- Purchase History

Restaurant Financial Plan Template [2024 Guide]

by I.J. Karam | Jan 1, 2024 | Business Plans , Financial Plan Guide

How much does it cost to open a new restaurant? What kind of information you need to come up with a financial forecast for your new venture? And just how do you create a professional restaurant business plan with financials?

These questions seem difficult to answer at first but creating a Restaurant Financial Plan is actually not that hard — and we’ll show you how to go about it — but it requires some research, patience, and time. If you would rather like to simplify the entire process, may we suggest you have a look at our Restaurant Business Plan template ? The template has a fully automatic and customizable financial model in Excel designed specifically for the Restaurant business. Here are a couple of screenshots to give you an idea:

Some of the main highlights of our Restaurant Business Plan template are as follows:

- It is extremely user-friendly, allowing you to create a professional financial plan with just a few clicks

- No financial expertise is required, nor do you need to do any research. Simply, feed in the cost and revenue assumptions for your business model — and our financial model will do the rest. Based on the information provided by you, it will automatically generate important financial statements. These include Cash Flow statement, Income Statement, and Balance Sheet. Plus, it will generate several tables and charts to provide great data representation and make financial analysis readable and easy to follow.

Coming back to building an effective financial plan for your project, this guide is all you need. We’ll walk you through all the key elements of a comprehensive Restaurant Financial Plan. First, let’s have a look at the key benefits of creating a robust financial plan for your upcoming F&B venture.

The Benefits of Creating a Financial Plan for your Restaurant Project

First, it can help you secure funding. When approaching potential investors or lenders, they will want to see that you have a solid plan in place showing how you will use their money and make a profit. A well-researched and detailed restaurant financial plan can give them the confidence they need to invest in your F&B project.

Second, a financial plan can help you make better decisions about your restaurant. It can help you identify potential financial risks and opportunities, and make adjustments accordingly. For example, if your financial plan shows that certain menu items are quite costly compared to others, you can make the necessary changes to improve profitability.

Third, it can help you manage your cash flow. A restaurant financial plan can help you forecast when cash will be coming in and going out, allowing you to better manage your finances and avoid any unexpected cash flow problems. Remember, cash is a key element that can make or break the success of your F&B business, but more on that later.

Finally, a financial plan helps you set and achieve financial goals for your restaurant. It can give you a clear picture of where you want to be financially in the short and long term and help you create a roadmap to getting there.

In summary, building a financial plan is crucial in order to successfully navigate the challenges and opportunities of running a restaurant business.

Let’s now have a look at the first key element of a restaurant financial model: your cost structure.

Restaurant Financial Plan: Costs Forecast

How much will it cost you to run your restaurant business? This is the first question you need to answer. Figuring out the involved costs can be simplified by following the next steps: Start by dividing your costs into two categories: Costs of Goods Sold (also referred as Direct Costs or COGS) and Operating Expenses (usually referred simply as Opex).

So, what falls in the category of Direct Costs/COGS? It includes the cost of buying the raw materials and the cost of preparing the different food items in your menu. These include the cost of food ingredients, raw vegetables, meat, condiments, etc. You should also include non-food items that you purchase from various suppliers, such as paper and cloth napkins, straws, and any other consumables. These expenses are usually “variable costs” as their monthly figure tends to vary with the amount of customers you receive.

On the other hand, operating expenses (Opex) include things such as salaries, rent, utilities, advertising, and all other overhead expenses you will incur. These expenses are rather indirect, since they are indirectly related to what you sell. You can also think of them as “fixed costs” since they tend to remain stable month after month. Nevertheless, they are just as important as your COGS, so make sure you include every operating expense that you’re likely to incur.

Now that you have determined the Direct Costs and Operating Expenses, it’s time to calculate the total cost of running your restaurant business. Here’s the formula:

Total Cost = Direct Costs + Operating Expenses

Keep in mind that while certain expenses will invariably go up over time, other expenses may remain stable. A case in point is the rent, which is not likely to change on year-to-year basis. On the other hand, your employee’s salary will probably increase every year.

You might think we have missed a third category of costs related to buying equipment such as your restaurant’s kitchen appliances or furniture, but that’s not the case. From a financial perspective, these types of expenditures are actually considered types of investments rather than expenses. Check the next section for more details.

Restaurant Financial Plan: Capital Expenditures

Now, let’s have a look at the capital expenditures (Capex) that are involved in a Restaurant business. Simply put, capex include all the long-term investments you make to launch and run your restaurant business. By long-term investment, we mean all assets that have a useful life of 12 months or more. Not only these assets have long-term usage, but their value typically depreciates over the years. They are not usually considered as operating expenses or COGS.

Restaurant Startup Costs

Now what are the startup costs involved in launching a restaurant? Well, the startup costs for a restaurant are simply the investments associated with starting it as well as all the expenses that are necessary for running the restaurant on a day-to-day basis until it breaks-even and becomes self-sustaining. Example of essential startup costs include leasing or buying equipment, obtaining all the required licenses, paying rent, paying restaurant employees, and stocking up on ingredients. Generally speaking, these costs are covered by your initial capital.

Restaurant Financial Plan: Revenue Forecast

Once you’ve assessed the startup costs, you should figure out the revenue your Restaurant business is likely to make. Predicting the revenue may look like a daunting task at first, as it involves many assumptions, like how many customers may visit your restaurant daily on average, the average dollar spent by each customer (average order value), etc. However, a thorough research can help you make these assumptions with a fair degree of accuracy. For this reason, it’s important that you understand your target audience , their spending habits, and the area of your operation. The more research you do and the more data you have to go by, the easier it becomes to make an accurate sales forecast.

Let’s see how this works with the help of an example.

Let’s say you want to predict how many customers will visit your venue on a given day. To be able to do this, you must first know your target audience. For simplicity’s sake, let’s assume your potential customers are all those who are between the age of 20 and 50 and living within a 5 km radius of your restaurant. Let’s further assume your target audience size is 30,000, out of which you expect 4% to visit your restaurant once a month. So, in a month, you will get 1,200 customers. Suppose each customer spends $20 on average, this works out to $24,000 in revenue a month. Continuing with this, you can easily calculate your expected annual turnover, which will be $288,000 (12 x 24,000).

