manufacturing company.

- Corporate tax planning strategies.

- Impact of VAT on small businesses.

- Tax implications of e-commerce businesses.

- Analyzing the double taxation agreement between countries.

- Tax saving strategies for individuals.

- Effects of tax reforms on business operations.

- Tax compliance challenges for startups.

- Analysis of indirect taxes on the hospitality industry.

Inventory Management

- FIFO vs. LIFO inventory management methods.

- Impact of Just-In-Time (JIT) inventory management on efficiency.

- Inventory control techniques in a retail store.

- Managing inventory in a seasonal business.

- Importance of inventory audits.

- Stock valuation methods and their impact on financial statements.

- Inventory turnover ratio analysis.

- Impact of inventory management on cash flow.

- Role of technology in inventory management.

- Inventory management practices in the pharmaceutical industry.

Role of Auditing in Business

- Importance of internal audits in organizations.

- Steps involved in the external audit process.

- Role of forensic audits in detecting fraud.

- Impact of auditing on financial reporting.

- Evaluating the effectiveness of audit committees.

- Audit risk assessment techniques.

- Differences between statutory and compliance audits.

- Role of audits in corporate governance.

- Auditing standards and their application.

- Case study on a major audit failure.

Corporate Social Responsibility (CSR) Accounting

- Importance of CSR in modern business practices.

- Reporting of CSR activities in financial statements.

- Analyzing the CSR activities of major corporations.

- Impact of CSR on a company’s reputation.

- CSR accounting and environmental sustainability.

- Evaluating the financial implications of CSR.

- Role of stakeholders in CSR activities.

- CSR reporting standards and guidelines.

- Comparing CSR activities of companies in different industries.

- Analyzing the social impact of CSR initiatives.

Forensic Accounting

- Techniques used in forensic accounting.

- Analyzing real-life cases of financial fraud.

- Role of forensic accountants in legal proceedings.

- Preventive measures against financial fraud.

- Impact of forensic accounting on corporate transparency.

- Digital forensics in accounting.

- Forensic accounting in insurance claim investigations.

- Evaluating the effectiveness of fraud detection tools.

- Case study on the Enron scandal.

- Ethical issues in forensic accounting.

Tips for Completing Your Accounting Project

- Plan Ahead: Start your project early to have ample time for research and analysis.

- Stay Organized: Keep all your research and data well-organized for easy reference.

- Use Reliable Sources: Ensure the information you use is accurate and from credible sources.

- Cite Your Sources: Always give credit to the sources you use in your project.

- Seek Help: Don’t hesitate to seek help from your teachers or classmates if you face any difficulties.

Accounting project topics are a great way to deepen your understanding of accounting concepts and develop practical skills. By choosing an interesting and manageable topic, you can make your project an enjoyable and rewarding experience.

Whether you are analyzing financial statements or studying the impact of taxes on a business, each project offers valuable insights into the world of accounting. So, pick a topic that excites you, follow the tips, and start working on your accounting project today!

Leave a Comment Cancel Reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Best 120 Research Topics For Accounting Students

Hey there, curious minds in the world of numbers and balance sheets! Are you ready to dive into the exciting realm of accounting research? Whether you’re an aspiring bean counter or a number enthusiast, we’ve got a treasure trove of 90 research topics for accounting students. Imagine unlocking the secrets behind financial reporting, discovering the magic of tax strategies, and exploring the ethics that guide the accounting world. From financial fairy tales to auditing adventures, this blog is your gateway to research topics that are as clear as crystal. So grab your pens, put on your thinking caps, and get ready to embark on a journey through the fascinating landscape of accounting ideas. Let’s explore together!

120 Research Topics For Accounting Students

Financial accounting topics.

- The impact of financial reporting on investor decisions.

- Analyzing the effectiveness of International Financial Reporting Standards (IFRS).

- Earnings management and its implications on financial statements.

- The role of auditors in ensuring financial statement accuracy.

- Evaluating the effects of fair value accounting on financial reporting.

- Accounting for goodwill and its significance in company valuation.

- The relationship between corporate social responsibility and financial performance.

- Investigating the use of financial ratios in assessing company health.

- The challenges of implementing accounting standards in small businesses.

- Detecting financial fraud through forensic accounting techniques.

Management Accounting Topics

- Cost-volume-profit analysis and its role in decision-making.

- Budgeting techniques and their impact on organizational performance.

- Activity-based costing vs. traditional costing methods.

- Environmental accounting: Measuring and managing sustainability costs.

- Performance measurement in nonprofit organizations.

- Analyzing the relevance of balanced scorecards in strategic management.

- The role of management accountants in driving organizational change.

- Evaluating the use of variance analysis in controlling costs.

- The impact of technology on management accounting practices.

- Target costing and its role in pricing strategies.

Auditing Topics

- The evolution of auditing standards over the years.

- The importance of independence in auditor-client relationships.

- Auditing implications of the digital economy.

- Assessing the effectiveness of internal control systems.

- The role of auditors in detecting money laundering.

- Auditor liability and the legal framework.

- The use of data analytics in modern auditing practices.

- Ethical considerations in auditing: A case study approach.

- Audit committee oversight and its impact on financial reporting.

- The future of auditing: Trends and challenges.

Taxation Topics

- Comparative analysis of different tax systems worldwide.

- Tax planning strategies for small businesses.

- The effects of tax policy changes on individual behavior.

- Transfer pricing: Challenges and solutions.

- International tax evasion and methods of detection.

- Tax incentives and their impact on economic growth.

- The role of tax havens in global finance.

- Estate planning and its tax implications.

- Tax compliance issues in the gig economy.

- Environmental taxes and their contribution to sustainability.

Ethics and Social Responsibility Topics

- Corporate governance practices and their impact on ethics.

- The role of accountants in promoting ethical behavior.

- Whistleblowing and its effect on organizational culture.

- Social accounting and its role in measuring societal impact.

- Corporate fraud and the need for ethical leadership.

- Conflicts of interest in accounting: Prevention and resolution.

- Ethical considerations in financial reporting for nonprofit organizations.

- Professional ethics in the digital age of accounting.

- The impact of cultural differences on ethical decision-making.

- Sustainability reporting and its role in stakeholder engagement.