Of course, given the nature of the restaurant business, you also need to factor in certain special scenarios, such as holidays, events, cold or hot weather, etc. Generally speaking, you are likely to do more business during holidays and events. Likewise, a stretch of cold season might lead to more people visiting your warm and cozy restaurant as outdoor activities become more difficult.

For an accurate sales forecast, it’s important that you undertake a thorough market survey and rely on past historical data if available.

Restaurant Financial Plan: Income Statement or Profit & Loss

Forecasting the Income Statement, which is also referred to as the Profit and Loss statement, or simply the P&L statement, requires a bit of math. But worry not, we are talking about basic, simple math!

First, you must establish the gross revenue for a specific period. Next, deduct the COGS (or direct costs) to determine the gross profit. Once you have this figure, deduct all your operating expenses and other payments from it to calculate the net profit before tax (that is, your restaurant’s business profit before you have paid the income tax). Finally, deduct the amount of tax you’ll pay from the last figure to calculate the net profit, also referred to as the “bottom line”.

Worried about all these calculations? If so, consider using the Restaurant Financial model which comes with our ready-made Restaurant business plan template. The tool will automatically generate your P&L statement once you have entered your revenue and cost assumptions.

Restaurant Financial Plan: Cash Flow Statement

The cash flow statement (CFS) predicts the amount of cash entering and leaving your restaurant business in a given period.

Before we look at what’s generally included in a CFS for a restaurant, let’s get one thing straight. There is a difference between cash flow and expense or income, even though some people conflate these terms. The main difference between these is in “timing”. Let’s take up an example to understand the finer subtleties clearly.

Let’s say you ordered soda cans worth $1,500 from your supplier on September 20 th . However, the invoice needs to be processed in 30 days. Upon receiving the order, your accountant is going to enter a COGS (or direct expense) of $1,500 in the September’s income statement. However, it’s in the CFS of October that he’ll enter a $1,500 operating cash outflow. That’s because, you will actually pay the vendor $1,500 in October since you have 30 days to pay the amount due.

When it comes to revenues, the same logic is applied. Suppose you supply soda cans worth $1,500 in September to an establishment but receive the payment in October. Your accountant will record revenue of $1,500 in September. However, the money will actually get collected in October (reflected in your CFS statement of October).

A statement of cash flow provides a summary of 3 types of cash flow movements during a specific period.

Cash flows from operation activities: This represents the amount of cash generated by your restaurant business in a specific period. So, you will include here all cash inflows that you amassed from your customer orders, as well as cash outflows, which include the money you paid for food items and other things, like raw materials and consumables.

Cash flows from investing activities: In this section, cash inflows denote the money you collected from selling a Capex item (like an old furniture or kitchen appliance) or an asset. Cash outflows, on the other hand, refer to money needed for acquiring new assets (like new kitchen equipment or a new delivery bike).

Cash flows from financing activities: In this section, cash inflows refer to new capital raised from equity investors or a business loan, while cash outflows refer to money paid to partners, like dividends.

Investors like businesses with a solid ability to generate substantial cash flows on a consistent bases. Having a profitable restaurant alone isn’t enough; what’s of the most importance is whether the restaurant business has the ability to generate sizeable cash flows on a consistent basis.

By using our automatic Restaurant Financial plan in Excel included in our ready-made Restaurant Business Plan package, you can generate a comprehensive cash flow statement with just a few clicks. All you have to do is update the cost and revenue assumptions for a given period and you’re all set.

Restaurant Financial Plan: Balance Sheet

This financial statement gives a summary of the assets and liabilities of your restaurant business over a specific period. Here’s the formula summarizing a balance sheet:

Assets = Liabilities + Equity

By using our Restaurant Financial plan in Excel that’s included in the premium Restaurant Business Plan package, you can easily generate a balance sheet automatically by entering the cost and revenue assumptions in the model.

Restaurant Financial Plan: Conclusion

Thanks to this comprehensive guide, by now you have a clear idea about how to create a solid restaurant financial plan. Keep in mind that a comprehensive financial plan, one that includes proper cost and revenue models, is a must-have for every serious restaurant business. Of course, you can create this all by yourself, but it will take you a lot of time and effort. If you would rather focus on the restaurant project itself and save time and effort by simplifying the process, then consider using our automatic Excel financial plan, which is a part of our Restaurant Business Plan Template .

Download a Ready-Made Business Plan, Choose Your Industry:

- F&B Business Plans

- Services Business Plans

- Retail Business Plans

- Tourism Business Plans

- Tech Business Plans

Recent Posts

- Bed and Breakfast Business Model Canvas: A Complete Guide

- Restaurant Business Model Canvas

- How to Create a Bar Business Plan

- Gym Financial Plan Template [2024 Guide]

- Laundry Financial Plan Template [2024 Guide]

How to Create Financial Projections for a New Restaurant

- September 30, 2022

- No Comments

Katie Fleming

Co-founder and COO of Owner Actions

- Disclosure: Owner Actions may be compensated for sales made through this article. Learn more.

Travel to any city, town, suburb, or any other location that has more than a hundred people and you’re going to find a restaurant where you can grab a bite to eat. Sure, it’s a necessity to eat food, but I think we can all agree on the fact that sometimes (or many times) it’s nice to get out and eat a nice meal made by professionals.

It’s common to see new dining establishments come and go in different communities, and it’s clear to see—based on events like the pandemic—that the restaurant industry isn’t for the faint of heart. However, there are thousands and thousands of examples of our local favorite places to eat, regional staples, or national/global franchise empires that have stood the test of time and continue to serve beloved food all while earning the owners plenty of money.

We believe the recipe for success comes down to two things: 1) Good food. 2) A rock-solid plan. And that rock-solid plan starts with financial projections which we’re going to walk you through the why and how for your new restaurant.

At ProjectionHub we have helped nearly 50,000 businesses create financial projections for their new endeavors and several thousand of those businesses have been restaurants. Nearly all of the restaurants that we’ve set up with projections have utilized one of our CPA-developed restaurant projection templates which I’m going to use as a roadmap to demonstrate how to make lender or investor-ready projections.

What Are Financial Projections?

First, I’ll provide a quick explanation as to what financial projections are and why they are important for your restaurant. Whenever an established restaurant is seeking financing either to expand or purchase new kitchen equipment or for any other viable reason, the bank or lender will ask for their financial statements so they can see the historical track record of performance for the business and ultimately make a decision on its ability to pay back the loan. The same is true for a new startup restaurant; however, there are no historical financial records to share.

That’s where projections come in.

Financial projections are meant to create a realistic and expected picture of what the financial performance of the business will look like for the first 1 to 5 years. Lenders and investors don’t expect you to be able to tell the future 5 years out, but they do expect you to have a realistic plan for estimated restaurant startup costs when you’ll break even, and how will you repay your loan even in the event that your business does not succeed. Typically requested financial projections include an Income statement, balance sheet, and cash flow statement.

Starting Assumptions for Restaurant Projections

When starting to create your restaurant financial plan, there are some key assumptions we need to make, including the following:

- When the projections need to start

- What fixed assets need to be purchased (startup costs)

- How much you’ll be investing personally into the startup

- Whether you’ll need a loan and if so, how much are you going to need/ask for

- Whether any other investors will be contributing and how much are they investing

In our example here, I am assuming our restaurant will open on January 1st, 2023, and that it’s going to require $800,000 to get up and running with our build-out, necessary equipment, some furniture/fixtures, signage, and some working capital to get us through the first few months operating at a loss. These numbers are going to be completely based on your vision for your specific restaurant, your location, etc., so don’t take these numbers as an expectation. What is important is that your numbers are realistic and attainable and that you can show your lenders/investors that it’ll be a worthwhile investment.

Projecting Revenue for a New Restaurant

The most essential part of the financial projections you’ll make for your restaurant is the revenue and cost of goods sold model. This is the part where you will demonstrate how the restaurant will make money, how much money will be made, how fast we will ramp up to that point, and how much is it going to cost for us to make it there. The key to the revenue projection is being realistic. We want to ensure we aren’t looking at the business opportunity through rose-tinted glasses just to make sure we secure financing or investment, but rather to make sure it is realistic for the market we are in.

Let’s jump in by making a few key assumptions for the revenue model. To do this, we’ll need to work through the following questions:

- How many tables will your restaurant have?

- How many days per week will you be open?

- What is the average party size you plan to attract/serve?

- Will you serve breakfast, lunch, and/or dinner?

- How many hours each day will be split between breakfast, lunch, and dinner menus?

- What is the estimated average length of visit for breakfast, lunch, and dinner?

- What percentage of capacity do you intend to be at for breakfast, lunch, and dinner?

- Will you offer takeout or catering?

- Will you sell alcohol?

- What menu items will you offer, how much are you selling them for, how much do they cost to make?

- On average how often is each menu item (or category) being purchased?

I know that may seem like a lot to figure out. However, your answers will help you understand how much you’ll spend and could generate. The math must work on paper. Otherwise, you could find yourself bleeding cash.

Below you’ll see a screengrab from our fine and casual dining template revenue tab. We’ve zoomed in on the evening or dinner time section. Here, we’re assuming our restaurant will be a little more upscale with 80 tables. It’ll be open six days a week, and most parties will be groups of two. We estimate a 2-hour average visit length, and our dining room will be open five hours a night.

We also expect to be at 20% capacity (on average) in our first month. And, we anticipate that capacity will grow slowly over time but never exceed 70%.

A quick note: Sure, there are restaurants that are booked for months and always at 90%+ capacity but no lender or investor wants to base their investment on the best case. They’d rather see that this business is feasible at a lower volume. This helps them ensure they can mitigate their risk as much as possible.

Based on those numbers we estimate that around 1,000 customers will dine with us in a month. You can see we summarized our menu options into categories with average prices and costs. Here’s why. Lenders don’t need to know exactly what’s on our menus. They simply want to know that the numbers will work.

Based on these numbers, we predict that the average revenue per person will come out to around $43.40. Our average cost will be around $17.36 per ticket. That’s a 60% margin on the cost of the meal alone given our food cost is at 40%. According to this source, many restaurant owners shoot for 28-35% cost of food margin so we’re likely being a little conservative there. Nonetheless, we have our parameters set to calculate our revenue numbers. Based on our inputs, we’ll generate just shy of $45,000 in our first full month in operation with our total cost of food and drink being a little over $18,000. Not too shabby!

Calculating Cost of Goods Sold for Your Restaurant Projections

Now we have our revenue projections lined up, and we understand what our food and drink costs will be in order to provide those meals. But we’re missing one key thing to calculate our cost of goods sold. You guessed it. People. These will be the people who are specifically tied to creating and serving the food and are paid on an hourly basis. Servers, hosts, and cooks are the employees we will be planning around.

There are a few numbers we want to have in mind:

- The maximum number of servers we’ll have working per month

- The number of tables one server can handle in an hour

- The typical number of hours our employees will work

- The average shift length

- The normal server hourly rate

- The average number of chefs and hosts working per hour

- The average hourly rate for chefs and hosts

For our fictitious upscale restaurant, we decided we will have no more than 12 servers at a time and no less than 2. Each server can take care of 4 tables per hour and will work an average shift of 8 hours earning $8/hour. This model assumes we are paying severs a base rate and they are splitting or keeping tips but that happens outside of our model because tips are above and beyond what customers pay for their bill and does not apply to our projections.

We plan to have 2 chefs working at the same time on average earning $25 an hour and 2 hosts working at the same time earning $10 an hour. These positions may not earn tips so we expect to pay them a higher base rate. And we penciled in an average of one “other” employee per hour for some flexibility.