Emerging Trends in Accounting Topics

- Blockchain technology and its impact on accounting processes.

- Artificial intelligence in financial statement analysis.

- The rise of sustainable accounting practices in business.

- Robotic process automation and its implications for accountants.

- Cloud-based accounting systems: Benefits and challenges.

- Big data analytics and its role in auditing practices.

- Cybersecurity risks in accounting and preventive measures.

- The integration of ESG factors into financial reporting.

- Digital currencies and their accounting treatment.

- The future role of accountants in a tech-driven world.

Public Sector Accounting Topics

- Governmental accounting standards and their implications.

- Performance measurement in public sector organizations.

- Public finance management and accountability.

- The challenges of budgeting in government agencies.

- Financial transparency and accountability in the public sector.

- Evaluating the impact of public-private partnerships on financial reporting.

- The role of accounting in disaster response and recovery.

- Social welfare accounting and its role in policy evaluation.

- Environmental accounting in government initiatives.

- Healthcare financial management and its unique challenges.

International Accounting Topics

- Comparative analysis of accounting practices across different countries.

- Harmonization vs. diversity in international accounting standards.

- The challenges of translating financial statements in multinational companies.

- Cultural influences on financial reporting practices.

- International taxation and its impact on cross-border business.

- Exchange rate fluctuations and their effects on financial reporting.

- The role of international accounting bodies in standard-setting.

- Case study: Accounting challenges in global supply chains.

- The impact of globalization on accounting education.

- The role of accountants in promoting cross-border investment.

Accounting Education Topics

- The effectiveness of online accounting education.

- Integrating practical experience into accounting curricula.

- Assessing the impact of technology on accounting education.

- The role of internships in shaping future accountants.

- Teaching ethics and professional responsibility in accounting programs.

- Diversity and inclusion in accounting education.

- Curriculum development for evolving accounting industry needs.

- The use of case studies in accounting classrooms.

- Lifelong learning and professional development for accountants.

- Enhancing critical thinking skills in accounting students.

10 Intriguing Research Topics in Accounting and Finance for Undergraduates

- The Impact of Technology on Modern Accounting Practices.

- Exploring Ethical Dilemmas in Financial Decision-Making.

- Analyzing the Role of Financial Ratios in Assessing Company Performance.

- The Link between Corporate Social Responsibility and Financial success

- Investigating the Influence of Economic Factors on Stock Market Trends.

- Financial Planning Strategies for Young Professionals: A Comparative Study.

- The Role of Microfinance in Empowering Local Entrepreneurs.

- The Dynamics of Personal Budgeting and its Long-Term Financial Benefits.

- Assessing the Implications of Cryptocurrencies on Traditional Financial Systems.

- Analyzing the Effects of Global Economic Events on International Trade.

10 Research Topics in Accounting and Finance for Postgraduate

- Unraveling the Complexities of Derivative Market Strategies in Risk Management.

- The Role of Artificial Intelligence in Enhancing Financial Analysis and Decision-Making.

- Exploring the Nexus Between Financial Instruments and Macroeconomic Stability.

- Green Finance: Assessing the Integration of Sustainability into Investment Practices.

- Cryptocurrency Regulations: Balancing Innovation and Financial Integrity.

- Behavioral Biases in Investment Decision-Making: Implications for Portfolio Management.

- The Dynamics of Mergers and Acquisitions: A Study of Value Creation and Integration Challenges.

- Quantitative Easing’s Ripple Effect: Analyzing its Impact on Interest Rates and Inflation.

- Innovations in Fintech and their Disruptive Influence on Traditional Banking Models.

- Islamic Finance: Analyzing its Principles and Their Application in Contemporary Financial Systems.

10 Research Title for Accounting Students

- “Navigating Financial Reporting Challenges in the Era of Digital Transformation”

- “Ethical Dilemmas in Corporate Financial Decision-Making: A Comprehensive Analysis”

- “Unlocking the Potential of Data Analytics in Auditing Processes”

- “The Role of Sustainability Reporting in Shaping Corporate Social Responsibility”

- “Cryptocurrencies and the Evolution of Financial Transactions: Opportunities and Challenges”

- “Impact of International Financial Reporting Standards (IFRS) Adoption on Cross-Border Business”

- “Behavioral Biases in Investment Decision-Making: Implications for Personal Finance”

- “Financial Fraud Detection: Integrating Machine Learning and Forensic Techniques”

- “Examining the Relationship Between Tax Policies and Economic Growth”

- “Mergers and Acquisitions: Evaluating Financial Performance and Value Creation”

As we draw the curtain on this exploration of 120 compelling research topics for accounting students, we hope you’re feeling as inspired as we are by the vast possibilities that await your inquisitive minds. The world of accounting is a dynamic landscape, evolving with every technological stride and ethical challenge that comes its way. These research topics for accounting students serve as invitations to delve deeper, question assumptions, and contribute to the ever-growing body of knowledge.

Remember, each research topic represents a gateway to discovery, innovation, and the chance to make a meaningful impact in the realm of accounting. Whether you choose to unravel the intricacies of financial technology, dissect ethical quandaries, or scrutinize the shifting paradigms of financial reporting, your journey promises to be both enlightening and rewarding.

Leave a Comment Cancel Reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

+237 650 068 843

Get in touch with us

[email protected]

Send us an e-mail

“A home for African Researchers”

Molyko-Buea, Cameroon

- HIRE A WRITER

150+ ACCOUNTING PROJECT TOPICS FOR STUDENTS [2025]

List of accounting project topics .

This blog post gives you insight into various account project topics students can formulate for their research work.

In choosing a research topic, make sure your topic covers both the independent and dependent variables. Narrow your accounting topic by selecting a case study organization.

Using Cameroon as our core example, we have formulated samples of 32 accounting project topics.

Students from other countries such as the USA, UK, Philipines, Canada, Kenya, etc. Can also follow these samples of accounting project topics as guides in formulating their own research topics in Accounting.