That brings our total direct labor cost to $13,844 for the first month and our total cost of goods sold number to just under $32,000. This allows us to calculate our gross margin, which is revenue minus the cost of goods sold and does not include other operating expenses. In this example, our restaurant’s gross profit is $13,312 in month one, or 29.41%. This number, of course, differs from your net profit margin which must account for your restaurant’s other expenses outside of food costs and direct labor.

Planning for Operating Expenses for a New Restaurant

A major component of figuring out if your restaurant will be fiscally possible is to understand the rest of the expenses associated with operating it. These numbers will vary considerably based on your marketing efforts, rent rates in your market, and things like utilities, subscriptions, and professional services.

The important thing is to make sure that your restaurant can generate the revenue needed to get the necessary gross profit margin. This way, by the time you account for all the other expenses, there is something leftover (or, at least, not much lost, especially early on). You can see a list below for reference but the biggest kicker will be your rent and marketing if you are trying to spread the word upon opening.

Salaries and Owner Compensation for a Startup Restaurant

You need one more piece of information to finish rounding out your projections. Will you have any salaried employees, and will you (as the owner) be paying yourself?

It is very common for one or more managers to be in a salaried position. In our example, we accounted for one general manager making $60,000 per year. However, in our example, we didn’t project any compensation for the owner. This way, we allow for as much money as possible to stay in the business and move us towards profitability.

Of course, in your situation, you may need to compensate yourself early on. What’s important is that your lender or investor will want to know how you plan to handle this important decision. The reason: It can have big profit implications.

Creating Financial Statement Pro Formas for Your New Restaurant

Now we’ve made it to the point where we wrap up our financial projections with a pretty bow and send it off to those we hope will invest in our restaurant dream. You may wonder how we’ll take our assumptions and calculations and put them into a format we can read and draw conclusions from. This is where we want to build a projected income statement and balance sheet.

The income statement pro forma will demonstrate the monthly and yearly revenue and net income. Your net income will be the number you have after taking out COGS, expenses, and income tax. Your lender or investors may want to see this report for 3-5 years out to tell when you’ll break even.

Next, your projected balance sheet will outline the assets your business has, and that will need to equal the liabilities and equity of your restaurant as well. It will demonstrate how much collateral your restaurant will have to secure a loan.

So, how do we actually make these reports? Well, that depends. There are a few ways we can go about doing this.

- You can create these projected financial statements with your numbers on your own by looking at some example statements.

- You could provide your numbers to an accountant to create financial projections for your restaurant.

- Or, you could use a high-quality template that’ll help you calculate and compile your numbers and automatically generate the financial statements you need to provide to lenders and investors. This is exactly what ProjectionHub does. You can find this restaurant projection template here as well as other versions for a full-service or fast-casual restaurant, food truck, or bar, plus more than 50 other industry templates.

Financial projections are just one important piece of the puzzle when starting a restaurant. Work with Owner Actions and take advantage of all of the resources they have to offer in order to come up with a sound launch plan for your endeavor!

Want to take on other tasks?

Leave a reply cancel reply.

You must be logged in to post a comment.

Related Posts

Your Go-to Guide for Financing an Acquisition

Have you thought about taking out a loan to buy a business?

Pre-acquisition Action Items: Steps You Must Take Before Buying a Business

Buying a business is a complex process. One of the smartest moves

A Step-by-Step Guide to Evaluate a Business Listing

Businesses listed on business brokerage sites often follow a specific format. It can

The Right Attorney for Your Acquisition

Buying a business? It’s a must to include an attorney on your

The Right Accountant for Your Acquisition

A knowledgeable business accountant is a must for any small business acquisition—and

Quick Links

Social links.

Owner Actions, Inc. helps people buy and build businesses by offering pro help, tools, and step-by-step resources.

- Partner with us

- SBA loan help

- Invest passively

- Pro business evaluations

https://www.tiktok.com/@owneractions

Privacy Policy | Cookies acceptance/policy | Spam Policy

© 2023. All Rights Reserved

Owner Actions, Inc. helps people buy, scale, and sell their businesses by offering pro help, tools, and step-by-step resources.

Find your team

Looking for a pro who can help you start, grow, or exit your business? Start here.

- Privacy Policy

- Terms of use

© Owner Actions, Inc. 2022. All rights reserved.

Privacy Overview

15 Financial Projection Assumptions for Restaurants

July 8, 2022

Adam Hoeksema

If you are looking to secure a loan or investment in order to start your own restaurant, the potential lender or investor is likely to ask for financial projections. In order to put together a realistic set of projections, you will need to base your assumptions on industry standards. We did the research for you and pulled together 15 key financial projection assumptions for restaurants that will help you fill out your restaurant financial projections spreadsheet . These assumptions will also be very helpful as you put together a business plan for your restaurant which you can use this free restaurant business plan template as a guide.

Restaurant Revenue Projection Assumptions

Let’s start with key assumptions for your restaurant revenue projections.

1. How many seats does the typical restaurant have?

According to Maxsun the typical fine dining restaurant should have 12 to 20 square feet per customer. A fast casual restaurant should have 11 to 14 square feet per customer.

According to this answer from Quora :

- A small restaurant has 8 to 20 tables accommodating 2 to 4 people. This gives a small restaurant a maximum capacity of 80 seats.

- A medium sized restaurant typically has from 15 to 35 tables with 2 to 6 seats per table. A medium sized restaurant would have a maximum capacity of roughly 120 seats.

- A large restaurant could have 40+ tables with a capacity of several hundred seats.

2. How many times can you turn a table per meal?

According to GloriaFood , for most sit down restaurants, you can turn a table 3 times at most during dinner hours. This assumes dinner hours from 5 PM to 10 PM with an average table turnover time of 90 minutes.

3. How many fast food orders can you take per Point of Sale Terminal per hour?

For a fast food or fast casual restaurant, one of the major bottlenecks can be how fast you can take an order. To give you some idea of how many orders per hour per point of sale terminal, we looked to a study from QSR Magazine that estimated that customers spend 4.5 minutes in the average drive through. So if you only have 1 point of sale terminal taking orders in your restaurant or food truck you can assume that you will only be able to take roughly 20 orders per hour if you can get the order and payment down to a 3 minute process.

4. How many orders per hour can a typical drive-through handle?

According to FESmag , it takes the typical customer 45 to 75 seconds to place an order in a drive-through. This means that at best, if there are no delays down the line, a drive-through can handle 48 to 80 orders per hour.

5. How often do Americans eat out per month?

One key assumption when working on financial projections for your restaurant is how often will your “regulars” visit the restaurant. According to a survey of 1,000 Americans, 56% say they dine out at a restaurant, get take out, or have a meal delivered 2 to 3 times per week. This should give you some from of reference when you are projecting how often your customers might visit your restaurant each month.

6. How much do Americans spend at restaurants per month?

According to a Bureau of Labor Statistics poll, the average American household spends $198 per month on food prepared away from home. Households spent roughly ⅓ of their total food budget at restaurants, take out or delivery.

7. How do new restaurants acquire customers?

One growing way to attract new customers is to ensure that your Google Business Profile is up to date and active. That way when customers search for “Restaurants Near Me” on Google you have an opportunity to show up. In the image below you can see the growing search volume trends of customers Googling “Restaurants Near Me”

From just over 16 million monthly search in the summer of 2018 to over 30 million search by June of 2022:

We also put together a detailed article on 14 ways to get more customers at your restaurant .

8. How much does a typical restaurant generate in monthly revenue?

It is impossible to say exactly how much revenue a restaurant should generate per month, but TouchBistro provides a great rule of thumb. Restaurants need to generate roughly $150 to $250 per square foot per year in sales in order to breakeven.

If you have a 3,000 square foot restaurant, you will want to generate roughly $600,000 per year in sales ($200 per square foot) to have a good chance of breaking even.

9. What percentage of restaurant revenue is typically carry out, delivery or drive through?

According to Statista , before COVID, the average full service restaurant had 17% of total sales as carry out. That number increased to 38% in 2020 during the height of the pandemic. As you plan your restaurant, you might assume that carry out could be higher than the pre-pandemic levels as consumer behavior has changed.

Restaurant Expense Projection Assumptions

Next, let’s look at some assumptions related to restaurant expenses.

10. How many tables can one server handle?

According to Qwick the average server can manage roughly 4 tables at once. We have seen reports of servers handling up to 8 tables at once, but a more sustainable approach seems to be in the 4 tables per server range.

11. How many orders can 1 cook support per hour?

This will depend on the complexity of your restaurant’s menu, but according to Qwick , the average restaurant will need roughly 4 cooks per 50 tables.

12. What is the average food cost as a percentage of revenue for a restaurant?

According to Lightspeed , the average food cost for a restaurant is between 28 and 35% of revenue.

13. What is the average labor cost as a percentage of revenue for a restaurant?

According to Upserve , most restaurants aim to keep labor costs between 20 to 30% of revenue. For a fast casual restaurant you might be toward the lower end of the range; whereas, a fine dining restaurant may be 30% or more for labor cost due to the higher level of service expected.

Restaurant Projected Profit Assumptions

Finally, let’s look at some expected profitability assumptions for your restaurant.

14. What is the average profit margin for a restaurant?

According to Toast, restaurant profit margins usually fall between 3 and 5 percent, but could reach as high as 15%. If you have used one of our restaurant financial projection templates and have a projected profit margin of greater than 15% you might want to take a second look at your numbers and make sure you aren’t being overly optimistic.

15. How long does it take for a restaurant to breakeven?

It is ok if your restaurant or bar doesn’t breakeven in the first year, but according to BinWise you should expect to reach a break even point in year 2 or 3.

If you need any help developing your restaurant financial projections, please do not hesitate to contact us , we would be happy to help!

About the Author

Adam is the Co-founder of ProjectionHub which helps entrepreneurs create financial projections for potential investors, lenders and internal business planning. Since 2012, over 50,000 entrepreneurs from around the world have used ProjectionHub to help create financial projections.

Other Stories to Check out

Understanding the debt service coverage ratio (dscr) for your sba loan.

Why does the SBA require your home as collateral for loans? This guide explains how business assets are valued and why home equity is often needed to secure SBA loans, ensuring lender protection and loan feasibility.

Why Does the SBA Want to Take my Home as Collateral?

Coffee shop profit margin averages and forecast template.

This report takes a look at the coffee shop industry, including coffee shop profit margin averages and forecasts, to help you make an educated decision on whether or not to open your own cafe.

Have some questions? Let us know and we'll be in touch.

Restaurant Business Plan Template & PDF Example

- September 4, 2024

- Food & Beverage

Creating a comprehensive business plan is crucial for launching and running a successful restaurant. This plan serves as your roadmap, detailing your vision, operational strategies, and financial plan. It helps establish your restaurant’s identity, navigate the competitive market, and secure funding for growth.

This article not only breaks down the critical components of a restaurant business plan, but also provides an example of a business plan to help you craft your own.

Whether you’re an experienced entrepreneur or new to the food and beverage industry, this guide, complete with a business plan example, lays the groundwork for turning your restaurant concept into reality. Let’s dive in!

Our restaurant business plan is structured to cover all essential aspects needed for a comprehensive strategy. It outlines the restaurant’s operations, marketing strategy, market environment, competitors, management team, and financial forecasts.

- Executive Summary : Offers an overview of the restaurant’s business concept, market analysis , management, and financial strategy.

- Restaurant & Location: Describes the restaurant’s prime location, size, seating capacity, and distinctive design, emphasizing its appeal to the target demographic.

- Supply & Operations: Outlines the supply chain management, focusing on local sourcing and quality ingredients, and details the operational aspects, including kitchen layout, equipment, and front-of-house operations.

- Key Stats: Shares industry size , growth trends, and relevant statistics for the full-service restaurant market.

- Key Trends: Highlights recent trends affecting the restaurant sector, such as health-conscious dining, sustainability, and technology integration.