Sample List of Accounting project topics

1. Liquidity Management in Commercial Banks (A Case Study of Afriland Bank, Yaounde)

2. Evaluation of Roles of Auditors in The Fraud Detection and Investigation in Cameroonian Industries

3. Budgeting and Budgetary Control in Business Organisation. (A Case Study of Some Selected Microfinance Institutions in Fako Division

4. Cash Management in A Supper Market Store. (A Case Study of Cash Management in Njiforbi Super Market)

5. Internal Control System in The Civil Service a Case Study of Ministry of Finance Centre Region Cameroon

6. The Effect of Lack of Proper Accounting System On Government-Owned Hotels (Case Study of Mountain Hotel Buea)

7. Accounting Information System in A Transport Organization. (A Case Study of CAMRAIL, Cameroon

8. The Analysis of the Impact of Value Added Tax On Revenue Generation in Cameroon (2012-2019)

9. Effect of Credit Management On the Financial Performance of Guinness Cameroon Plc

10. Impact of Internet Banking On Profitability of Commercial Banks in Cameroon – A Study of Afriland First Bank Yaounde Plc, 2012-2019

11. The Impact of Merger and Acquisition On the Performance and Growth of Banks In Nigeria – A Case Study Of UBA Cameroon Plc

12. Effects of Total Quality Management On Productivity Using the Probit Model

13. Budgeting and Budgetary Control as Tools for Accountability in Government Parastatals

14. Problems and Prospects of Auditing in Government Organization

15. Impact of Financial Accounting On the Corporate Performance of Business Organization

16. Impact of Accounting Information On the Decision-Making Process of an Organization

17. The Effect of Cost Accounting Techniques On the Performance of SMEs in Kumba Town

18. The Impact of Liquidity and Profitability as A Survival Strategy for Banks in Cameroon: The Case of Some Selected Commercial Banks in Buea

19. An Appraisal of the Relevance of Financial Incentives to Workers’ Motivation

Accounting Project Topics with Materials [Free Download]

20. The Budgeting and Budgetary Control of Non-Profit Making Organization in Bamenda

21. The Impact of Microfinance Bank On the Performance of Small Scale Businesses in Meme Division

22. Impact of Inventory Management On Manufacturing Organization (A Study of Guinness Cameroon Plc

23. A Study On the Factors Affecting E-Commerce Adoption in Cameroonian Banks (A Case Study of NFC Bank Buea Plc)

24. Awareness of Confidence Accounting Amongst Accounting Lecturers in Cameroon

25. Financial Statement Fraud in an Organization: Problems and Solutions

26. Impact of Budgeting, Planning, and Control On the Profitability of a Manufacturing Company

27. Evaluation of Capital Structure and Profitability of Business Organisation (A Case Study of Selected Quoted Companies)

28. The Impact of Information Technology (I.T) On The Performance Banks of Cameroon

29. Effects Of Computerized Accounting System On The Performance Of the Banking Industry In Cameroon

30. Impact Of Credit Management On The Profitability Of A Manufacturing Firm in Cameroon

31. Impact Of Financial Accounting On The Corporate Performance Of Business Organizations in Cameroon

32. Impact Of Management Accounting On Financial Performance in Cameroon (A Case Study Of NFC Bank)

33. The Impact Of Financial Reporting On The Performance Of Small And Medium Size Enterprises in Cameroon

34. The Effects Of Financial Statements On The Growth Of Small And Medium Size Enterprises in the Limbe Municipality.

35. The Role Of Accounting Information System On The Performance Of Microfinance Institutions In Buea Municipality

36. The Effect Of Internal Control On Detection And Prevention Of Fraud In Small And Medium Size Enterprises The Case Of Buea Municipality

37. The Effects of Working Capital Management on the Financial Performance of Micro-finance institutions in Buea Municipality. Case of Lobe Cooperative Credit Union

38. The Role of Auditing in Enhancing Transparency and Accountability of Financial Reports in Commercial Banks” Case Study: National Financial Credit Bank

39. The Effects of Corporate Governance on the Financial Performance of Microfinance Institutions in Cameroon

40. The Management Of Liquidity And The Effect On The Performance Of Commercial Banks In Cameroon With The Case Of: Afriland First Bank Limbe

41. The Effect Of Internal Control On The Detection And Prevention Of Fraud In Commercial Banks Case Of NFC Bank Buea Branch

42. The Relevance Of Book Keeping On The Performance Of SMEs In The Buea Municipality

43. The Impact of Internal Control Practices on the Financial Performance of Small and Medium Size Enterprises in Buea

44. Analysis Of Cash Internal Control Weaknesses In Perpetuating Fraud In Commercial Banks In Buea

45. Evaluation of an Effective Financial Management on Computerized Accounting System

46. The Impact Of Financial Statement On Decision Making In Financial Institutions

47. The Role of Budgeting in Managerial Planning and Control

48. The Impact Of Covid-19 On The Profitability Of Micro Financial Institutions In Buea

49. The Effects Of Information Communication Technology On Accounting Practices

50. Cash Management And Growth Of Small- Scale Businesses In Buea

51. The Determinants Of Capital Structure On The Debt Equity Ratio Of SMEs in Buea

52. Effect of Corporate Governance on the Financial Performance of MFIs

53. The Role Of Internal Control On The Performance Of Commercial Enterprises Case Study: Congelcam S.A

54. The Effect Of Automated Teller Machine Services On Customer Satisfaction Of Commercial Banks In Cameroon

55. The Use Of Ratios As Lending Tools For Banks in Cameroon

56. The Relationship Between Bookkeeping And The Performance Of SMEs in Buea

57. The Effect of Computerized Accounting Systems on the Quality of financial reporting by Small and Medium Sized Enterprises in the Buea Municipality

58. The Role Of Accounting Practices On The Growth Of Small And Medium Size Enterprises In Buea Municipality

59. The Impact Of Taxes On The Growth Of Selected Small And Medium Size Enterprises In Buea.

60. The Role of Internal Audit in Public Organizations in Cameroon: Case Study Buea Regional Hospital, Cameroon

61. Impact Of Internal Control On The Growth Of Small And Medium Size Enterprises Buea Municipality.

62. Determinants Of Dividend Payout Ratio Case Study: Ecobank

63. The Impact Of Financial Statement Analysis On The Decision Making Of Brewery Industries In Cameroon

64. The Impact Of Insurance On The Sustainability Of Small And Medium Size Enterprises IN Buea Municipality

65. The Impact Of Ratio Analysis On Investment Decision-Making in Guinness Cameroon Sa

66. The Impact Of Accounting Information System On The Performance Of CCC Plc Microfinance Institution In Cameroon

67. The Effect Of Management Accounting Techniques On The Financial Performance Of Manufacturing Companies In Tiko Municipality