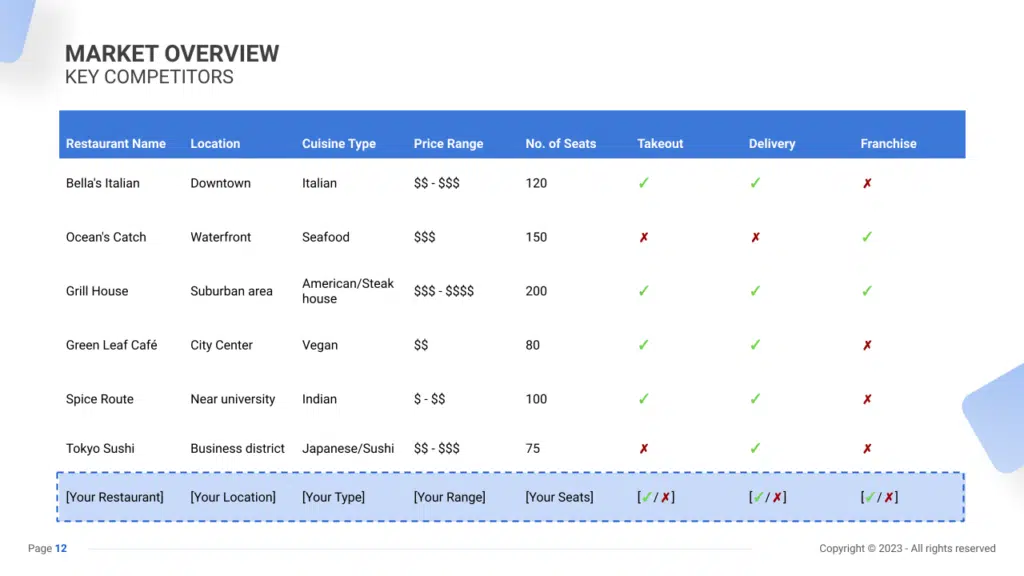

- Key Competitors: Analyzes the main competitors in the vicinity, showcasing the restaurant’s unique selling proposition in comparison.

- SWOT : Strengths, weaknesses, opportunities, and threats analysis.

- Marketing Plan : Strategies for promoting the restaurant to maximize visibility and customer engagement.

- Timeline : Key milestones and objectives from the initial setup through the launch and operational optimization.

- Management: Information on who manages the restaurant and their roles.

- Financial Plan: Projects the restaurant’s financial performance, including revenue, profits, and expected expenses, aiming for profitability and sustainable growth.

Restaurant Business Plan Template (Download)

Fully editable 30+ slides Powerpoint presentation business plan template.

Download an expert-built 30+ slides Powerpoint business plan template

Executive Summary

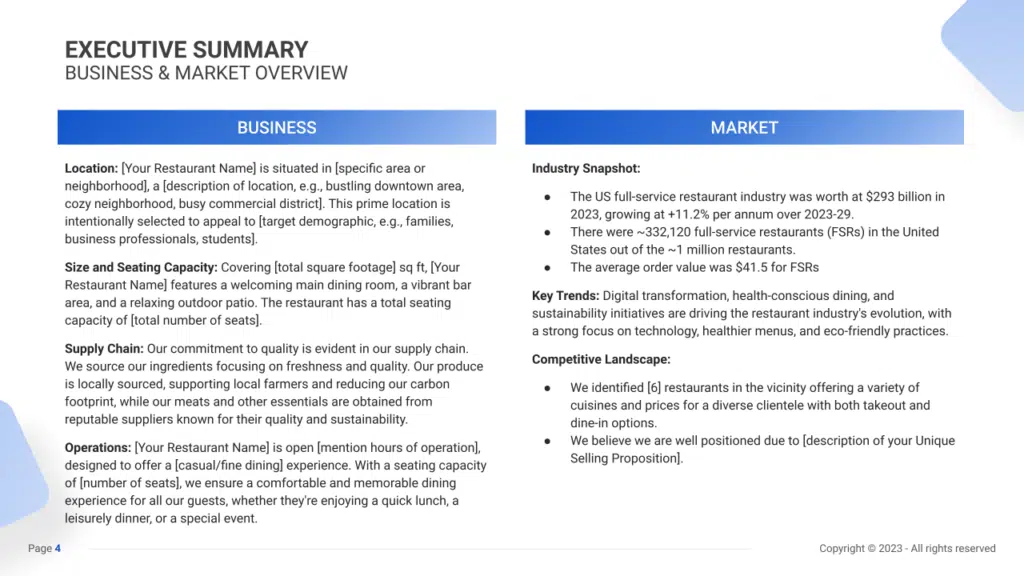

The Executive Summary introduces your restaurant’s business plan, offering a concise overview of your establishment and its offerings. It should detail your market positioning, the variety of cuisines and dining experiences you offer, its location, size, and an outline of day-to-day operations.

This section should also explore how your restaurant will integrate into the local market, including the number of direct competitors within the area, identifying who they are, along with your restaurant’s unique selling points that differentiate it from these competitors.

Furthermore, you should include information about the management and co-founding team, detailing their roles and contributions to the restaurant’s success. Additionally, a summary of your financial projections, including revenue and profits over the next five years, should be presented here to provide a clear picture of your restaurant’s financial plan.

Restaurant Business Plan Executive Summary Example

Business Overview

The business overview should detail the restaurant’s specific features, such as its seating capacity, ambiance, and supply chain practices. It’s important to emphasize how the restaurant caters to its target demographic through its strategic location and operational model.

Example: “[Your Restaurant Name],” located in [specific area or neighborhood], covers [total square footage] sq ft and includes a main dining area, bar, and outdoor patio, offering a total of [number of seats] seats. The restaurant’s commitment to quality is reflected in its locally sourced produce and sustainable supply chain practices, catering to a diverse clientele.

Market Overview

This section involves analyzing the size, growth, and trends of the full-service restaurant market. It should address the industry’s digital transformation, health-conscious dining preferences, and eco-friendly practices, positioning the restaurant within the broader market context.

Example: “[Your Restaurant Name]” enters a U.S. full-service restaurant market valued at $293 billion. The restaurant’s focus on technology, healthier menu options, and sustainability aligns well with current market trends and consumer preferences, setting it apart from six main competitors in the area.

Management Team

Detailing the management team’s background and expertise is crucial. This section should highlight how their experience in culinary arts and restaurant management contributes to the success of the restaurant.

Example: The Executive Chef and Co-Owner of “[Your Restaurant Name]” leads menu development and kitchen operations, ensuring high-quality food preparation and presentation. The General Manager and Co-Owner manages daily operations, staff, customer service, and financial aspects, ensuring a seamless dining experience.

Financial Plan

This section should outline the restaurant’s financial goals and projections, including revenue targets and profit margins, providing a clear picture of its financial aspirations and health.

Example: “[Your Restaurant Name]” aims to achieve $2.7 million in annual revenue with an 11% EBITDA margin by 2028. This financial goal is supported by a focus on quality dining experiences, strategic marketing, and operational efficiency, positioning the restaurant for growth in the competitive full-service restaurant market.

For a Restaurant, the Business Overview section can be concisely divided into 2 main slides:

Restaurant & Location

Briefly describe the restaurant’s physical environment, emphasizing its design, ambiance, and the overall dining experience it offers to guests. Mention the restaurant’s location, highlighting its accessibility and the convenience it offers to diners, such as proximity to entertainment venues or ease of parking. Explain why this location is advantageous in attracting your target clientele.

Supply & Operations

Detail the range of cuisines and dishes offered, from appetizers and main courses to desserts and specialty beverages. Outline your sourcing strategy, ensuring it reflects a commitment to quality and sustainability, and matches the market you’re targeting.

Highlight any unique culinary techniques, exclusive ingredients, or innovative kitchen technologies that set your restaurant apart. Discuss your operational strategies, including inventory management, supplier relationships, and kitchen workflow, to ensure efficiency and consistency in delivering exceptional dining experiences.

Industry size & growth

In the Market Overview of your restaurant business plan, start by examining the size of the restaurant industry and its growth potential. This analysis is crucial for understanding the market’s scope and identifying expansion opportunities.

Key market trends

Proceed to discuss recent market trends , such as the increasing consumer interest in farm-to-table dining, ethnic cuisines, and experiential dining experiences.

For example, highlight the demand for restaurants that offer unique cultural dishes, the growing popularity of health-conscious and dietary-specific menus, and the integration of technology in enhancing the dining experience.

Competitive Landscape

A competitive analysis is not just a tool for gauging the position of your restaurant in the market and its key competitors; it’s also a fundamental component of your business plan.

This analysis helps in identifying your restaurant’s unique selling points, essential for differentiating your business in a competitive market.

In addition, competitive analysis is integral in laying a solid foundation for your business plan. By examining various operational aspects of your competitors, you gain valuable information that ensures your business plan is robust, informed, and tailored to succeed in the current market environment.

Identifying Competitors in the Restaurant Industry

To comprehensively understand the competitive landscape, start by identifying both direct and indirect competitors in your area. Direct competitors are restaurants offering similar cuisines or targeting a comparable customer base. For instance, if your restaurant specializes in authentic Mexican cuisine, other nearby Mexican restaurants are direct competitors. Indirect competitors may include food trucks, cafes, or even fast-casual eateries offering diverse menus that overlap with your offerings.

Leverage digital tools like Google Maps, Yelp, or food delivery apps to map out the locations of your competitors. Reviews and ratings on platforms like TripAdvisor and social media can offer valuable insights into competitors’ strengths and weaknesses . Positive reviews highlighting exceptional service or a unique dining experience at a competitor’s restaurant can signify an area of focus for differentiation and improvement.

Restaurant Competitors’ Strategies

To conduct a comprehensive analysis, delve into various aspects of your competitors’ operations:

- Menu Offerings: Assess the breadth and uniqueness of dishes offered by competitors. Take note if any local restaurants are gaining traction by focusing on farm-to-table ingredients, regional specialties, or offering innovative fusion cuisines, as these aspects often indicate emerging market trends .

- Service and Ambiance: Evaluate the overall customer experience. Identify if there’s a competitor renowned for its fine dining experience, another known for its trendy and vibrant atmosphere, or one that excels in providing a casual, family-friendly environment. These elements significantly contribute to a restaurant’s success and differentiation.

- Pricing and Positioning: Compare pricing strategies . Determine whether competitors are positioned as budget-friendly eateries or if they adopt a more upscale approach with premium pricing, highlighting gourmet ingredients, or exclusive dining experiences.

- Marketing Channels : Analyze how competitors market their restaurants. Do they leverage social media platforms for promotions, engage in collaborations with local influencers, or host special events or themed nights? Understanding their marketing tactics provides insights into effective promotional strategies that resonate with the target audience .

- Operational Efficiency: Observe if competitors have adopted technological advancements such as online reservations, mobile apps for ordering, or contactless payment systems. These innovations not only streamline operations but also contribute to an enhanced customer experience.

What’s Your Restaurant’s Value Proposition?

Reflect on what uniquely distinguishes your restaurant from the competition. It could be your innovative fusion of cuisines, a strong emphasis on locally sourced and sustainable ingredients, or perhaps a distinctive ambiance that reflects a particular cultural theme or historical narrative.

Listen attentively to customer feedback and observe emerging industry trends to identify gaps or unmet demands in the market. For instance, if there’s a growing interest in plant-based dining experiences and competitors have not tapped into this niche, it could present an opportunity for your restaurant to cater to this demand and stand out.

Consider how your restaurant’s location influences your strategy. A downtown location might warrant a focus on quick service and catering to office lunch crowds, while a suburban setting could embrace a more relaxed, family-friendly dining environment.

First, conduct a SWOT analysis for the restaurant , highlighting Strengths (such as a unique menu and exceptional customer service), Weaknesses (including potential high operational costs or strong competition in the area), Opportunities (for example, a growing interest in diverse cuisines and healthy eating), and Threats (such as economic downturns that may decrease consumer spending on dining out).

Marketing Plan

Next, develop a marketing strategy that outlines how to attract and retain customers through targeted advertising, promotional discounts, an engaging social media presence, food blogger outreach, and community involvement, such as local events or charity sponsorships.