68. The Impact Of Taxes On The Performance Of SMEs In Buea Municipality

69. The Effect Of Corporate Social Responsibility On The Financial Performance Of Small And Medium Size Enterprises In Cameroon

70.0 The Effect Of Internal Controls On The Performance Of CCC PLC.

71. The effect of IT on fraud occurrences within a commercial financial institution

72. The Effect Of Internal Control On Budget Implementation In Cooperative Credit Unions In Cameroon

73. Internal Control And Its Effects On The Budget Implantation In Cooperative Credit Unions In Buea Municipality

74. The Efficiency Of Computerized Accounting System On The Service Delivery Of NGOs in Cameroon

75. Financial Accounting Information useful in Lending Management Decision in Fako Chapter

76. The Relevance Of Book Keeping on SMEs in the Buea Municipality

77. The Impact Of Accounting Information System On Small And Medium Size Enterprises Performance In Buea Municipality

78. The Effect Of Internal Control On Detection And Prevention Of Fraud In Small And Medium Size Enterprises In Buea Municipality

79. Cost and Management Accounting Practices on the Performance of Small and Medium size enterprises in Buea Municipal

80. The Effect of audit on the performance of small and medium-sized enterprises in Buea Cameroon.

81. Effect of working capital on the profitability of Small and Medium-sized Enterprises in Buea

82. The Role Of Ratio Analysis In Business Decision Making: Case study G3 BIZ LTD LIMBE

83. The Impact Of Liquidity Management On Capital Adequacy in NFC Bank

84. The Effects of Liquidity Management On the Financial Performance of ECOBANK

85. The Impact Of Information Technology On Accounting System In Financial Institutions

86. The Role Of Financial Statement In Investment Decision-Making Case Study FINASDDEE Credit Line Limbe

87. The Effects of Credit Risk Management on The Financial Performance of Some Microfinance Institutions in Fako

88. The Influence of Computerized Accounting Systems On the Performance Of Micro Finance Institutions In Buea

89. The Influence Of Computerised Accounting Systems On Small And Medium Enterprises In The Limbe Municipality

90. The Effects of Inventory Management on the Performance of Small and Medium Size Enterprises In Buea

91. The Effects Of Total Quality Management (TQM) Practice On Customer Satisfaction

92. The Effects Of Inventory Management On The Performance Of SMEs in Buea

93. The Impact of Information Technology On Tax Administration in Cameroon

94. The Influence Of Computerized Accounting On Financial Reporting And Performance In Microfinance Institutions In Buea Municipality

95. The Effects Of Cash Management Practices On The Growth Of SMEs In The Buea Municipality

96. The Effect Of Cost Accounting On The Performance Of Small And Medium Size Enterprises In Cameroon

97. The Effect Of Taxes On The Growth Of Aningdoh Credit Union Limited (ANNICUL)

98. The Effects Of Tax Expenses On The Financial Performance of Small and Medium Size Enterprises: Case of Some SMEs in Bamenda II

99. Determinants of Interest Rates on the Growth and Sustainability of Manchok Cooperative Credit Union Limited (MACCUL)

100. The Impact Of Taxes On The Performance Of Smes In Fako Division

101. The Role Of Bookkeeping On The Performance Of Small And Medium Size Enterprise In Buea

102. Effect of Covid 19 On Restaurant Performance

103. The Role of Internal Control On the Performance of Commercial Enterprises in Cameroon

104. The Effect Of Cost Accounting System On The Performance Of SMEs

105. The Effects Of Cash Management On The Financial Performance Of Enterprises: Evidence Of Selected Micro And Small Enterprises In Bertoua Municipality

106. The Impacts Of Budgeting, Planning, And Control On Profitability Of Manufacturing Companies With The Case Of Source Du Pays Sa

107. The Influence of Internal Checks and Risk Management on The Financial Performance of Commercial Banks in Cameroon

108. Control System Of Entity As An Influential Force On External Audits For Corporate Reporting: Case Of Union Bank PLC. Douala

109. An Evaluation Of The Process Of Fiscal Decentralisation To The Local Government Of Cameroon: Case Of Selected Councils In The South West Region

110. The Effects Of Taxes On The Performance Of Micro Enterprises: The Case Of Njinikom Sub Division

111. The Effect of Taxation on the Performance of Small and Medium-Sized Enterprises in Buea

112. The Impact Of Budgetary Control On The Profitability of SMESs IN Buea Municipality

113. The Impact Of Internal Control On The Performance Of Microfinance Institutions In the Fako Division

114. The Perception Of Taxation On The Growth Of Micro-Enterprises In Cameroon

We provide guidance and directives on the following other services

- Topic selection

- Data Analysis

- PowerPoint Building

- Editing services

- Proofreading services

- Plagiarism checking

- Plagiarism removal

- For More Information, hit the WhatsApp Icon and get to Us

Whatsapp us now: +237 650068843

Useful Links

Top 13 Highest Paying Jobs In Cameroon

How to start a real estate business in Cameroon

Share this post

Comments (2)

I have interest in number 29, in fact I had almost that same topic in mind. What are all these topics for, u thought they are projects that I could read.

hi iam interested on number 22

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Related Posts

20 PowerPoint Preparation Tips for Masters and PhD Students

The Do and Don’t of designing a simple and powerful PowerPoint slide. #1. Use High-Quality, Fresh Templates Choosing a beautiful and...

Adult Education Project Topics For Undergraduates Students In Cameroon

Below is a shortlist of possible topics for research for the Adult Education Department 1. The Influence Of Teaching Methods On...

Management Project Topics for Students in Cameroon

1. The Impact of the Anglophone Crisis On the Profitability of Small and Medium Size Enterprises In Buea Municipality 2. Failure...

60+ Marketing Project Topics for Undergraduate Students

1. The Effect of Advertisement On Consumer Brand Preference 2. Effect of Personal Selling and Marketing On Sales Growth 3. Impact of...