Marketing Channels

Utilize various marketing channels to engage with your audience and attract new patrons.

Digital Marketing

- Social Media: Utilize social media platforms such as Instagram, Facebook, Twitter, and TikTok to showcase your restaurant’s ambiance, signature dishes, behind-the-scenes glimpses, chef profiles, and customer testimonials. Regularly engage with your audience by responding to comments, hosting interactive polls, or sharing user-generated content.

- Email Marketing: I mplement an email marketing strategy to build a loyal customer base. Offer incentives such as exclusive recipes, promotional offers, or early access to special events in exchange for subscribing to your newsletter. Regularly communicate with your subscribers, sharing updates, promotions, and stories that resonate with your brand.

- Website and SEO: Maintain an informative website showcasing your menu , chef profiles, reservation options, and reviews. Optimize it for local SEO to ensure visibility in searches related to your cuisine and location.

Local Advertising

- Printed Materials: Distribute well-designed flyers in nearby neighborhoods, advertise in local magazines, and collaborate with tourism centers or hotels for exposure.

- Community Engagement: Sponsor local events, collaborate with food bloggers or influencers, and participate in food festivals or charity events to increase brand visibility and community involvement.

- Partnerships: Forge partnerships with complementary businesses (such as wine shops or local farmers’ markets) for cross-promotions or collaborative events.

Promotional Activities

Engage potential customers through enticing offers and events.

- Special Offers: Launch promotions like ‘Chef’s Tasting Menu Nights’ or ‘Happy Hour Discounts’ to attract new diners and retain regulars.

- Loyalty Programs: Implement a loyalty system offering rewards for frequent visits or referrals, such as a free appetizer or dessert after a certain number of visits.

- Events and Special Occasions: Host themed nights, seasonal menus, or exclusive culinary events to create buzz and attract diverse audiences.

Sales Channels

Efficiently manage sales channels to maximize revenue and customer satisfaction.

In-Restaurant Upselling

- Menu Strategies: Highlight premium dishes or chef’s specials, offer wine pairings or dessert suggestions, and train staff to upsell without being pushy.

- Merchandising: Display branded merchandise, specialty sauces, or cookbooks for sale to complement the dining experience.

Online Ordering and Delivery

- Online Ordering Platform: I mplement an easy-to-use online ordering system for takeout or delivery orders. Offer exclusive online discounts or bundle deals.

- Delivery Partnerships: Collaborate with food delivery services or establish in-house delivery for customers’ convenience.

Reservation Management

- Reservation System: Utilize an efficient reservation platform to manage bookings. Offer incentives for off-peak reservations or special occasions.

Membership and VIP Programs

Developing membership and VIP programs can cultivate a loyal customer base and drive recurring revenue:

- VIP Memberships: Create exclusive membership tiers offering perks like priority reservations, chef’s table access, or private event invitations.

- Reward Programs: Develop a digital loyalty system where customers earn points for every dollar spent, redeemable for discounts, exclusive menu items, or special events.

Strategy Timeline

Finally, create a detailed timeline that outlines critical milestones for the restaurant’s opening, marketing campaigns, customer base growth, and expansion objectives, ensuring the business moves forward with clear direction and purpose.

The management section focuses on the restaurant’s management and their direct roles in daily operations and strategic direction. This part is crucial for understanding who is responsible for making key decisions and driving the restaurant towards its financial and operational goals.

For your restaurant business plan, list the core team members, their specific responsibilities, and how their expertise supports the business.

The Financial Plan section is a comprehensive analysis of your financial projections for revenue, expenses, and profitability. It lays out your restaurant’s approach to securing funding, managing cash flow, and achieving breakeven.

This section typically includes detailed forecasts for the first 5 years of operation, highlighting expected revenue, operating costs and capital expenditures.

For your restaurant business plan, provide a snapshot of your financial statement (profit and loss, balance sheet, cash flow statement), as well as your key assumptions (e.g. number of customers and prices, expenses, etc.).

Make sure to cover here _ Profit and Loss _ Cash Flow Statement _ Balance Sheet _ Use of Funds

Related Posts

Steakhouse Business Plan Template & PDF Example

- May 7, 2024

Bubble Tea Business Plan Template & PDF Example

- March 19, 2024

Bar Business Plan Template & PDF Example

- February 26, 2024

Privacy Overview

IMAGES

COMMENTS

Jan 1, 2024 · By using our automatic Restaurant Financial plan in Excel included in our ready-made Restaurant Business Plan package, you can generate a comprehensive cash flow statement with just a few clicks. All you have to do is update the cost and revenue assumptions for a given period and you’re all set. Restaurant Financial Plan: Balance Sheet

The tables setting out your restaurant's financial forecast. Now let's take a look at your restaurant's financial forecast tables. The restaurant's forecasted P&L statement. This table will give you an idea of your business’ growth over the first three to five years, and allow you to see if it’s likely to be profitable.

Sep 30, 2022 · This article on creating financial projections for a new restaurant is a guest post, brought to you by the team at ProjectionHub.ProjectionHub is a leading provider of 50+ industry-specific templates thousands of owners have used to form plans and secure financing for their restaurants, bars, coffee shops, and other businesses.

Oct 21, 2024 · Every business needs a financial model. Whether you want to understand what’s your breakeven, your valuation or create a budget for your restaurant business plan, you’ve come the right way. In this article we’ll explain you how to create powerful and accurate financial projections for a typical 120 seats restaurant. 1. Forecast Customers

Jul 8, 2022 · A fast casual restaurant should have 11 to 14 square feet per customer. According to this answer from Quora: A small restaurant has 8 to 20 tables accommodating 2 to 4 people. This gives a small restaurant a maximum capacity of 80 seats. A medium sized restaurant typically has from 15 to 35 tables with 2 to 6 seats per table. A medium sized ...

Sep 4, 2024 · The Financial Plan section is a comprehensive analysis of your financial projections for revenue, expenses, and profitability. It lays out your restaurant’s approach to securing funding, managing cash flow, and achieving breakeven.