Real Estate Management Project Topics For Undergraduates And Postgraduate Students In Cameroon

Real estate management as a course deals with the appraisal, management, acquisition, development, marketing, and disposal of properties. Real estate management...

Essay Writing Tips for University Students in Cameroon

Essay writing has become a common and well-known assessment procedure in all fields of study and academic works in all...

Secretarial Studies Project Topics for Undergraduate and postgraduate students in Cameroon

Secretarial Studies Project Topics for Undergraduate and postgraduate students in Cameroon 1. The Role Of A Secretary In Office Administration And...

Insurance Project topics for undergraduates and postgraduate students

1. The Role Of Insurance Companies In The Economic Development Of Cameroon: Case Study of Insurance companies in Fako 2. The...

Computer Science Project Topics for Undergraduate Students in Cameroon

Computer Science Project Topics for Undergraduate Students in Cameroon 1). Design And Implementation Of Civil Servant Retirement System in Cameroon 2)....

Public Law Project Topics For Undergraduate And Postgraduate Students In Cameroon

Public Law Project Topics For Undergraduate And Postgraduate Students In Cameroon 1. Protection Of The Rights Of Individuals In Armed Conflict...

WhatsApp us

189+ Best Accounting Project Topics And Materials For Students

Are you wondering about cool projects to explore in the world of numbers and money? Well, buckle up because we’re about to dive into an awesome list of Accounting Project Topics And Materials designed just for you!

You might be thinking, ‘What’s so exciting about accounting?’ Trust me, it’s not just about counting coins. These topics are like treasure chests filled with fascinating ideas. From learning how businesses handle their cash to uncovering the secrets behind financial statements, taxation, and even catching financial fraudsters—there’s a whole bunch of interesting stuff waiting for you.

Think of these topics as your ticket to understanding how money moves in the business world. Ever wondered how companies figure out what to spend and where to save? Or how do they make sure everything adds up correctly? Well, these projects will give you a sneak peek into those secrets.

So, get ready to explore, learn, and become the next financially proficient youth with these awesome Accounting Project Topics And Materials! Let’s get started on this money-making adventure together!

Must Know: Insurance Project Ideas

Table of Contents

What Are The Best Accounting Project Topics?

Selecting the finest Accounting Project Topics involves thoughtful consideration of subjects that open doors to comprehensive learning experiences. These topics are carefully curated to offer students engaging insights into the intricate world of finance and accounting. Ranging from dissecting financial statements and understanding taxation principles to exploring the nuances of cost accounting and auditing practices, these topics serve as pathways to comprehend essential financial management concepts.

They aim not only to broaden students’ horizons but also to instill practical skills and analytical thinking crucial for navigating the complexities of the accounting domain. The best Accounting Project Topics and materials are those that serve as bridges between theoretical knowledge and practical application. They act as catalysts for deeper understanding by immersing students in topics such as ethics in accounting, international standards, risk management strategies, and the integration of technology in modern accounting systems.

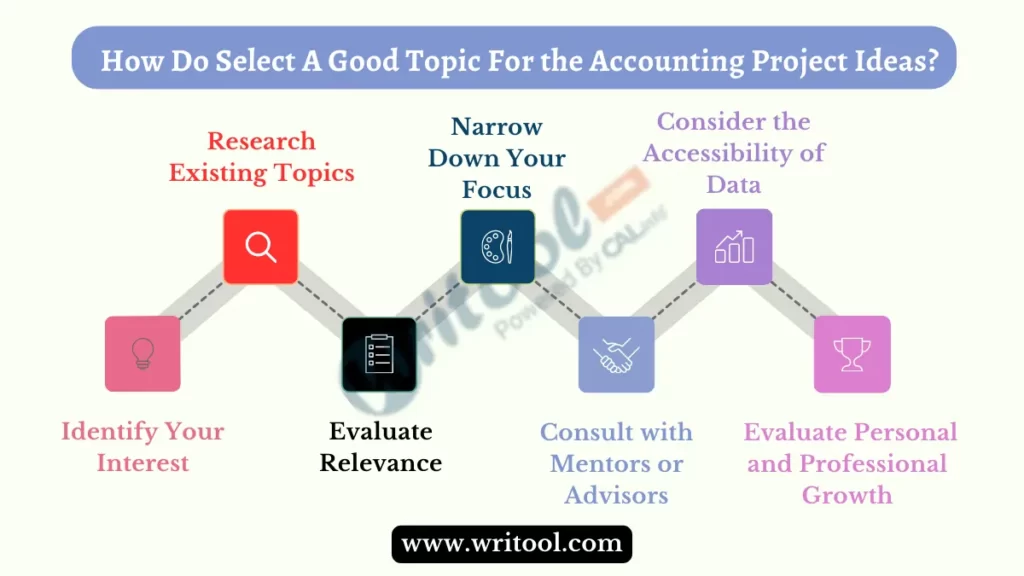

How Do You Select A Very Good Topic For Your Graduation Project In The Accounting Section?

Here are 7 easy steps to help you choose an excellent topic for your graduation project in the accounting section:

1. Identify Your Interests

Start by listing areas of accounting that captivate your attention. Whether it’s auditing, taxation, financial analysis, or cost accounting, understanding your interests will guide you toward a topic that keeps you engaged throughout your project.

2. Research Existing Topics

Explore various resources like textbooks, journals, online databases, and academic websites to discover existing topics in accounting. This can inspire new ideas or help you refine existing ones by understanding what has been previously studied.

3. Evaluate Relevance

Consider the relevance and significance of potential topics. Ensure the chosen subject aligns with current trends, addresses practical issues, or offers solutions to existing problems in the accounting field.

4. Narrow Down Your Focus

Once you have a list of potential topics, narrow it down based on feasibility, resources available, and the scope of your project. Aim for a specific aspect within a broader topic to maintain focus and depth.

5. Consult with Mentors or Advisors

Seek guidance from professors, mentors, or advisors. Discuss your ideas with them to receive valuable insights, suggestions, and feedback. Their expertise can help you refine your topic and ensure its academic viability.

6. Consider the Accessibility of Data

Ensure that you can access the necessary data and resources to support your research. A feasible project topic should have readily available information for analysis and study.

7. Evaluate Personal and Professional Growth

Lastly, reflect on how the chosen topic aligns with your academic and career goals. Consider how researching this topic might contribute to your knowledge, skills, and future aspirations in the field of accounting.

List of 189+ Best Accounting Project Topics And Materials For Students

These topics cover various areas within accounting and can be further developed into project proposals or research papers:

Good Financial Accounting Project Topics And Materials

- Impact of Financial Reporting Quality on Investment Decisions

- Evaluation of Accounting Conservatism in Financial Statements

- Adoption and Implementation of International Accounting Standards in Developing Countries

- Assessing the Effectiveness of Accounting Information in Stock Market Predictions

- Corporate Disclosure Practices and Investor Confidence

- Financial Statement Analysis of Multinational Corporations

- Accounting for Leases under IFRS 16 vs. ASC 842: A Comparative Analysis

- Accounting for Intangible Assets: Valuation and Reporting Issues

- Financial Reporting and Corporate Social Responsibility (CSR) Disclosures

- The Role of Accounting in Mergers and Acquisitions

Recent Managerial Accounting Project Topics And Materials

- Throughput Accounting: Theory and Practical Application in Manufacturing

- Target Costing in New Product Development: Case Studies in Different Industries

- Performance Measurement Systems in Service Industries

- Cost Management Techniques in Healthcare Organizations

- Transfer Pricing Strategies and Their Impact on Multinational Corporations

- Strategic Cost Analysis for Decision-Making in Competitive Markets

- Environmental Management Accounting Practices in Sustainable Businesses

- Activity-Based Budgeting: Implementation Challenges and Benefits

- Cost Allocation Methods and Their Effect on Profitability Analysis

- Management Accounting Techniques for Non-Profit Organizations

Auditing and Assurance

- Audit Committee Effectiveness and its Impact on Financial Reporting Quality

- Role of Big Data Analytics in Auditing Procedures

- Auditor Liability: Legal and Ethical Implications

- The Impact of Corporate Governance on External Audit Quality

- Auditing in the Era of Industry 4.0: IoT, AI, and Automation

- Forensic Audit Techniques in Fraud Detection and Prevention

- Internal vs. External Audits: Comparative Analysis and Advantages

- The Evolution of Audit Reports: Past, Present, and Future Trends

- Assessing Audit Risk in Complex Business Environments

- Continuous Auditing and its Application in Contemporary Businesses

Taxation And Accounting Project Topics And Materials

- Tax Compliance and Ethics: A Comparative Study Across Countries

- Taxation Policies and Economic Development: Lessons from Emerging Markets

- Tax Incentives and Investment Decisions in Developing Economies

- Taxation of E-commerce Transactions: Challenges and Opportunities

- Tax Implications of Cryptocurrency Transactions

- Environmental Taxation and its Role in Sustainable Development

- Tax Planning Strategies for High-Net-Worth Individuals

- Tax Reform Proposals and Their Socioeconomic Impact

- Taxation of Multinational Corporations: Transfer Pricing Issues

- Tax Treaties and their Influence on International Business Transactions

Forensic Accounting

- Corporate Governance and Fraudulent Financial Reporting

- Cybersecurity Risks in Financial Systems and Forensic Countermeasures

- Whistleblowing Policies and Their Role in Fraud Detection

- Digital Forensics and Investigation Techniques in Financial Crimes

- The Use of Artificial Intelligence in Forensic Accounting

- Investigating Embezzlement and Financial Misconduct in Organizations

- The Role of Forensic Accountants in Dispute Resolution

- Money Laundering: Detection and Prevention Strategies

- Forensic Accounting Techniques in Bankruptcy Cases

- Ethical Dilemmas and Challenges in Forensic Accounting Investigations

Accounting Information Systems

- ERP Systems Implementation and its Impact on Accounting Processes

- Cloud Computing in Accounting Information Systems

- Data Analytics in AIS: Enhancing Decision-Making Processes

- Information Security in Accounting Information Systems

- Blockchain Technology in Financial Reporting and Auditing

- AIS and Corporate Governance: Ensuring Data Integrity and Security

- AI-Powered Predictive Analytics in Financial Reporting

- The Evolution of AIS and its Future Trends

- AIS in Small and Medium-sized Enterprises (SMEs): Challenges and Opportunities

- Mobile Accounting Applications: Advantages and Risks

Easy Ethics in Accounting Project Topics And Materials

- Professional Ethics in Accounting: Codes and Practices

- Ethical Leadership and its Impact on Financial Reporting Integrity

- Conflicts of Interest in Accounting: Analysis and Mitigation Strategies

- Corporate Social Responsibility (CSR) and Ethical Accounting Practices

- Ethical Decision-Making in Accounting: Case Studies

- The Role of Ethics in Accounting Education and Professional Development

- Whistleblowing and Ethical Dilemmas in Accounting Firms

- Ethical Challenges in Tax Planning and Compliance

- Gender Diversity in Accounting and Ethical Implications

- Ethical Issues Surrounding Creative Accounting Practices

Accounting for Specific Industries

- Hospitality Industry Accounting Practices and Challenges

- Accounting in the Pharmaceutical Industry: Regulations and Reporting Standards

- Accounting for Government and Non-Governmental Organizations (NGOs)

- Agricultural Accounting: Challenges and Solutions

- Financial Reporting in the Entertainment Industry

- Real Estate Accounting and Property Management

- Healthcare Accounting: Revenue Recognition and Cost Control

- Accounting Practices in the Fashion and Retail Industry

- Aviation Industry Accounting: Revenue Management and Cost Analysis

- Accounting for the Energy Sector: Challenges and Environmental Reporting

Financial Regulation and Compliance

- Dodd-Frank Act and its Impact on Financial Reporting

- Basel Accords and their Influence on Banking Regulations

- Financial Regulatory Reforms post-Global Financial Crisis

- Compliance with Anti-Money Laundering (AML) Regulations in Financial Institutions

- Role of Central Banks in Ensuring Financial Stability

- Regulatory Challenges in Fintech and Digital Banking

- Insider Trading Regulations: Case Studies and Implications

- Credit Risk Management and Regulatory Compliance

- Corporate Governance Regulations and Financial Performance

- Regulatory Changes and Their Effects on Financial Markets

International Accounting Project Topics And Materials

- International Tax Planning Strategies for Multinational Corporations

- Cross-Border Mergers and Acquisitions: Accounting and Reporting Challenges

- Harmonization of Accounting Standards: Achievements and Challenges

- The Impact of Globalization on Accounting Practices

- International Financial Reporting Standards (IFRS) and US GAAP Convergence

- Comparative Analysis of Accounting Systems in Different Countries

- Challenges of Foreign Currency Translation in International Accounting

- International Accounting and Reporting in Developing Economies

- Accounting Harmonization in the European Union

- Cultural Influences on Accounting Practices in Global Businesses

Accounting Education and Profession

- Pedagogical Techniques in Teaching Accounting to Students

- The Role of Technology in Accounting Education

- Accounting Skills and Competencies for Future Professionals

- Continuous Professional Development in Accounting: Challenges and Solutions

- The Influence of Internships on Accounting Students’ Career Choices

- Gender Disparity in the Accounting Profession

- Accounting Accreditation and its Impact on Education Quality

- Ethics Education in Accounting Programs: Curricular Design and Effectiveness

- The Future of Accounting: Emerging Roles and Career Prospects

- Professional Certifications in Accounting: Benefits and Challenges

Financial Management and Analysis

- Working Capital Management Strategies and Firm Performance

- Capital Budgeting Techniques in Investment Decision-Making

- Financial Risk Management in Global Corporations

- Corporate Restructuring and Financial Performance

- Merger and Acquisition Valuation Methods

- Dividend Policy and its Impact on Shareholder Wealth

- Initial Public Offerings (IPOs) and Stock Market Performance

- Corporate Cash Holdings and Firm Value

- Behavioral Finance: Biases in Investment Decision-Making

- Corporate Governance and Financial Distress Prediction Models

Accounting for Non-Profit Organizations

- Financial Sustainability of Non-Profit Organizations

- Donor Stewardship and Financial Accountability in NGOs

- Fund Accounting and Grant Management in Non-Profit Entities

- Performance Measurement in Non-Profit Organizations

- Budgeting and Financial Planning in Non-Profit Sector

- Reporting Requirements for Non-Profit Entities

- Fundraising Strategies and Financial Reporting for Non-Profits

- Volunteer Services and their Valuation in Non-Profit Accounting

- Compliance and Governance Challenges for Non-Profit Organizations

- Impact Assessment and Reporting in Non-Profit Sector

Accounting for Small Businesses and Startups

- Accounting Practices for Small Business Sustainability

- Financial Reporting Challenges for Small Businesses

- Start-up Financing Options and Accounting Implications

- Cash Flow Management in Small Businesses

- Tax Planning Strategies for Small and Medium-sized Enterprises (SMEs)

- Accounting Software for Small Business: Selection and Implementation

- Financial Decision-Making in Startup Ventures

- Accounting for Intellectual Property in Startups

- Challenges of Financial Management in Growing Small Businesses

- Cost Accounting for Small-Scale Manufacturing Units

Accounting in Developing Economies

- Accounting Infrastructure in Developing Countries

- Challenges of Implementing International Accounting Standards in Developing Economies

- Corporate Governance in Emerging Markets

- Accounting for Microfinance Institutions in Developing Nations

- Public Sector Accounting Reforms in Developing Economies

- Financial Reporting Challenges in Less-Developed Countries

- Role of Informal Economies in Accounting Practices

- Accounting for Poverty Alleviation Programs

- Challenges of Taxation in Developing Nations

- Accounting Education in Developing Economies

Environmental Accounting Project Topics And Materials

- Environmental Accounting Standards and Reporting Frameworks

- Carbon Accounting and Emission Trading

- Environmental Cost Accounting: Measurement and Reporting

- Social and Environmental Responsibility Reporting by Corporations

- Ecological Footprint Accounting in Organizations

- Sustainability Reporting and Triple Bottom Line Accounting

- Environmental Management Accounting for Business Decision-Making

- Green Accounting: Benefits and Implementation Challenges

- Renewable Energy Accounting and Financial Reporting

- Environmental Auditing and Compliance Reporting

Accounting and Technology

- Accounting Automation and its Effects on Employment

- Robotic Process Automation in Accounting and Finance

- Accounting Information Systems Integration with AI and Machine Learning

- Cybersecurity Measures in Accounting Information Systems

- Cloud-Based Accounting Solutions: Advantages and Risks

- Big Data Analytics in Accounting: Applications and Limitations

- Role of Blockchain in Accounting and Financial Transactions

- Mobile Applications for Personal Financial Management

- AI-powered Financial Planning and Analysis Tools

- Digital Transformation in Accounting Firms

Accounting and Social Issues

- Impact Investing and Social Accounting

- Gender Pay Gap Reporting and its Financial Implications

- Diversity and Inclusion Reporting in Corporate Financial Statements

- Corporate Philanthropy Reporting and its Effect on Stakeholders

- Income Inequality and its Reflection in Financial Reporting

- Human Rights and Corporate Accountability Reporting

- Social Impact Measurement in Financial Reporting

- Corporate Ethics and Social Responsibility Reporting

- Accounting for Sustainable Development Goals (SDGs)

- Fair Trade Accounting and Reporting

Accounting in Specific Geographic Regions

- Accounting Practices in Asia-Pacific Countries

- Accounting Standards and Regulations in Latin America

- Accounting Challenges in African Nations

- European Union Accounting Harmonization and its Implications

- North American Accounting Regulations and Practices

- Accounting Differences in Middle Eastern Countries

- Accounting Reforms and Practices in BRICS Nations

- Accounting Challenges in Post-Soviet Bloc Countries

- Accounting Practices in Pacific Island Nations

- Comparative Analysis of Accounting Systems in Developed vs. Developing Nations

Accounting and Governance

- Corporate Governance Mechanisms and Financial Reporting Quality

- Board Diversity and Financial Performance of Companies

- Shareholder Activism and Corporate Governance

- Corporate Social Responsibility and Board Oversight

- Governance Mechanisms in Family-Owned Businesses

- Executive Compensation and Corporate Governance

- Role of Auditors in Corporate Governance

- Governmental Influence on Corporate Governance Practices

- Whistleblowing Policies and Corporate Governance

- Stakeholder Theory and Corporate Governance

Best Accounting Project Materials For Students

Here, we give various types of educational, professional, and other materials commonly used in the field of accounting, including some examples and potential categories.

1. Educational Materials

Textbooks play a crucial role in accounting education, covering fundamental concepts to specialized areas. Here’s a table showcasing some popular accounting textbooks:

Online Courses

Online platforms offer a variety of accounting courses. Here are examples from different levels:

Lecture Notes and Slides

Universities and colleges often provide lecture materials online. Here’s how a table might categorize these:

2. Professional Materials

Accounting standards and pronouncements.

Accounting standards issued by various bodies are crucial for professionals. Here’s a potential table layout:

Journal Articles and Research Papers

Research papers and articles contribute to accounting knowledge. Here’s an example table structure:

Accounting software aids in managing financial tasks. A table could display different software options:

3. Other Materials

Calculators.

Financial calculators are essential tools in accounting. A simple table might look like this:

Templates and Spreadsheets

Pre-made templates and spreadsheets streamline accounting tasks. Here’s a sample table layout:

News and Analysis

Staying updated with current business news is vital for accountants. A table could display different news sources:

List of Simple accounting project topics and materials PDF

Here are the simplest final-year project topics for accounting students and good Accounting project topics and materials for college students.

What Are Some Creative Project Topics For Accountancy And Oc?

Here are ten creative project topics that blend Accountancy (Accounting) with Organizational Communication (OC):

- Communication Strategies in Financial Reporting: Analyzing how effective communication enhances the comprehension of financial reports for diverse stakeholders.

- Ethical Communication in Accounting Practices: Investigating how ethical communication influences decision-making processes within accounting firms and financial organizations.

- Impact of Digital Transformation on Accounting Communication: Exploring how technological advancements affect communication practices in accounting, such as through automation and AI.

- Narrative Accounting: Storytelling in Financial Reporting: Examining the use of storytelling techniques in financial statements and their impact on stakeholders’ understanding.

- Cross-Cultural Communication Challenges in Global Accounting Firms: Studying communication barriers and strategies in multinational accounting corporations operating in diverse cultural settings.

- Communication Styles and Conflict Resolution in Accounting Teams: Analyzing various communication styles within accounting teams and their role in resolving conflicts and enhancing productivity.

- Internal Communication and Change Management in Accounting Practices: Investigating effective internal communication strategies during organizational changes within accounting firms.

- Role of Communication in Forensic Accounting Investigations: Examining how communication techniques aid in conducting successful forensic accounting investigations.

- Communicating Sustainability in Financial Reporting: Exploring the communication of sustainable accounting practices and environmental/social impact in financial reports.

- Communication and Client Relationships in Accounting Services: Investigating the significance of effective communication in maintaining client relationships and delivering quality accounting services.

So, these ‘Accounting Project Topics and Materials’ are all about money and how it works in different places. Imagine them like different doors you can open to learn cool things about numbers and businesses. They show how people use math to talk about money in companies, how new tech helps with accounting, and even how working together in accounting teams is super important. It’s not just about numbers; it’s like discovering secrets about money in the real world. These materials are like a treasure map, helping us explore and understand how money decisions are made in companies, charities, and more.

These ‘Accounting Project Topics and Materials’ are a bit like a fun book series but about money and business. They’re packed with stories about how people handle cash and make smart choices. From learning about how companies talk about money to discovering new ways technology helps count coins, these topics are like puzzle pieces that make up the big picture of money. They’re a guide to exploring how cash moves around and how people make decisions with it.

What are examples of projects in accounting?

An example of a project in accounting could involve conducting a financial statement analysis to evaluate a company’s performance and financial health.

What is a good project for a recent accounting graduate

A comprehensive project in forensic accounting investigating financial fraud or irregularities within an organization could be valuable for a recent accounting graduate.

How do I get the best accounting project topics?

Exploring recent industry trends, consulting academic resources, and discussing potential ideas with mentors or professors can help in identifying the best accounting project topics.

Related Posts

101+ Interesting Taxation Project Ideas To Write About & Examples

100+ Best Zoology Research Project Topics And Materials In 2024

Leave a comment cancel reply.

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

1.858.217.5144

Start your project

What are some recommended accounting topics to include in a presentation?

When creating an accounting presentation , it’s essential to cover key topics that provide valuable insights into financial operations, compliance, and performance. Depending on the purpose of the presentation—whether for internal reporting, client meetings, or educational purposes—here are some recommended accounting topics :

1. Financial Statements Overview

- Balance Sheet : Presenting a company’s financial position, including assets, liabilities, and equity.

- Income Statement : Showing revenues, expenses, and net income to reflect profitability over a period.

- Cash Flow Statement : Analyzing cash inflows and outflows related to operating, investing, and financing activities.

2. Revenue Recognition

- Discuss the principles of revenue recognition and how they apply under various accounting standards (e.g., IFRS 15 and ASC 606 ). This is particularly useful for stakeholders to understand when and how revenue is recognized in financial reports.

3. Depreciation and Amortization

- Explain the methods used for depreciation (e.g., straight-line, double declining balance) and amortization of assets, highlighting their impact on financial statements.

4. Cost Accounting and Budgeting

- Cover cost management techniques, including fixed vs. variable costs , direct vs. indirect costs , and how they influence budgeting and decision-making. Discuss budgeting methods like zero-based budgeting and variance analysis .

5. Tax Accounting

- Review tax provisions and deferred tax liabilities/assets . This can include updates on the latest tax regulations, corporate tax strategies, or an overview of tax compliance.

6. Auditing and Internal Controls

- Provide an overview of audit processes and the importance of internal controls for ensuring compliance and accuracy in financial reporting. Discuss common audit findings and recommendations for strengthening internal controls.

7. Break-even Analysis

- Explain the concept of break-even analysis , which helps businesses understand how much they need to sell to cover costs, and when they will start making a profit.

8. Key Financial Ratios

- Present financial ratios such as liquidity ratios (current ratio, quick ratio), profitability ratios (gross margin, return on assets), and efficiency ratios (inventory turnover, accounts receivable turnover). These help in assessing a company’s financial health.

9. Accounts Receivable and Payable Management